Bitcoin ends “Uptober” in the red for the first time in 7 years

For the first time in seven years, Bitcoin closed October in the red, breaking a six-year streak of profitable “Uptobers.”

In the final hours of the month, the asset fell 3.35%, despite optimism over easing trade tensions between the U.S. and China and expectations of further Fed rate cuts.

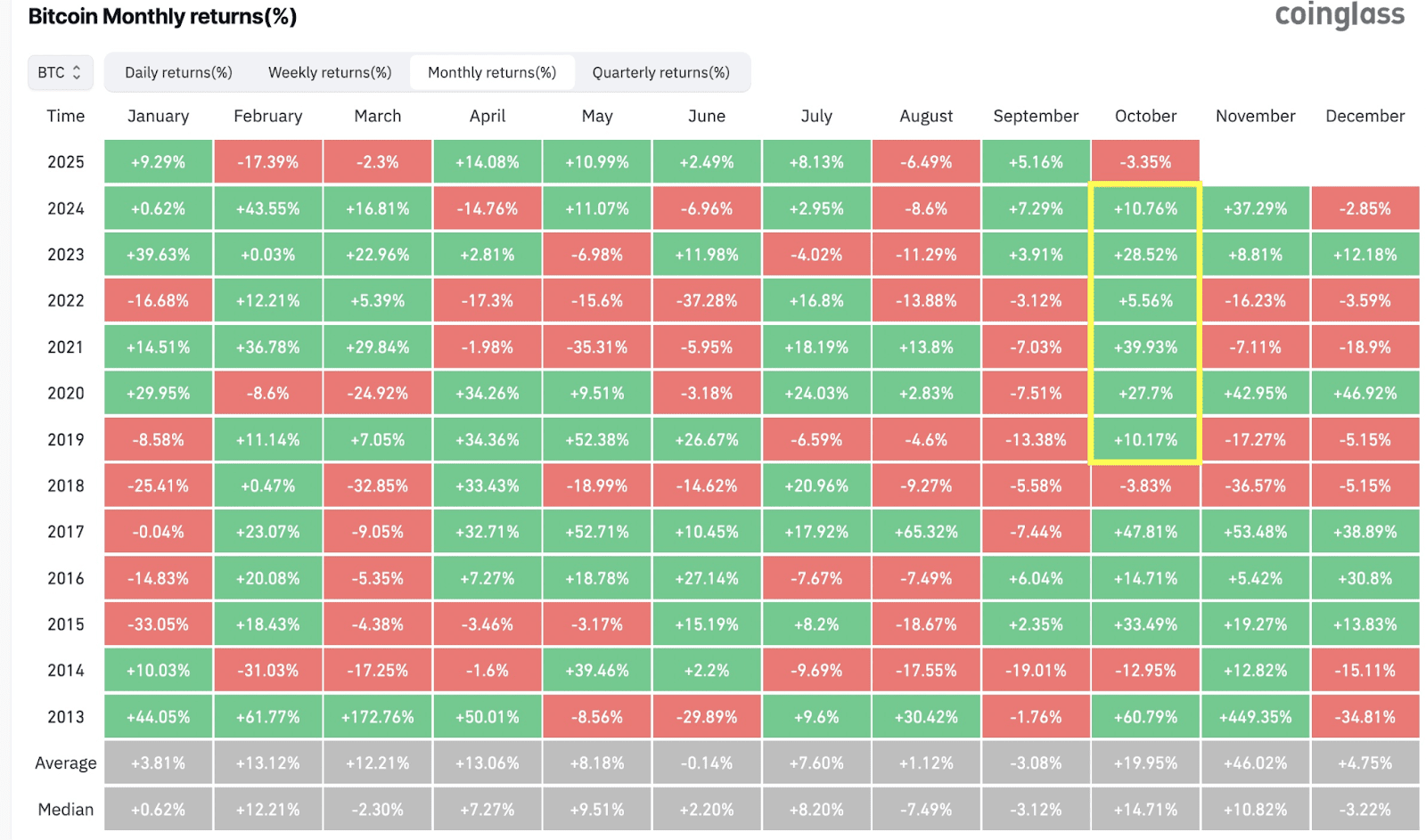

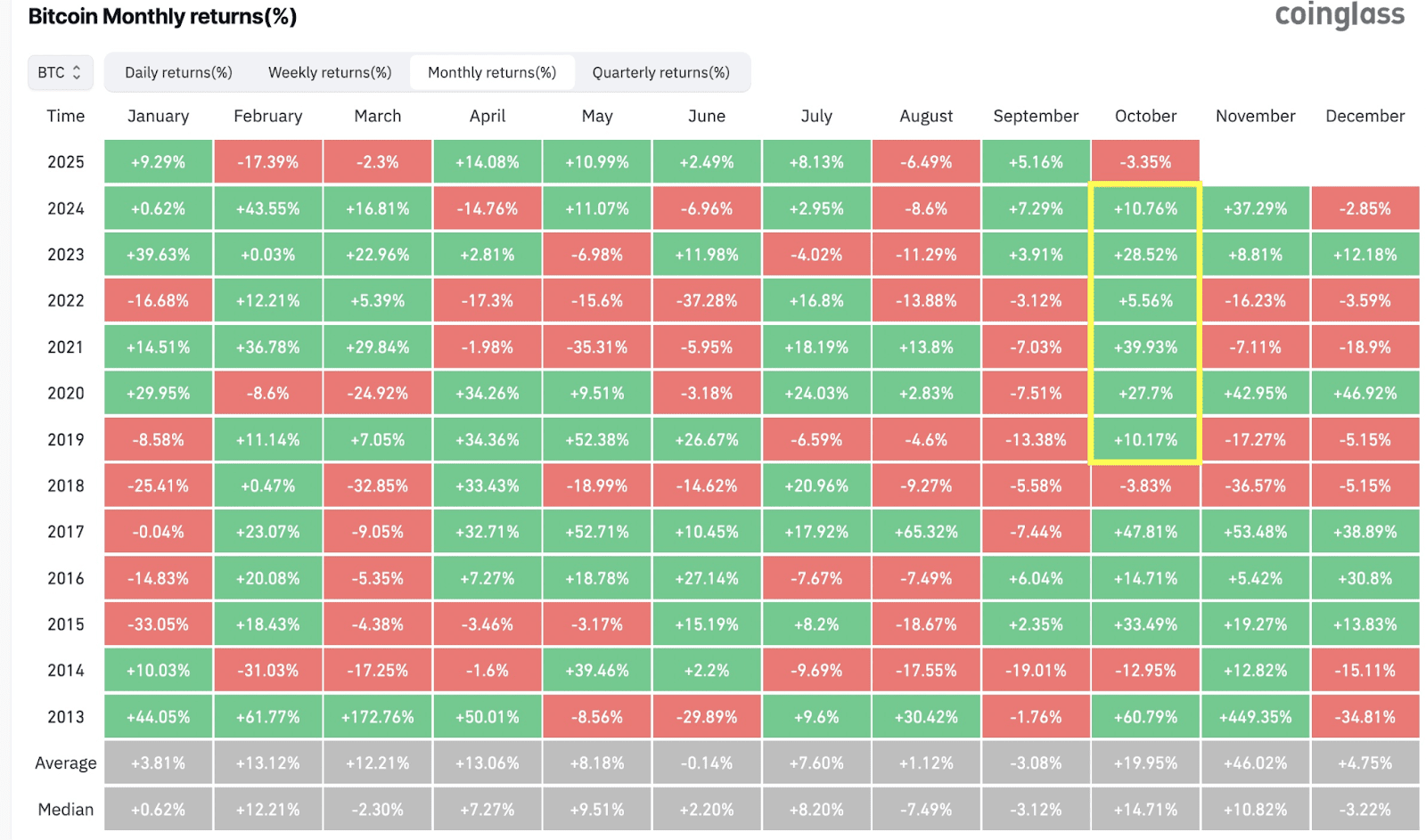

Traders are divided. Some argue that Bitcoin needed a strong green candle to end the month and sustain its bullish trend - but that never came. Others note that October’s volatility was unusually high and point out that, historically, it’s Bitcoin’s second-strongest month of the year - though this one was the weakest since 2018.

Traders are divided. Some argue that Bitcoin needed a strong green candle to end the month and sustain its bullish trend - but that never came. Others note that October’s volatility was unusually high and point out that, historically, it’s Bitcoin’s second-strongest month of the year - though this one was the weakest since 2018.

Monthly Bitcoin performance across different years. Source: coinglass.com

The drop was driven by several factors: a mid-October flash crash sparked by renewed U.S.–China tariff threats and a muted response to the Fed’s 0.25% rate cut, which failed to revive investor appetite for risk assets.

Historically, November has been Bitcoin’s best month. According to CoinGlass, the average gain for November since 2013 is 46%, while the October–December period is typically the strongest quarter, averaging a 78% increase. In recent years, Bitcoin rose 57% in 2023 and 48% in 2024, but during bear markets like 2018 and 2022, it fell as much as –42% and –15%, respectively.

There’s little correlation between October’s results and the months that follow, but after a weak October, Bitcoin’s three-month average return is about 11%, compared to 21% after a strong one.

If history is any guide, November could be a turning point - either the start of a rebound or the beginning of a deeper correction not seen since 2018.

Recommended