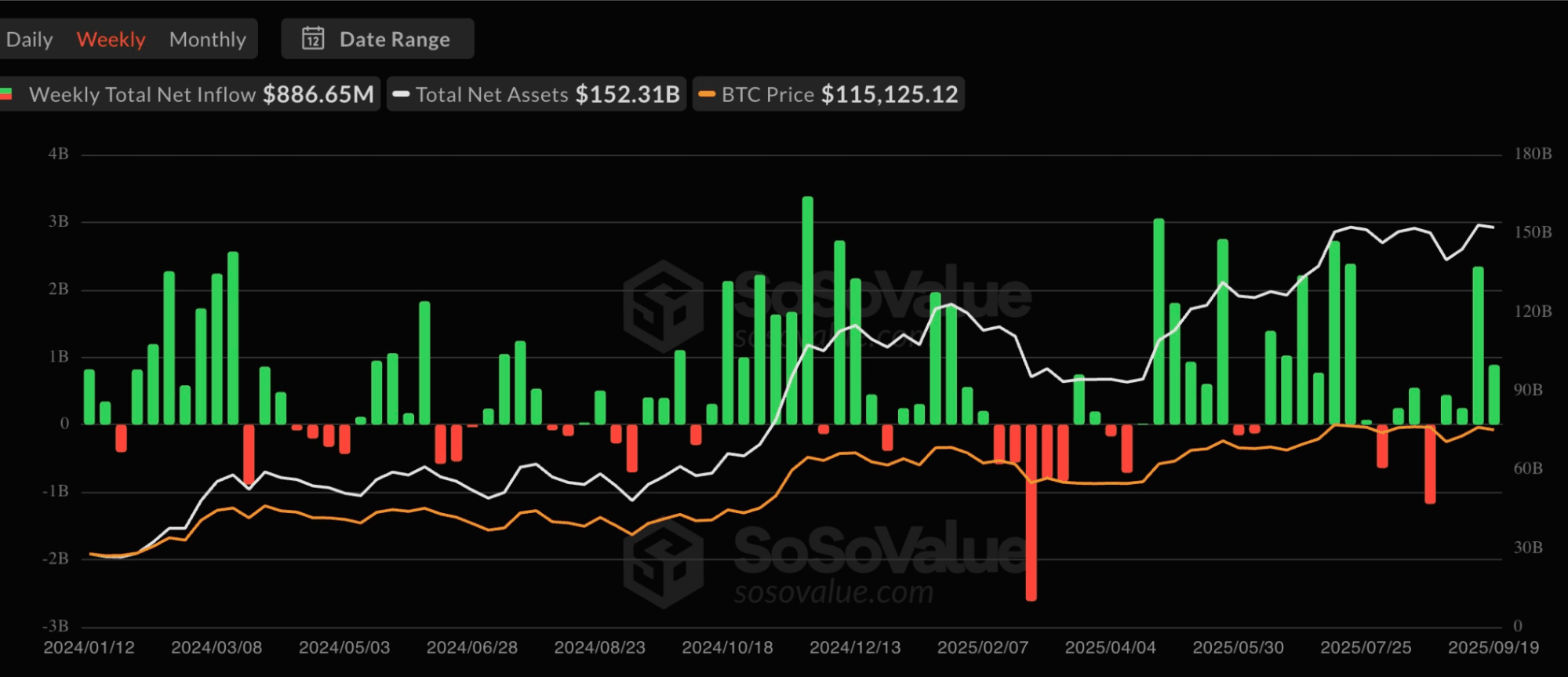

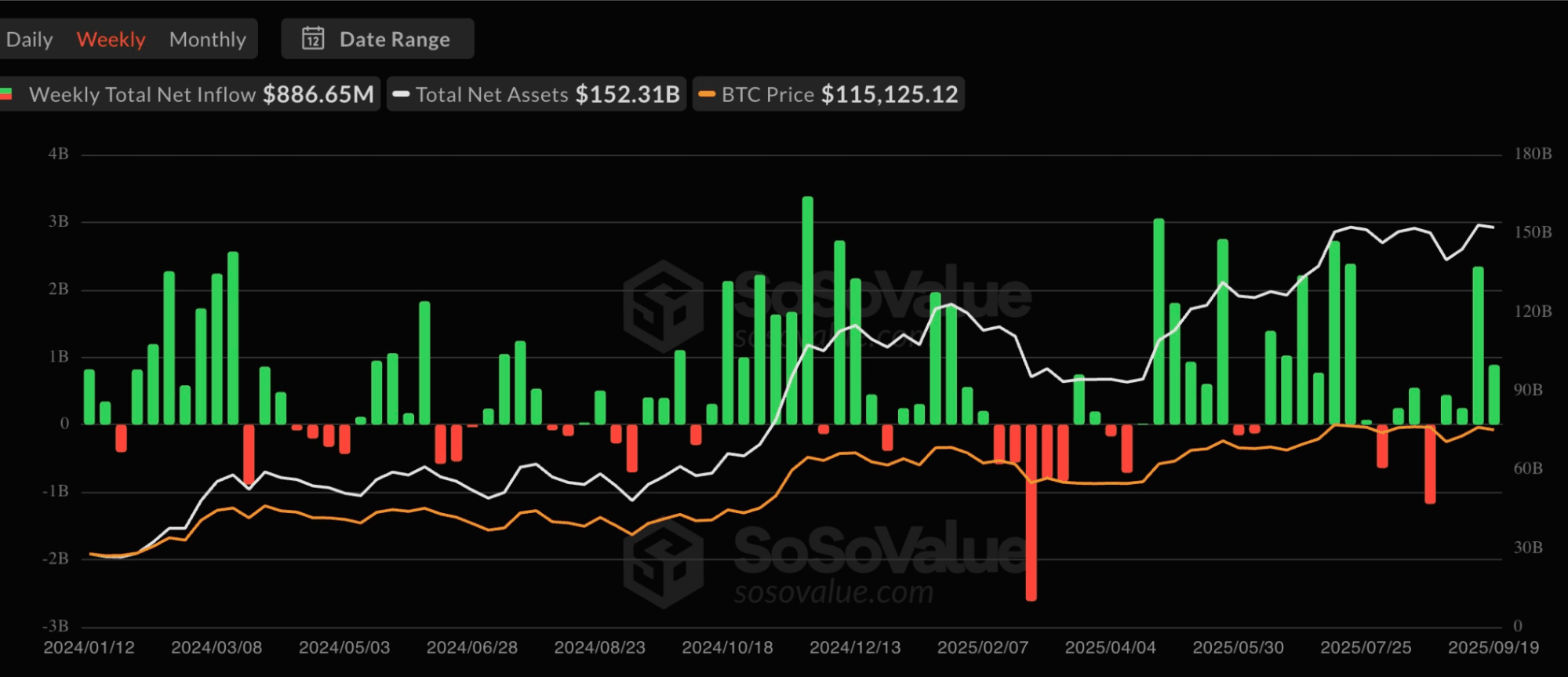

Bitcoin ETFs log fourth straight week of inflows

U.S. spot Bitcoin ETFs added roughly $887 million in net inflows for the week of September 15–19, according to SoSoValue.

Four of the five sessions finished positive, keeping weekly trading activity steady around $16.6 billion. Despite the green prints, total assets under management (AUM) ended the week near $152.3 billion versus about $153.2 billion a week earlier, a sign that softer BTC prices offset part of the flow effect.

Total net flows across U.S. spot Bitcoin ETFs. Source: SoSoValue

Daily prints show a front‑loaded week. Monday brought about $260 million and Tuesday $292 million – the week’s largest single‑day gain. Wednesday was the outlier. A $51 million outflow coincided with the highest turnover of the week (≈$4.24 billion), pointing to mid‑week rebalancing or profit‑taking. Flows returned to positive on Thursday ($163 million) and Friday ($223 million).

AUM swung with price: roughly $151.7 billion on Monday, a weekly high near $155.1 billion on Thursday, and $152.3 billion into Friday’s close.

By products, leadership was narrow. CoinMarketCap’s flow table shows IBIT (iShares Bitcoin Trust, BlackRock) contributing about $867 million for the week, effectively carrying the aggregate result. FBTC (Fidelity Wise Origin Bitcoin Fund) finished modestly positive (≈$35 million) after a sharp mid‑week withdrawal, while GBTC (Grayscale Bitcoin Trust ETF) remained in net outflow (≈$86 million). The remainder of the week’s total came from peers outside the visible frame, but the message is clear: demand concentrated in one ticker did most of the lifting.

Through September 19 Bitcoin ETFs have logged roughly $3.5 billion in month‑to‑date inflows, marking four straight green weeks after August’s two red ones. Momentum has cooled from the prior week’s $2.34 billion surge, yet participation stayed firm with volumes holding around $16.6 billion.

Recommended