Bank of Japan keeps rates unchanged, announces ETF sales

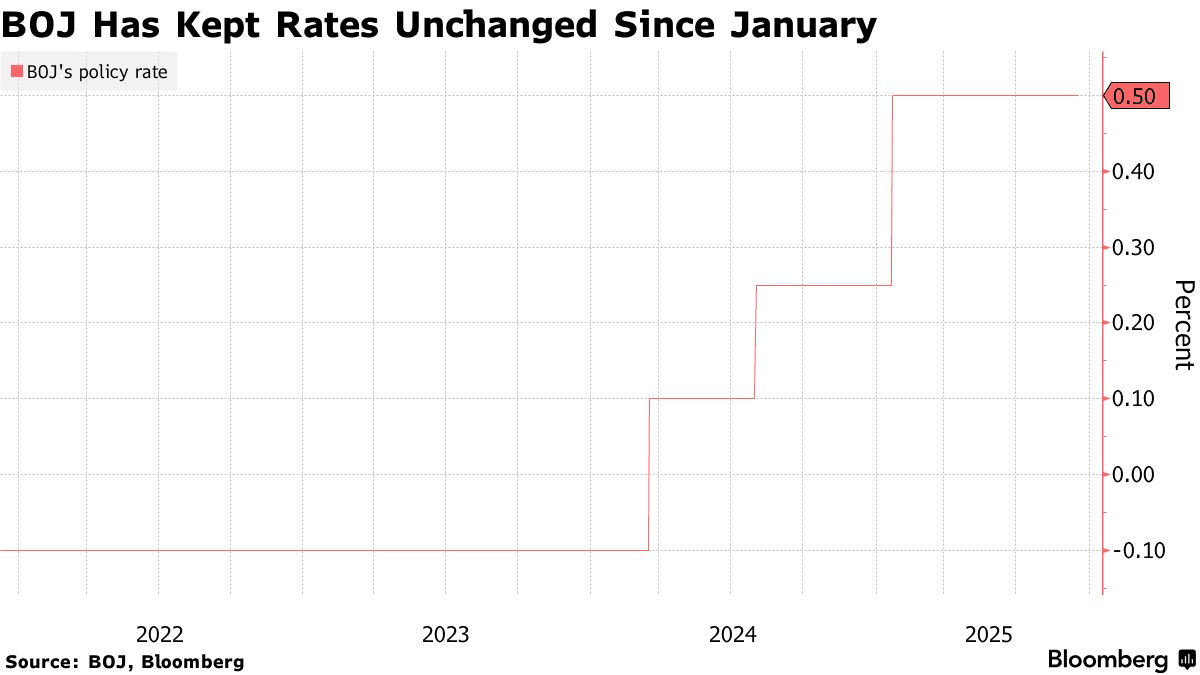

On Friday, the Bank of Japan (BOJ) kept its key rate steady at 0.5% but at the same time announced plans to begin selling part of its assets - ETFs and REITs accumulated over years of ultra-loose policy.

The decision passed with a 7–2 majority, as board members Hajime Takata and Naoki Tamura voted for a 25 bp rate hike. Such dissent highlights growing pressure on the central bank to speed up normalization.

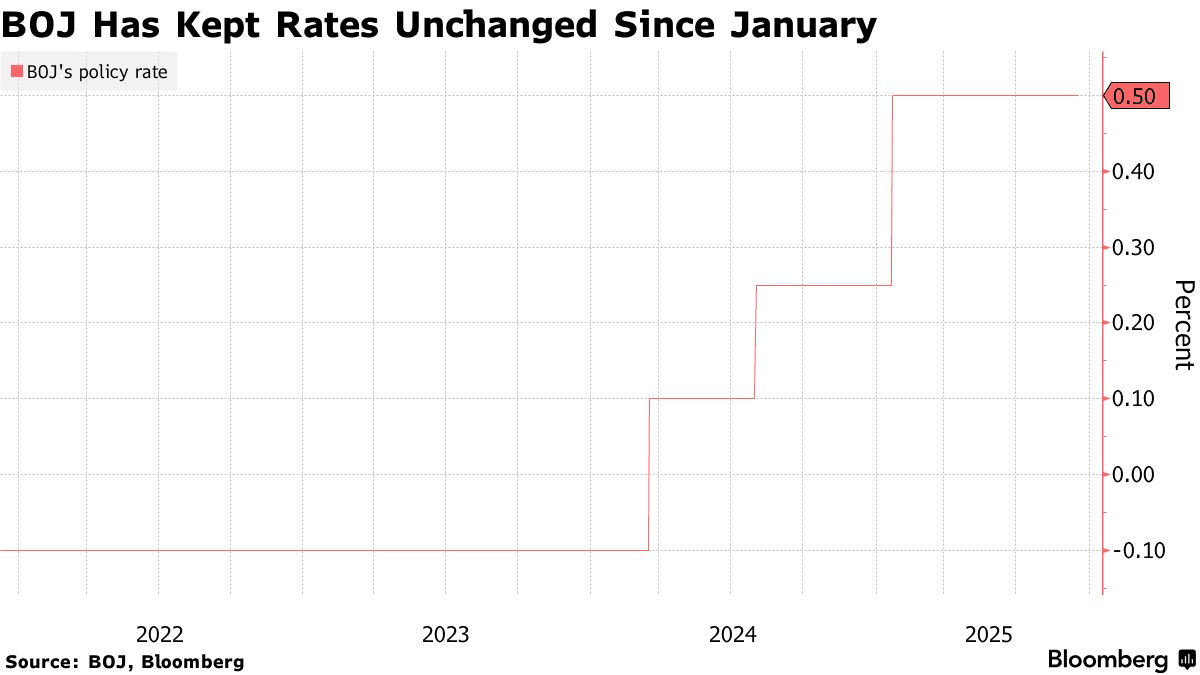

Japan base interest rate chart from 2021. Source: bloomberg.com

According to the BOJ statement, annual sales will amount to about ¥330B ($2.24B) in ETFs and about ¥5B in REITs. Morgan Stanley estimates the BOJ’s total ETF portfolio at ¥79.5T ($533.7B), equal to more than 7% of the Tokyo Stock Exchange’s market cap.

Markets reacted immediately: the Nikkei 225, which had climbed to a record 45,852 points, reversed course and closed down 1–1.4%. The TOPIX fell 0.5%. Yields on 10-year government bonds spiked, while the yen strengthened about 0.4–0.5% against the dollar.

The BOJ said the goal of the program is to reduce its market footprint “without disrupting stability.” Economists drew parallels to the early 2000s, when the sale of crisis-era bank equity holdings stretched over 18 years.

Asset sales will begin once operational procedures are in place, and the pace may be adjusted at future meetings. The next policy decision is set for Oct. 29–30, with swaps already pricing in nearly a 55% chance of a rate hike.

Thus, the Bank of Japan has taken another step toward exiting the era of aggressive stimulus, signaling a long-term shift toward balance sheet reduction while remaining cautious about the economy.

Recommended