American Banker: Only 2% of banks have launched stablecoins

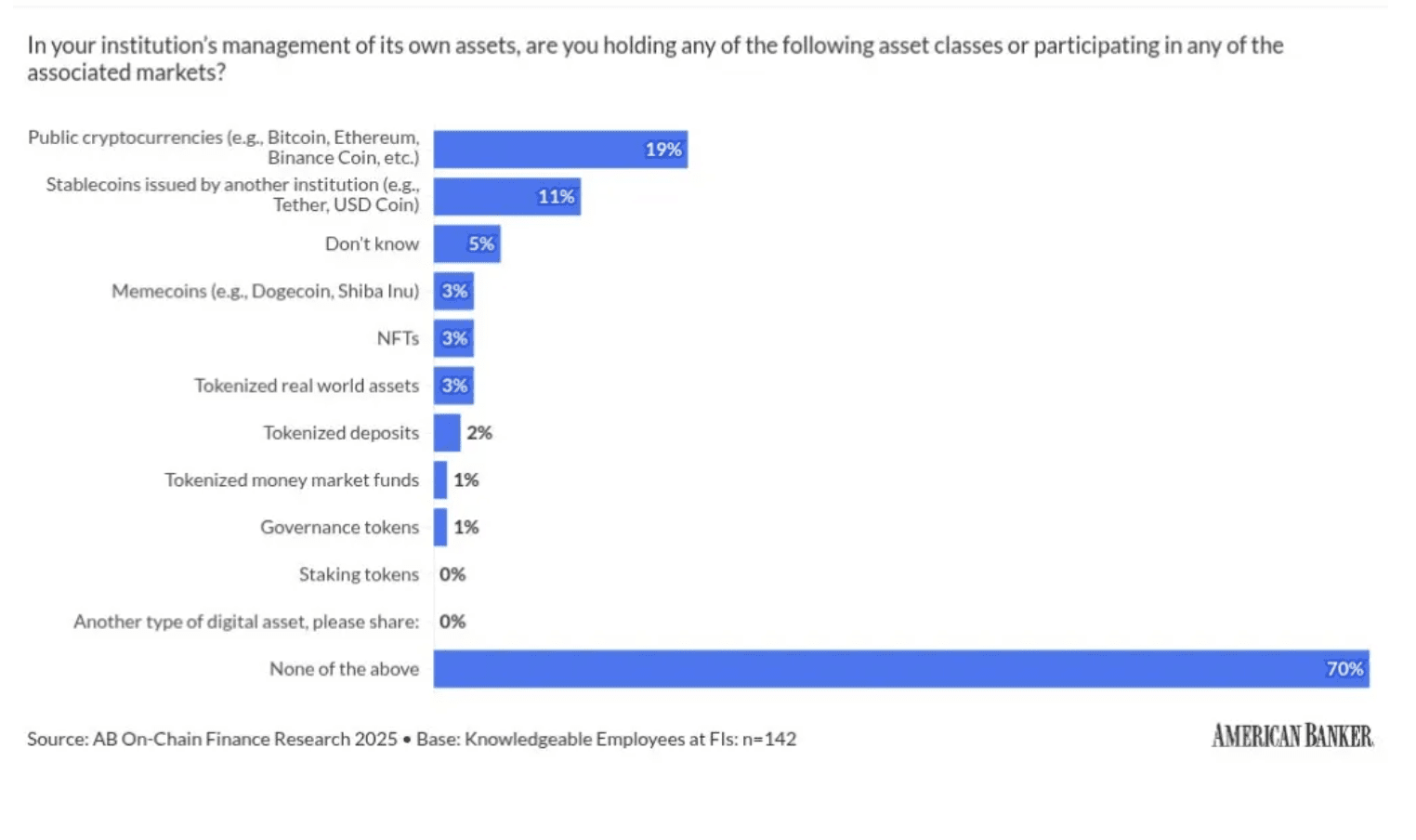

A report from American Banker shows that 19% of large banks already work with cryptocurrencies and 11% hold stablecoins, while most are still preparing to launch their own digital-asset initiatives.

In 2025, interest in cryptocurrencies and stablecoins among banking executives has continued to rise, though progress remains cautious.

A survey of 142 representatives from banks, credit unions, and fintech companies found that only 2% of institutions have launched their own stablecoins, another 2% are running pilot programs, and 4% are preparing partnerships with other banks for issuance. Meanwhile, around 70% are still discussing such initiatives or haven’t started development at all.

The most active participants are regional and national banks with assets exceeding $10 billion: 6% of which have already launched or are testing their own stablecoins. Among credit unions, 43% are in early discussions, signaling growing interest in digital currencies.

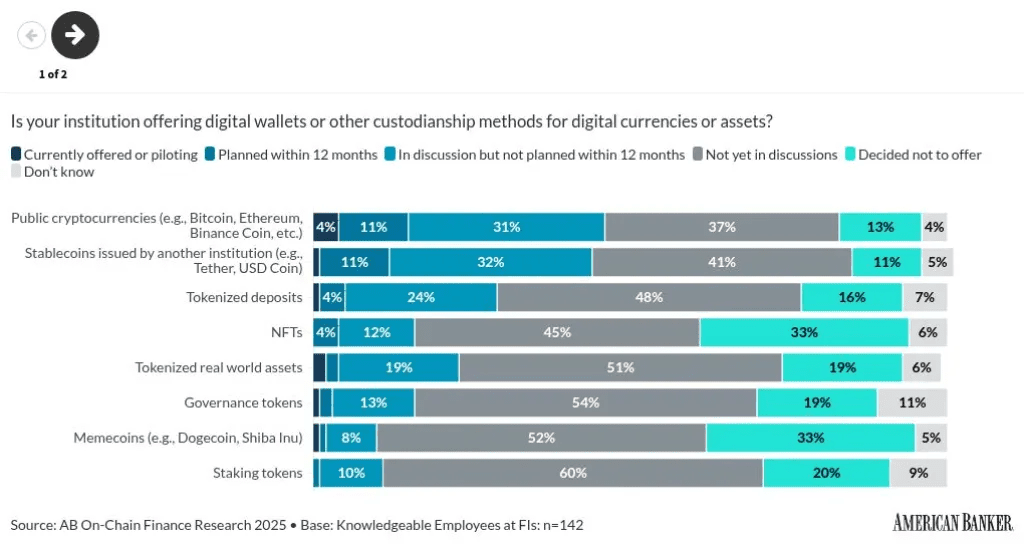

Survey results on digital-asset adoption strategies among financial institutions. Source: americanbanker.com

A recent example is the French banking giant ODDO BHF, which manages over €150 billion in assets and has launched its own euro-backed stablecoin EUROD, fully collateralized with fiat reserves held in European banks.

When it comes to crypto custody, 15% of banks and credit unions plan to introduce digital wallets for Bitcoin and Ethereum within the next 12 months, while 12% are developing stablecoin custody solutions.

Nearly 19% of large banks already hold public cryptocurrencies on their balance sheets, and another 11% hold stablecoins. For small and mid-sized banks, this figure does not exceed 10%.

Survey results on digital-asset adoption strategies among financial institutions. Source: americanbanker.com

Cryptocurrencies are increasingly integrated into the strategic planning for traditional financial institutions. Analysts expect that within two years, banks will compete directly with fintech companies not only in payments but also in the issuance of their own digital assets.

Recommended