Binance Research: 10 key crypto market charts 2025

Binance Research highlights strong crypto performance in 2025, with market cap up 9.9% YTD, global liquidity hitting multi-year peaks, and ETF inflows exceeding $28B driving institutional adoption.

Binance Research has released its complex analysis of the crypto markets in 2025, showing strong performance across digital assets despite facing macro headwinds. The report, authored by Moulik Nagesh and Asher Lin Jiayong, identifies ten key charts that are defining the current market cycle.

Crypto market cap up $600B in 2025 despite volatility

Crypto markets have delivered impressive returns in 2025, with total market capitalization increasing 9.9% year-to-date and adding over $600 billion in value. After a brief pullback in Q1, markets rebounded sharply in Q2 and maintained momentum into Q3, hitting successive all-time highs across major assets.

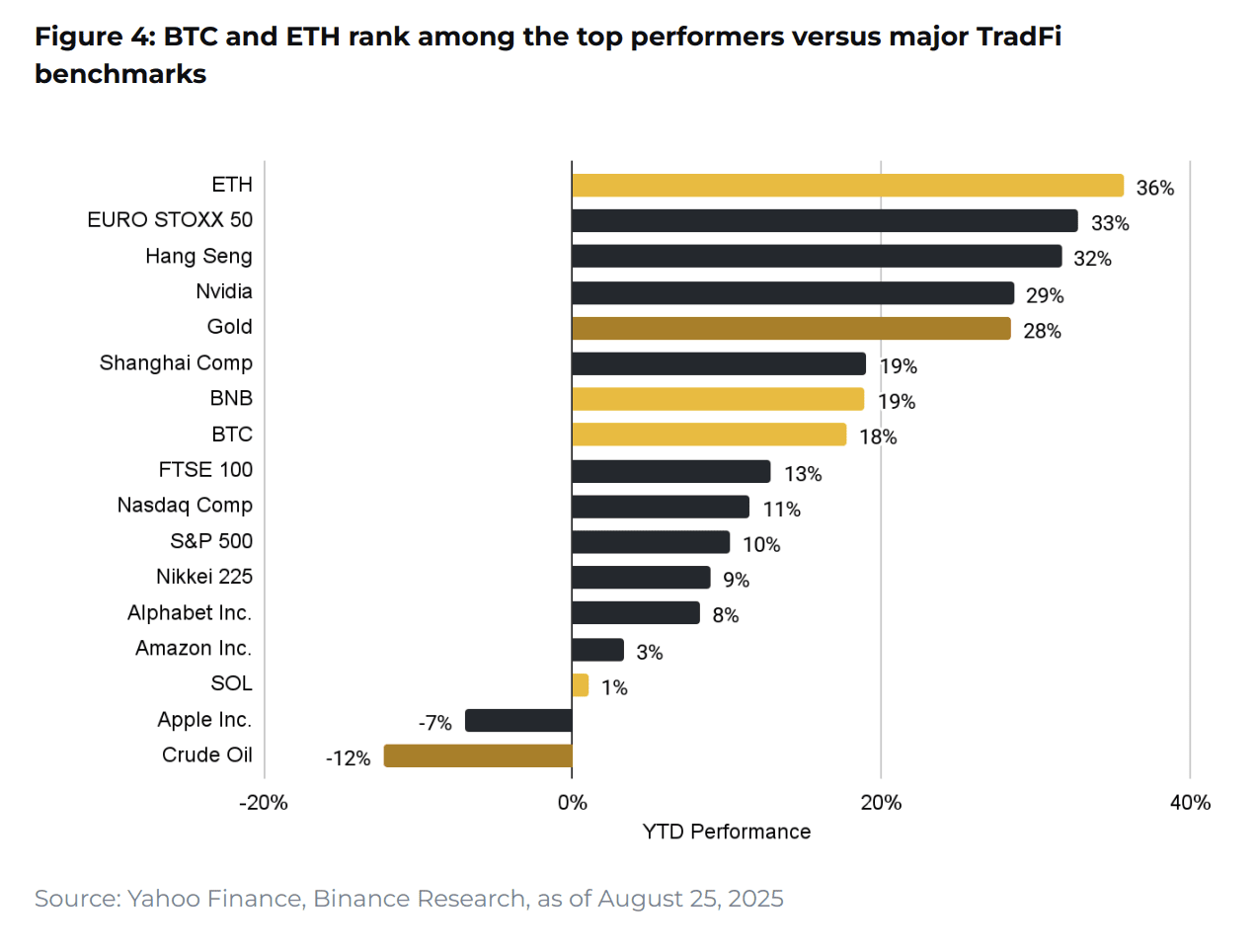

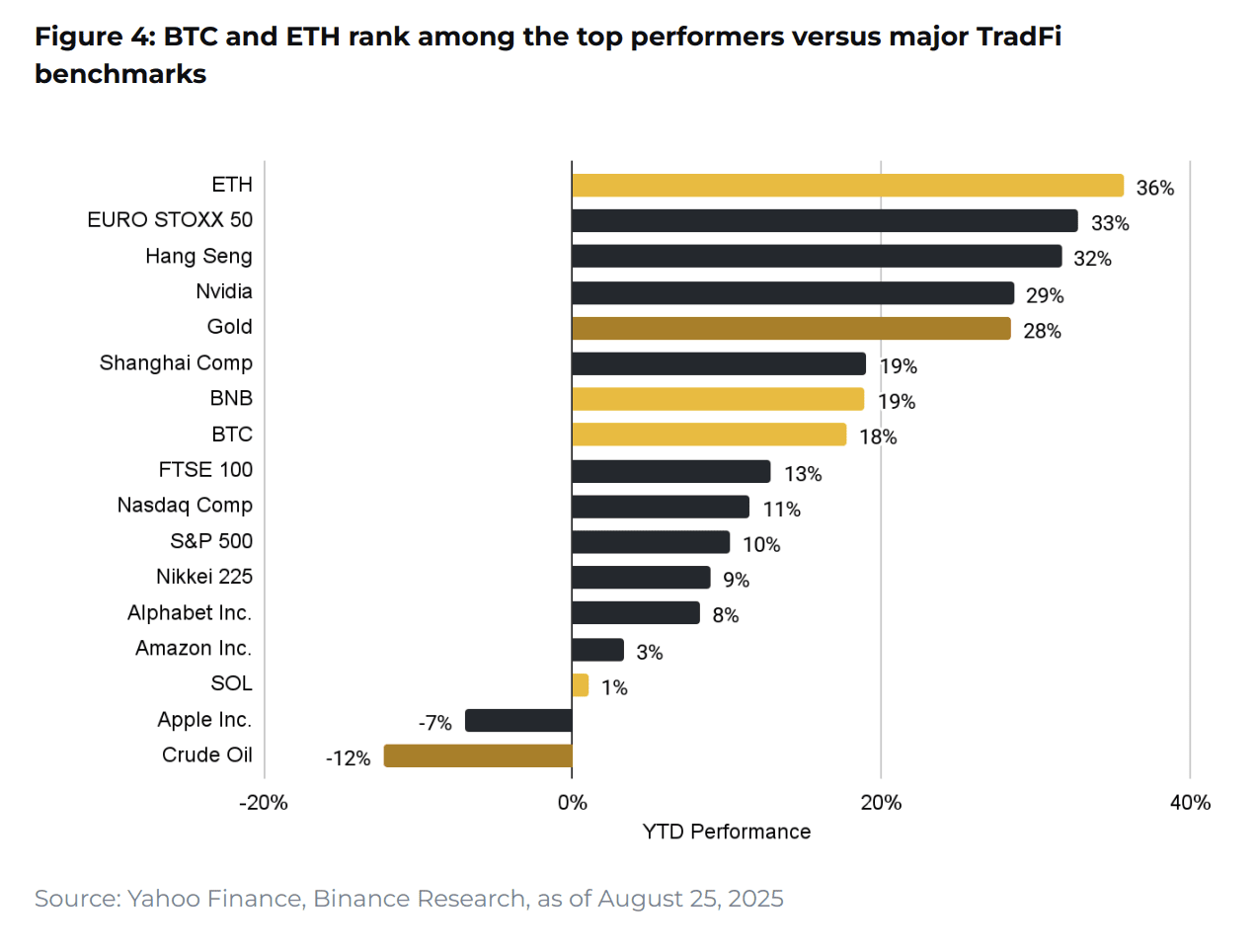

ETH has emerged as the standout performer, leading all major assets with approximately 36% gains, while BTC posted solid 18% returns. Both cryptocurrencies have outperformed traditional benchmarks, with BTC demonstrating unique versatility as both a macro hedge and short-term risk asset.

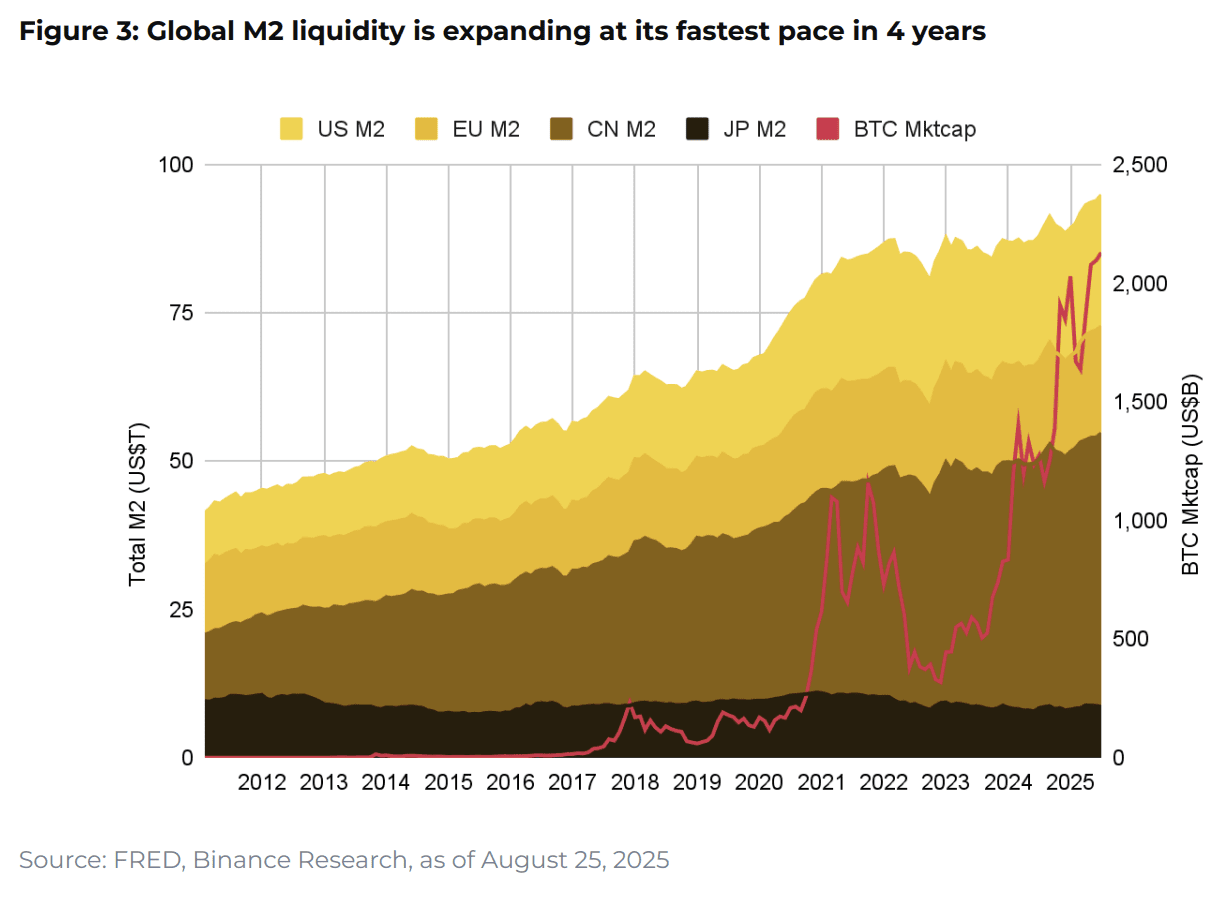

Global liquidity surge drives rising crypto demand

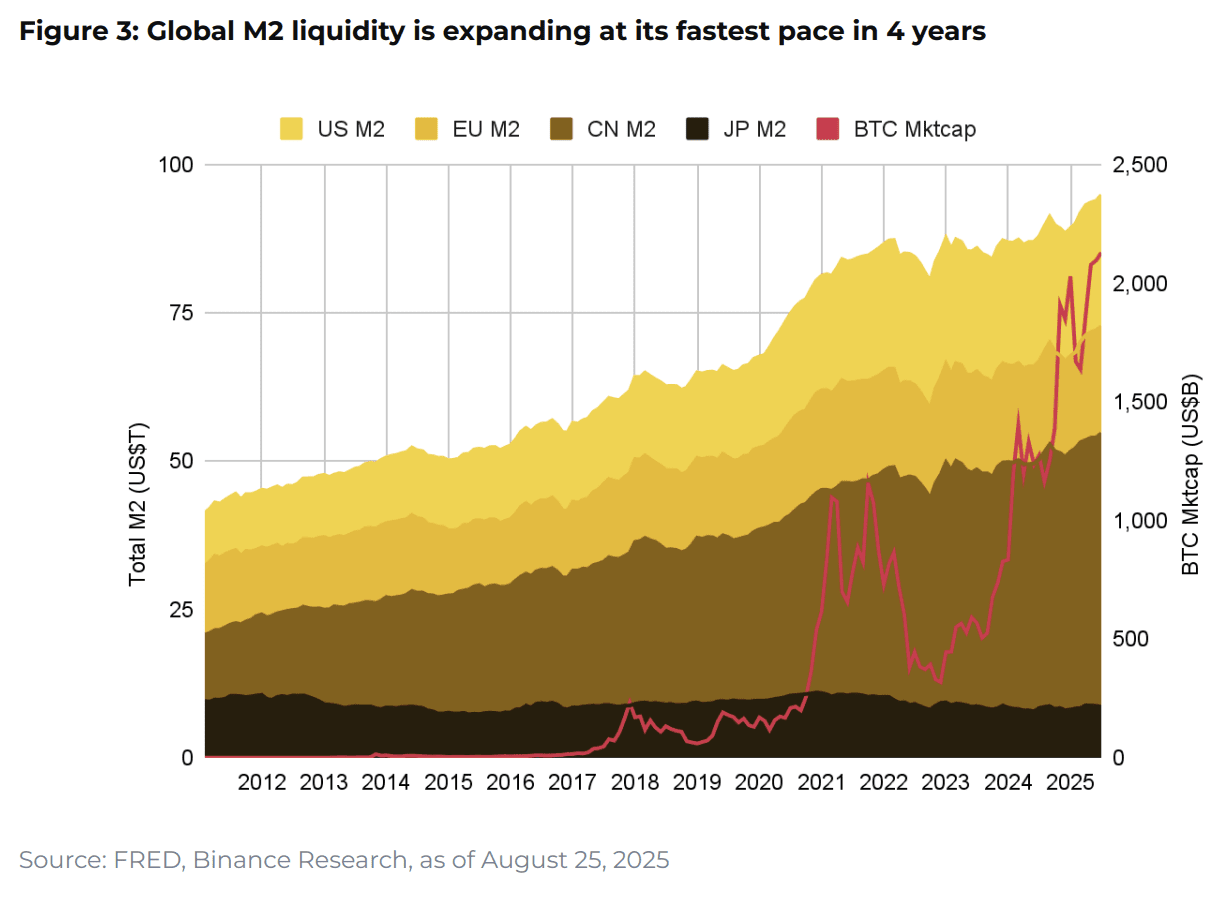

A key driver behind crypto's strong performance has been the expansion of global M2 liquidity, which reached a four-year high with the strongest six-month increase since 2021. The broad money supply rose by $5.6 trillion, creating favorable conditions for risk assets.

While the Federal Reserve maintains a hawkish stance, it wound down quantitative tightening and signaled possible policy pivots. Other major economies have kept monetary policies accommodative, supporting renewed interest in digital assets.

Bitcoin & Ethereum ETFs fuel institutional adoption

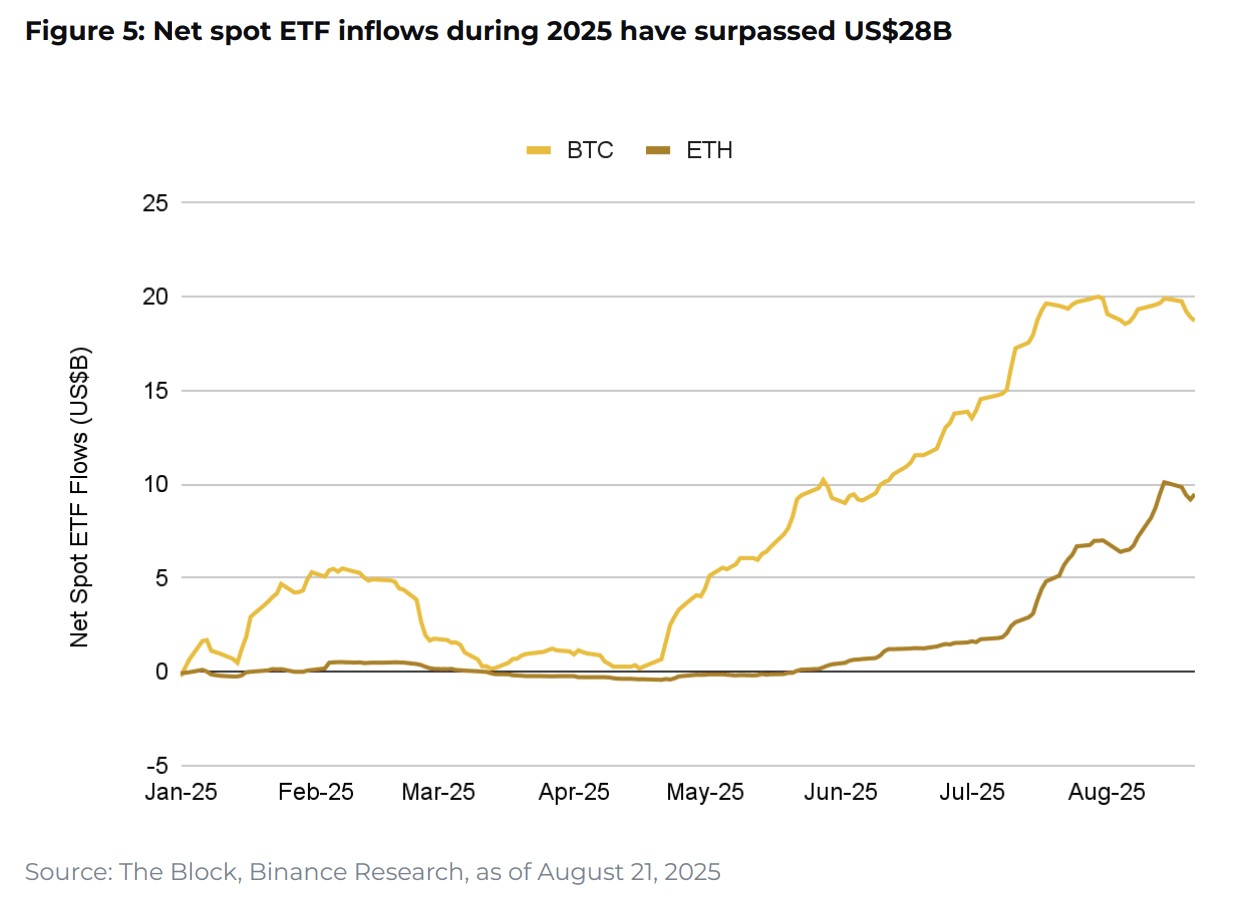

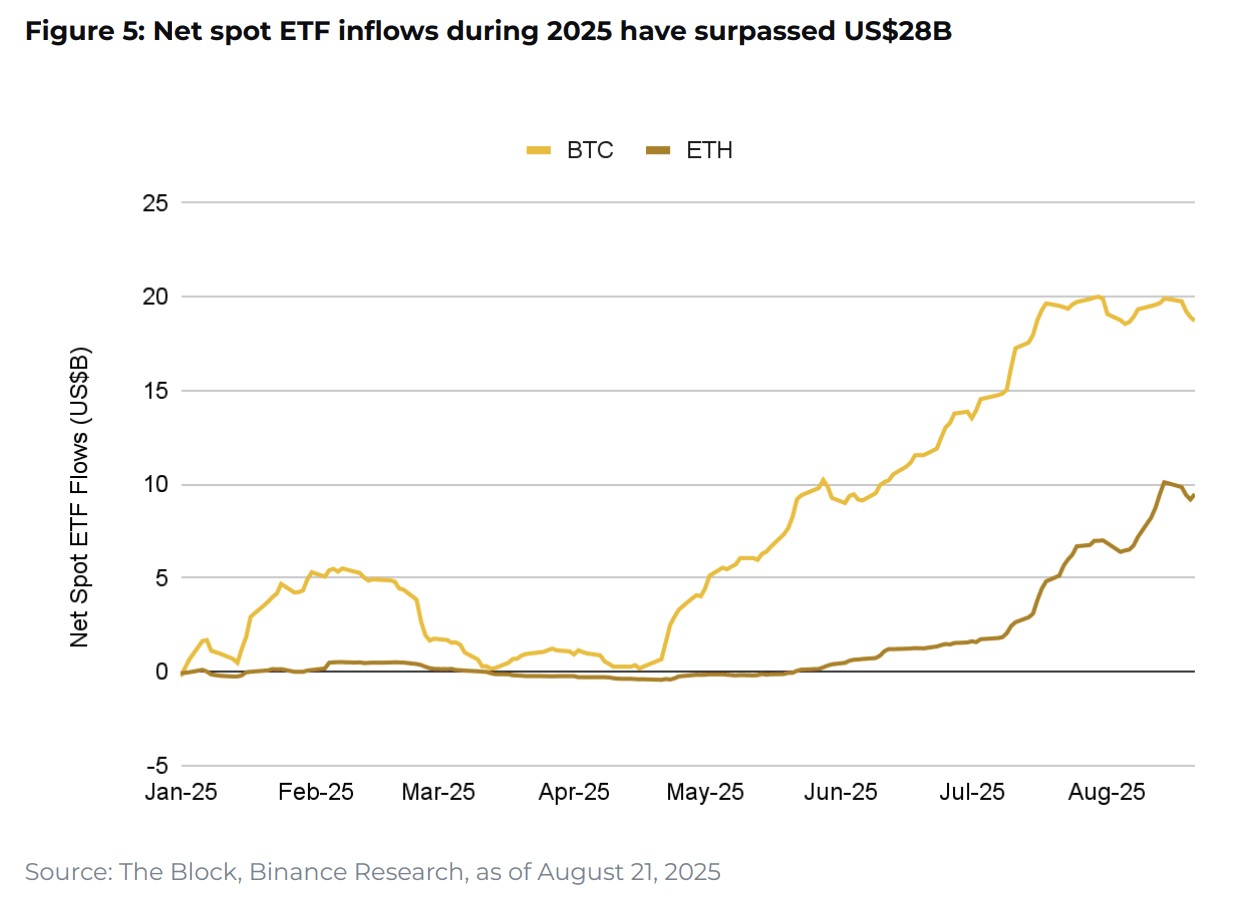

U.S. spot Bitcoin and Ethereum ETFs have attracted over $28 billion in net inflows during 2025, becoming major volume drivers in crypto markets. Cumulative net inflows since launch now exceed $52 billion, with ETF holdings surpassing 1.29 million BTC (approximately $154 billion).

BlackRock dominates the space with over $58 billion in assets under management, well ahead of Fidelity’s $12B. The research notes that unlike speculative flows, ETF allocations tend to be "stickier," creating lasting demand and anchoring liquidity in regulated venues.

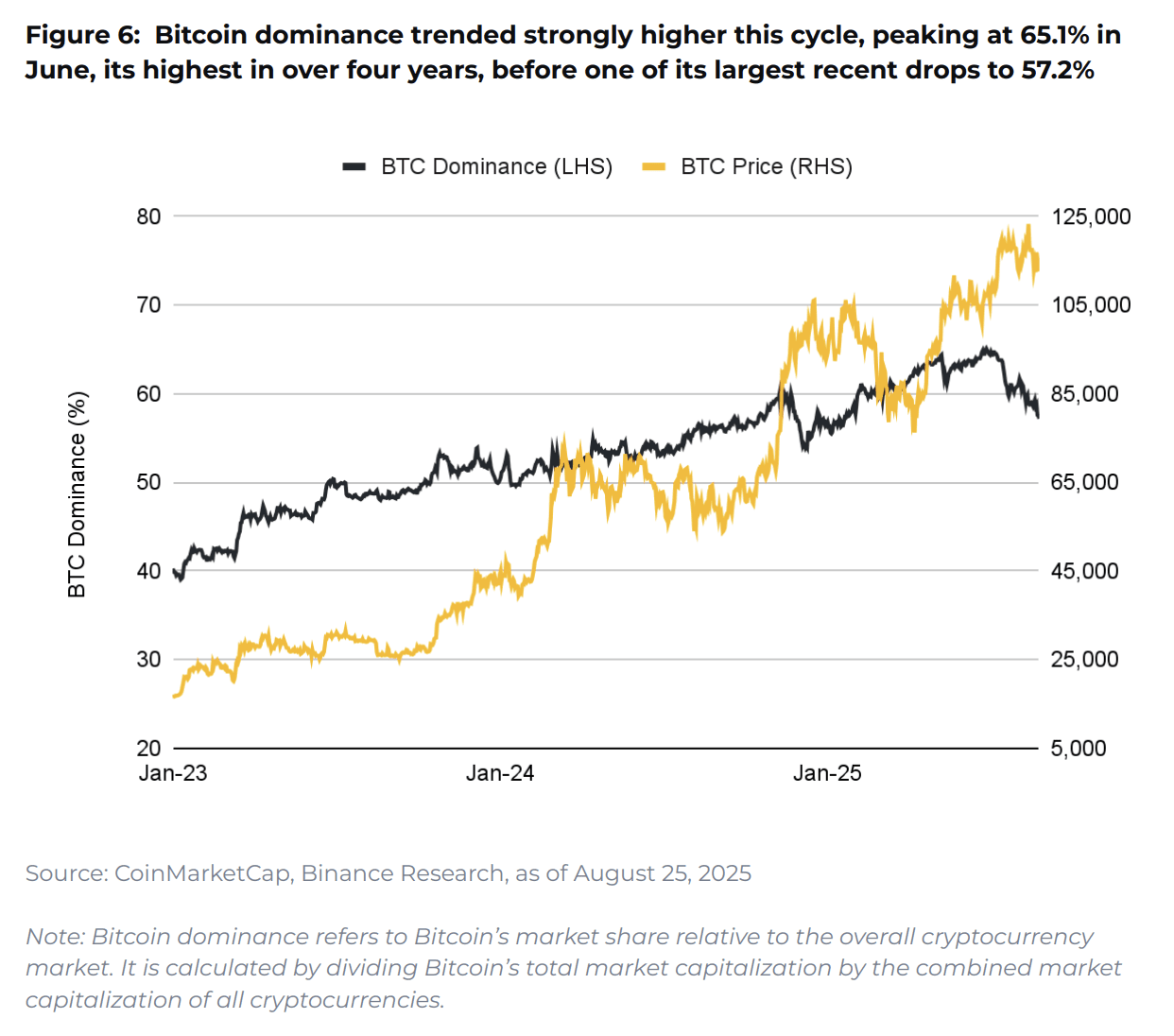

Bitcoin dominance eases, altcoins show signs of rotation

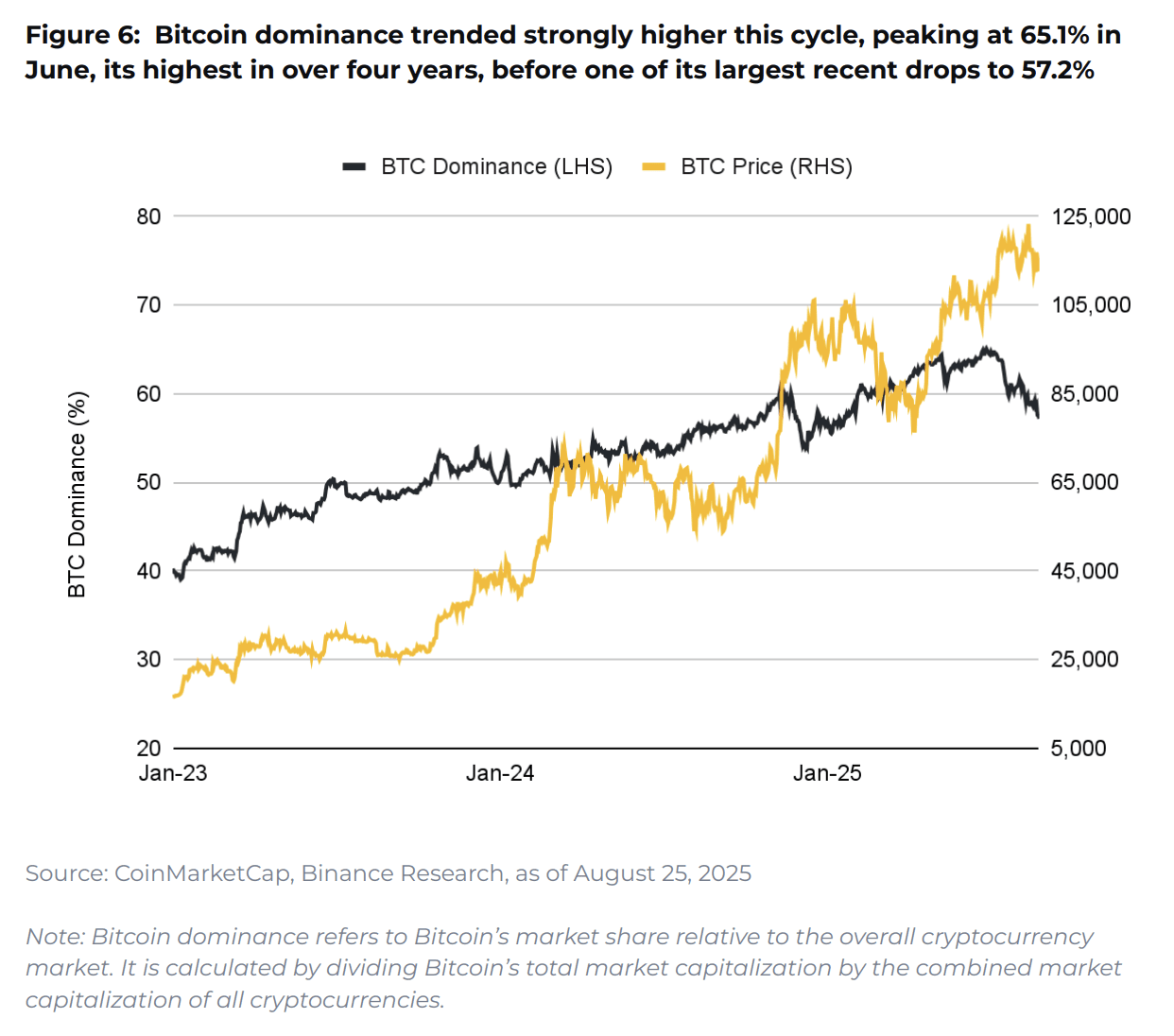

Bitcoin dominance surged from approximately 40% to 65.1% earlier this year, marking a BTC-led cycle fueled by macro uncertainty and structural demand from ETFs, corporate treasuries, and sovereign reserves. However, dominance has recently eased to 57.2%, suggesting capital may rotate toward altcoins.

The report identifies this as a key metric for tracking market dynamics, with historical patterns showing that dominance retracements often mark early stages of stronger altcoin performance once Bitcoin stabilizes.

Related: BTC Dominance Index: how to use it?

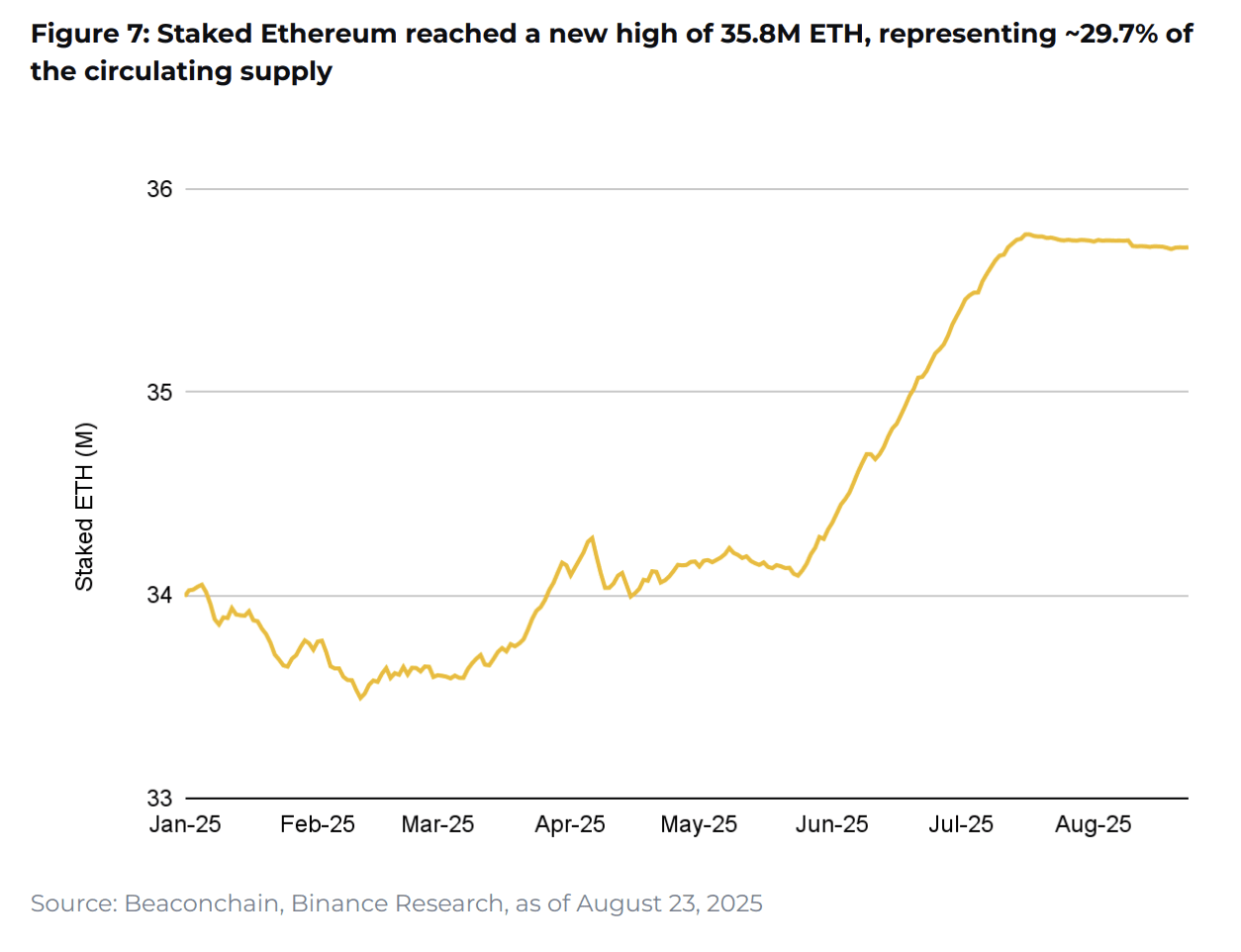

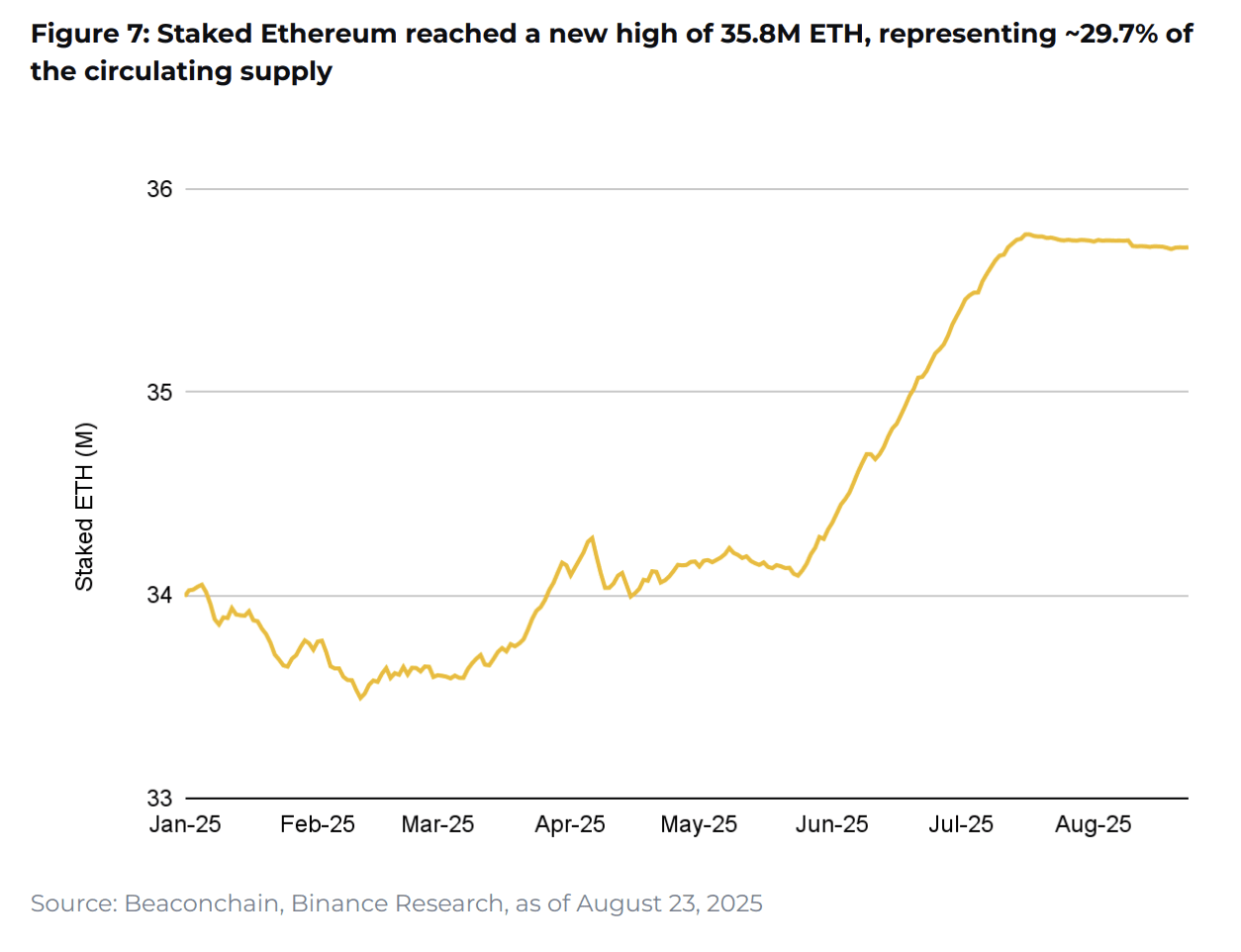

Ethereum staking hits record 35.8M ETH after Pectra upgrade

Ethereum staking hit a record 35.8 million ETH, representing approximately 29.7% of the circulating supply. The surge was driven by the Pectra upgrade in May 2025, which increased the maximum effective balance per validator from 32 ETH to 2,048 ETH, letting large stakers consolidate holdings more efficiently.

Rising institutional adoption has also contributed to staking growth, with ETH-focused treasuries and funds adding staking into portfolio strategies to earn extra yield.

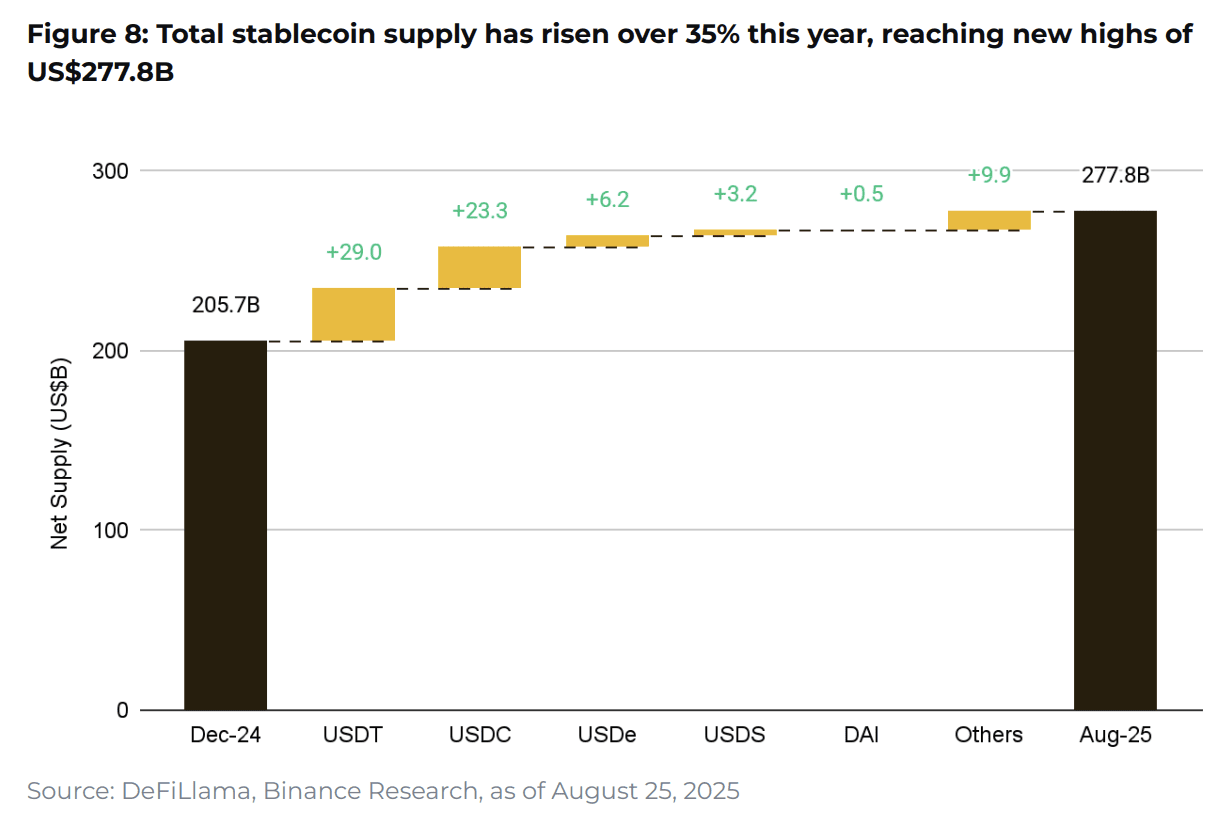

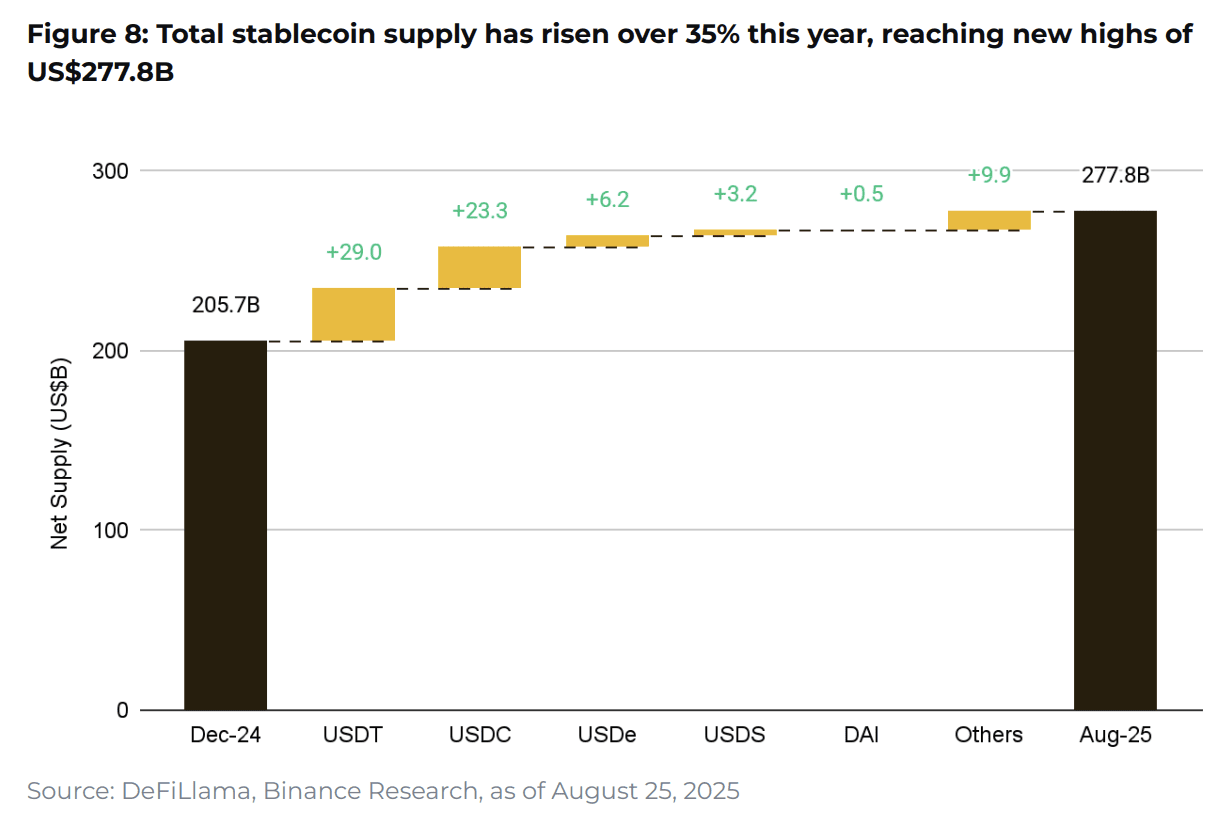

Stablecoin supply jumps 35% to record $278B

Stablecoin supply has surged over 35% to a record $277.8 billion, signaling fresh capital inflows and greater market buying power. The growth has been supported by improved regulatory clarity, particularly the passage of the GENIUS Act, which provides clearer frameworks for stablecoin operations.

Policy developments have expanded stablecoins' role beyond trading into payments and settlement use cases, with projects like JPMorgan's Kinexys demonstrating their utility in streamlining interbank transactions.

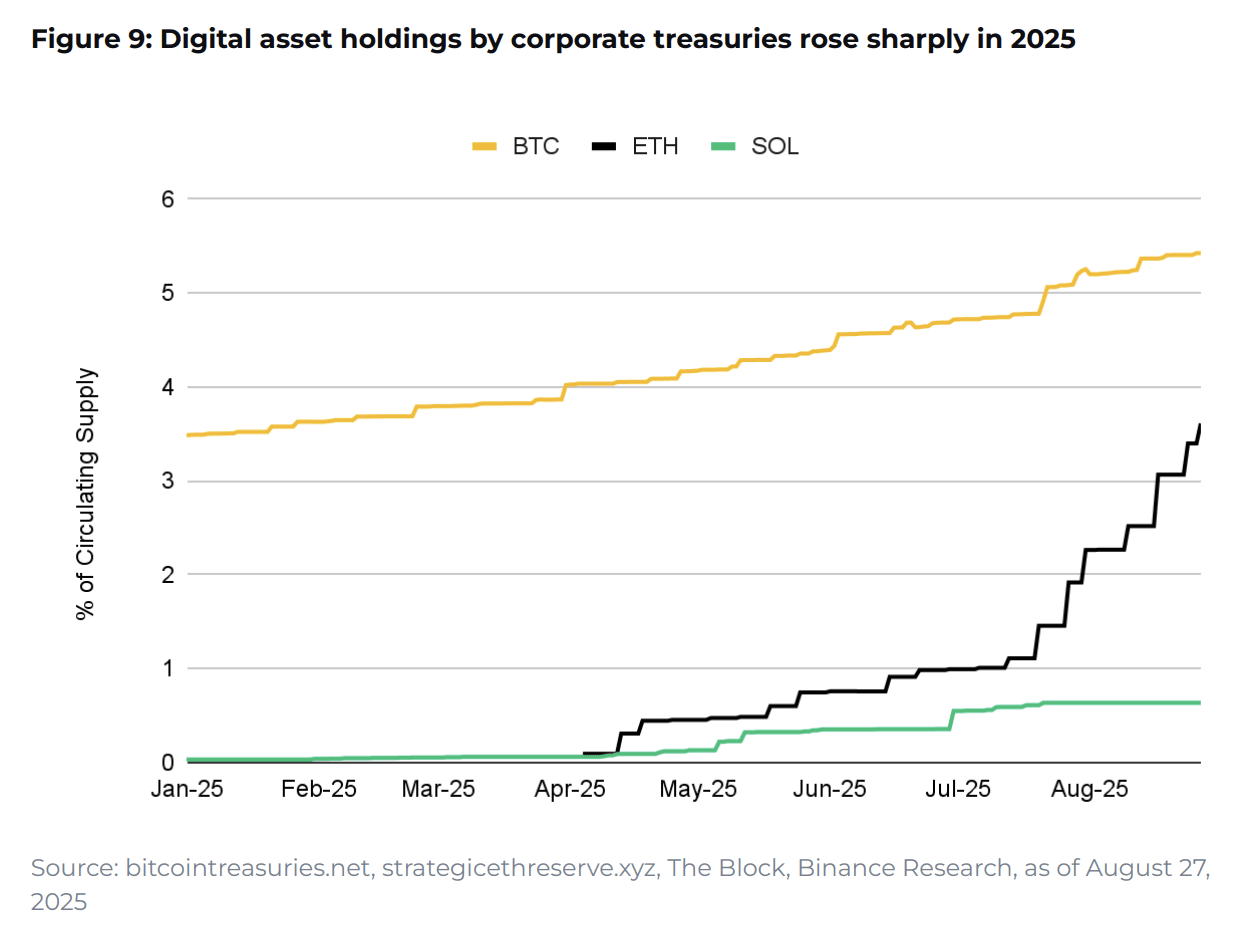

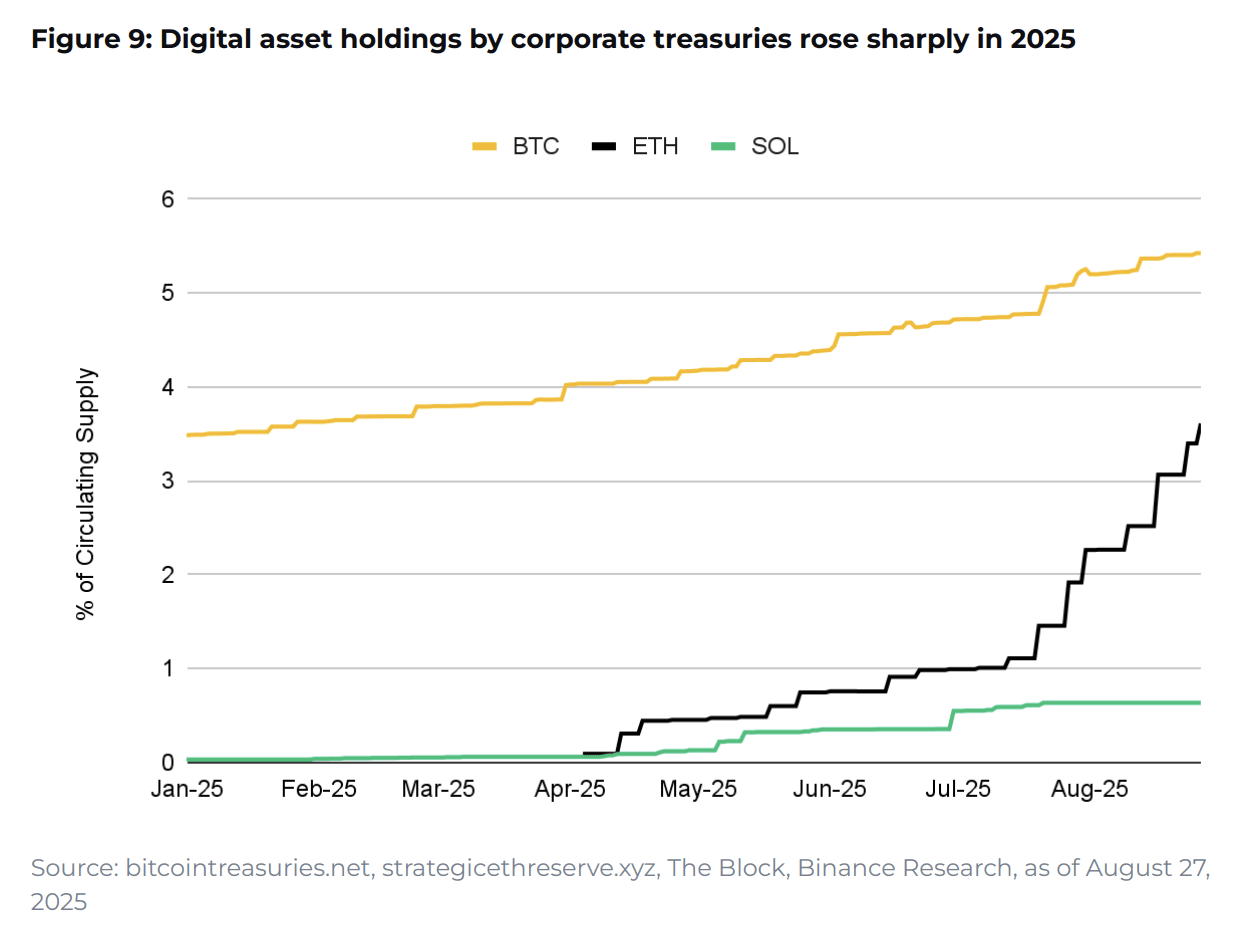

Corporate Bitcoin and Ethereum holdings surge among public firms

Corporate digital asset holdings have become a central market narrative. More than 170 public companies now collectively hold approximately 1.07 million BTC (5.4% of circulating supply), with Strategy accounting for roughly 59% of corporate holdings at 632,457 BTC.

Ethereum's corporate footprint is accelerating even faster, with ETH holdings by public companies rising 88.3% in the past month to 4.36 million ETH – the largest monthly increase on record. Over 70 entities now have ETH exposure, collectively holding around 66% of ETH assets managed by ETFs.

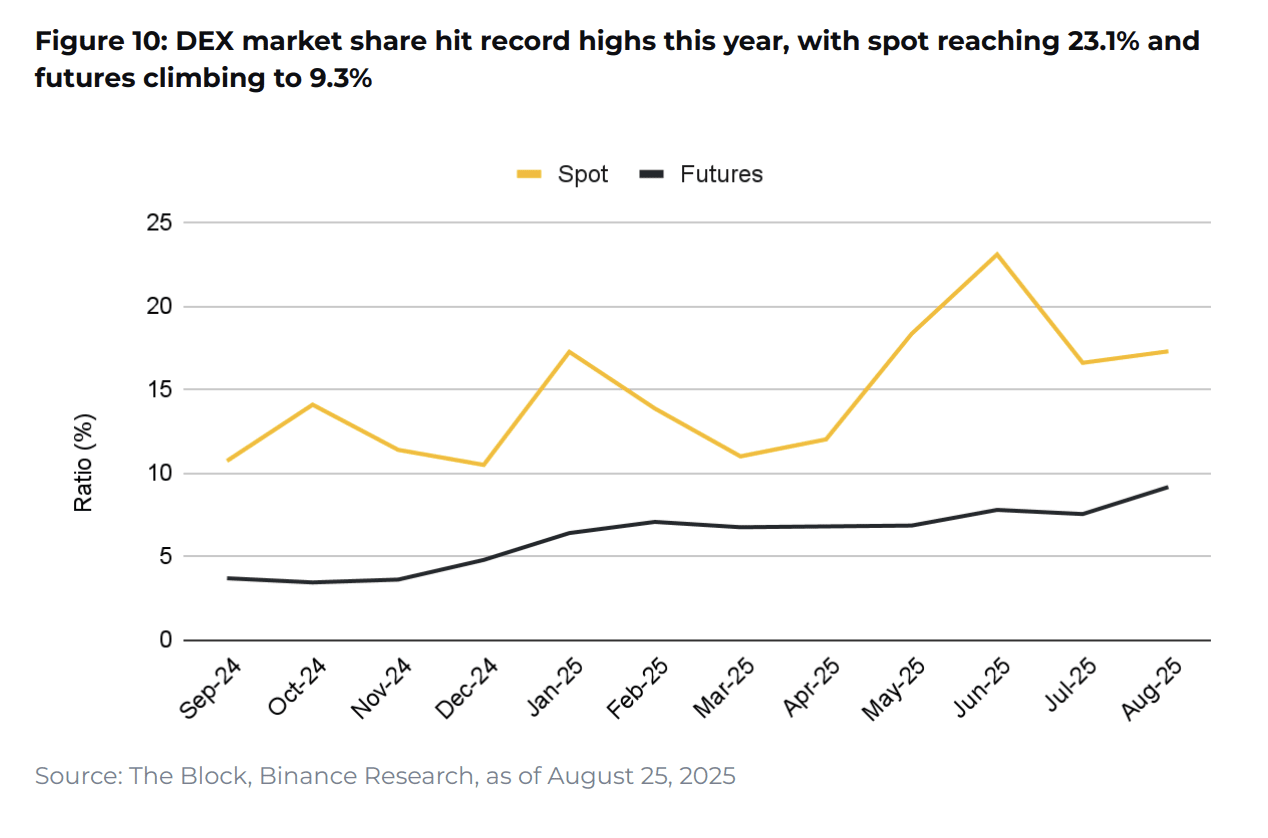

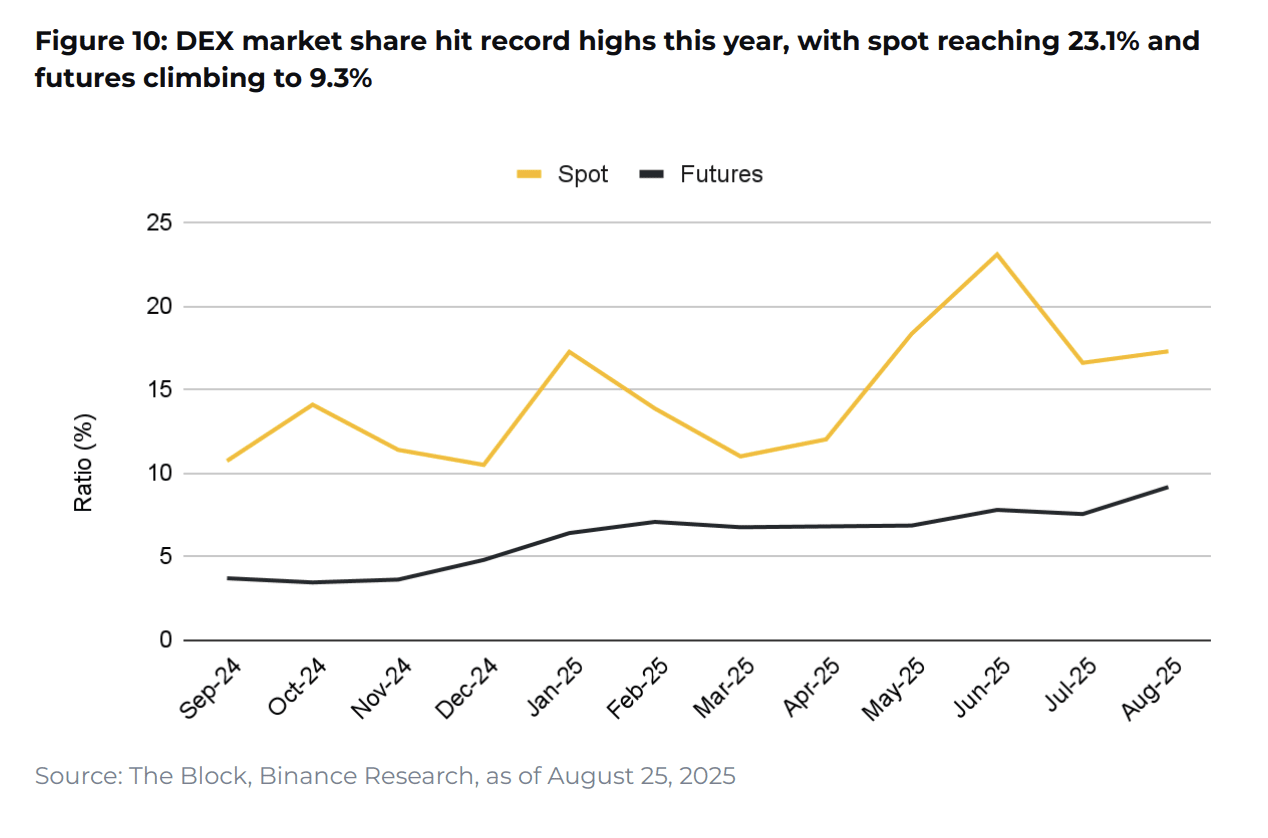

DEX market share climbs to record 23% in spot and 9% in futures

Decentralized exchanges continue capturing larger shares of global crypto trading, with DEX market share peaking at 23.1% in spot trading and 9.3% in futures. The shift reflects structural changes in how liquidity is routed across markets.

Hyperliquid has led the on-chain derivatives trend, with perpetual volume rising from $198B in January to nearly $360B by August. The report notes that hybrid models combining centralized liquidity with on-chain execution are likely to accelerate DEX growth.

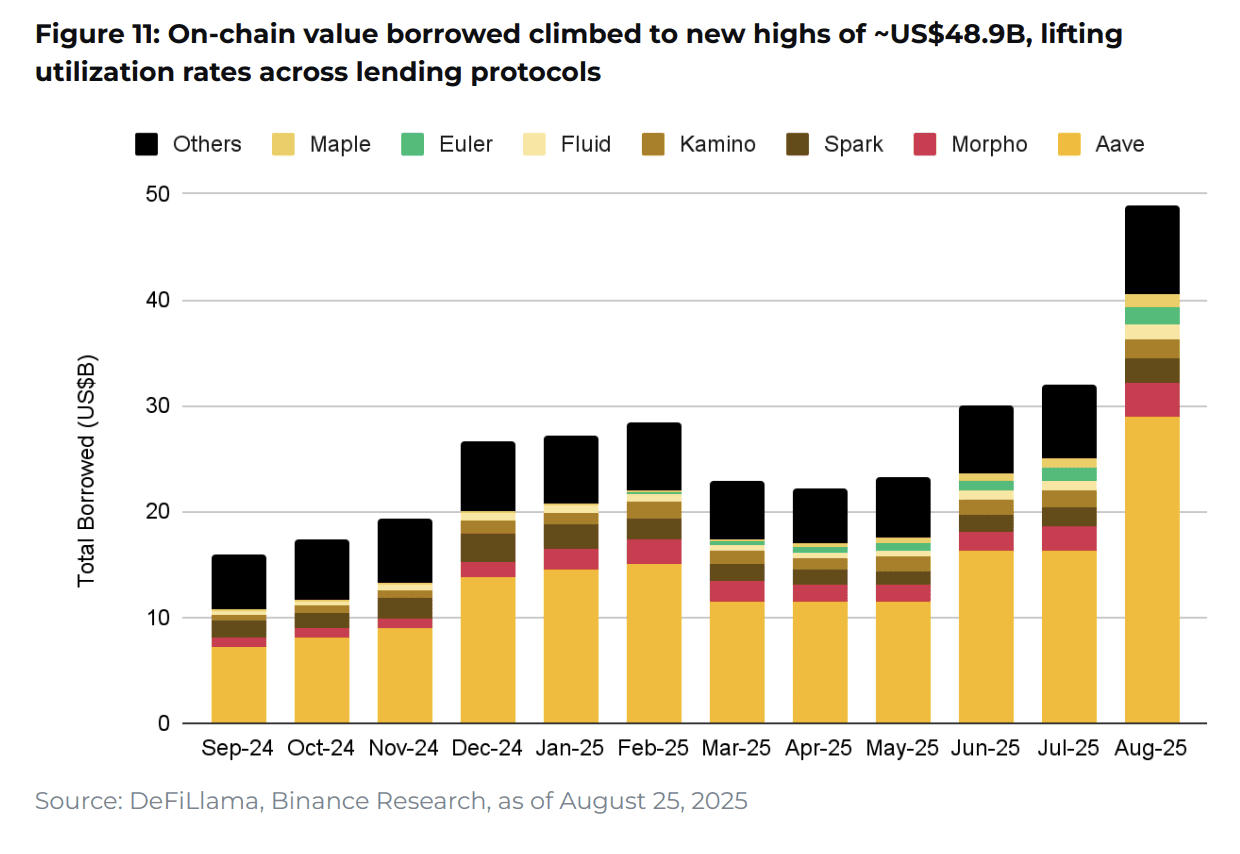

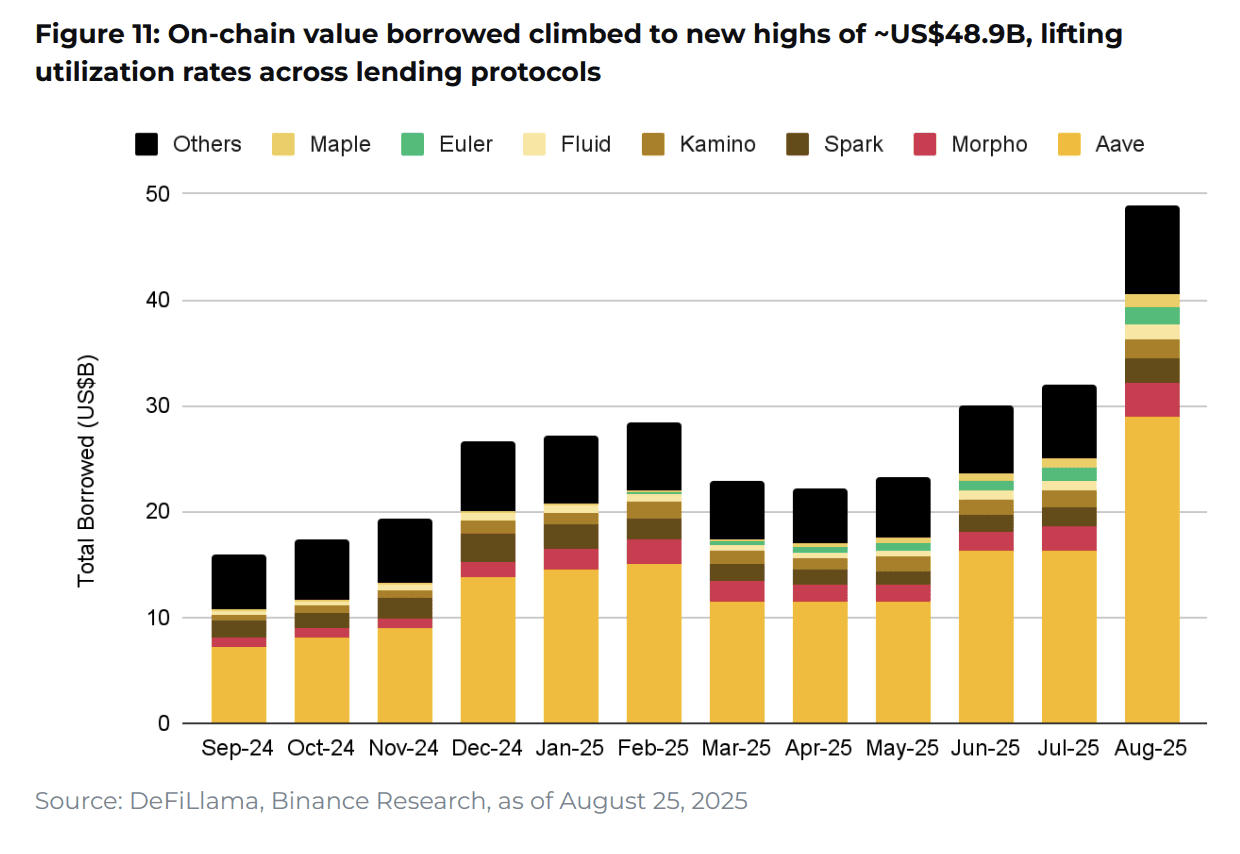

DeFi lending activity rises 80% as borrowing demand grows

On-chain lending reached new highs with total value locked climbing to nearly $79.8 billion. More significantly, total borrowing activity surged 80%, lifting average utilization rates across major protocols and indicating a shift from pure growth to meaningful usage.

Aave remains the market leader with approximately $39.9 billion in TVL (50% of the DeFi lending market) and $12.4 million in protocol fees over the past 30 days. New entrants like Morpho, Euler, and Maple are pushing modular and RWA-focused architectures.

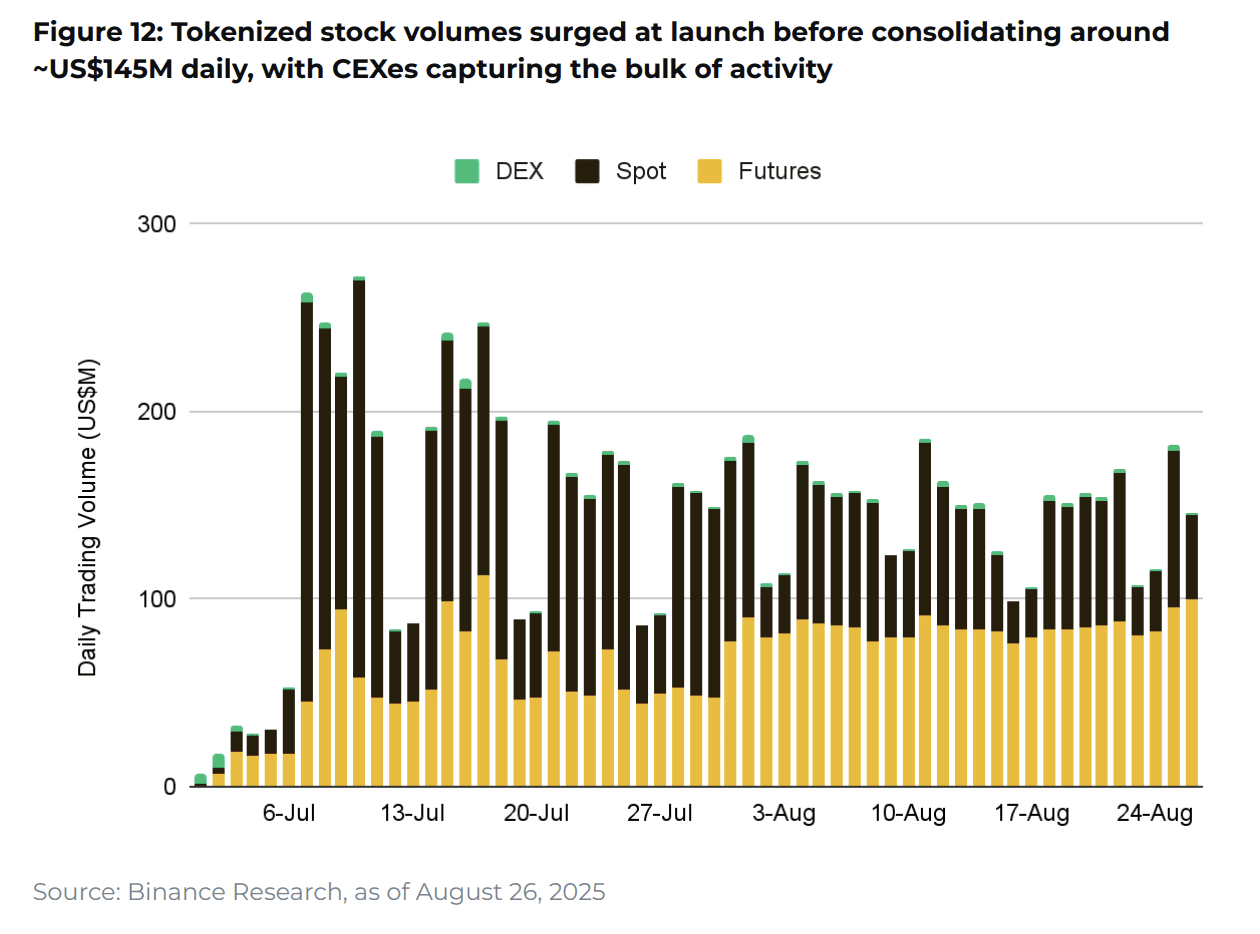

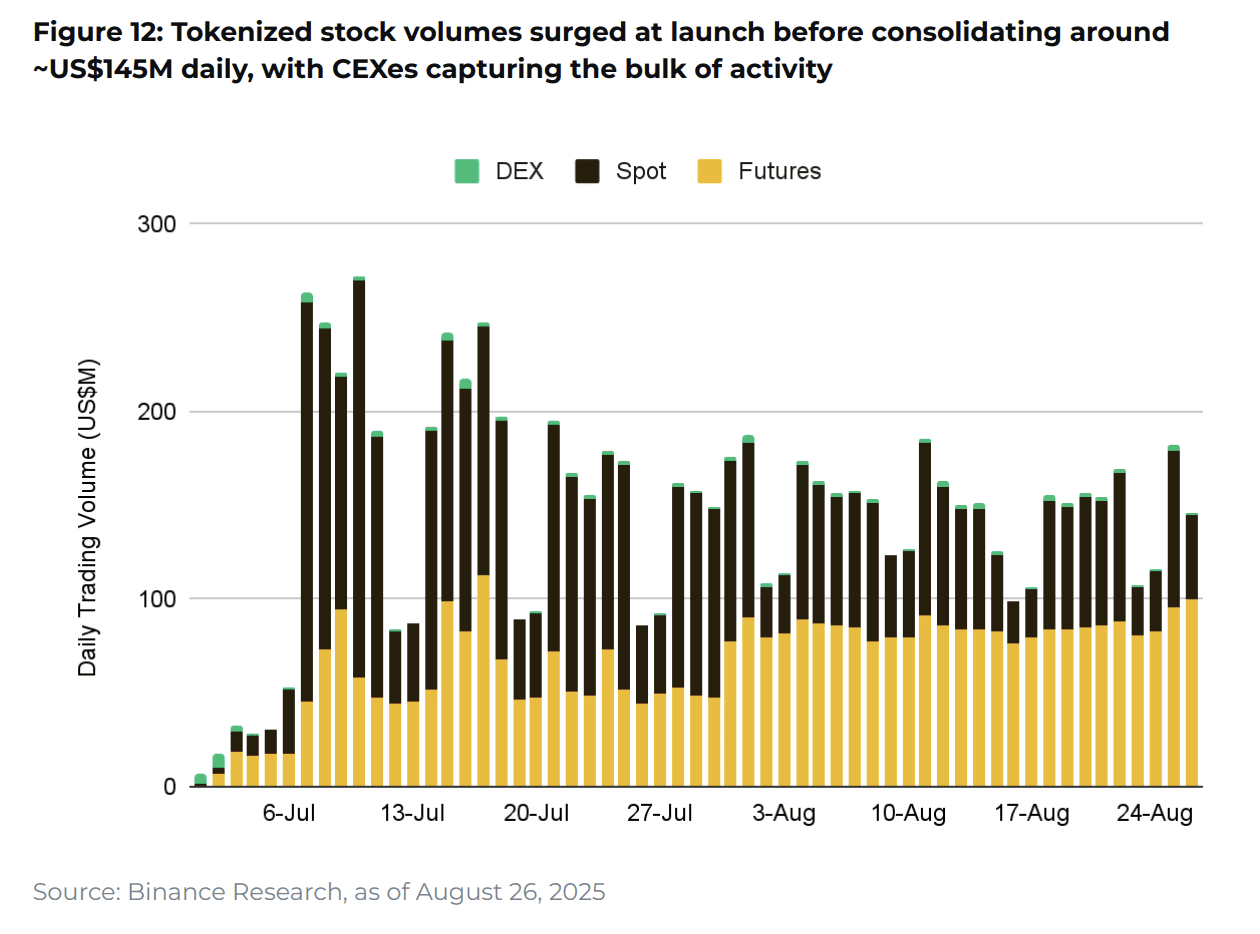

Tokenized equities market grows 378% as adoption accelerates

Tokenized equities have reached a market capitalization of approximately $349 million, supported by improved infrastructure and regulatory clarity. Tokenized TSLA and SPY grew over 378% since July, with active on-chain holders rising from 22.4K in early July to over 66.5K in August.

The report notes that adoption patterns mirror DeFi's early stages, with experimentation preceding scale. Researchers estimate tokenizing only 1% of global equities could create a $1.3T market.

Related: What is Tokenized Gold?

Outlook: structural forces set stage for next crypto growth cycle

Binance Research concludes that while near-term volatility may increase with anticipated rate cuts and trade tensions, the digital asset market's next phase will be shaped by structural forces including monetary easing, expanding liquidity, corporate treasury allocations, and clearer regulation.

With Bitcoin dominance declining and stablecoin reserves reaching new highs, conditions look favorable for broader ecosystem participation and continued market maturity.

Recommended