AI's $800 billion deficit threatens future development

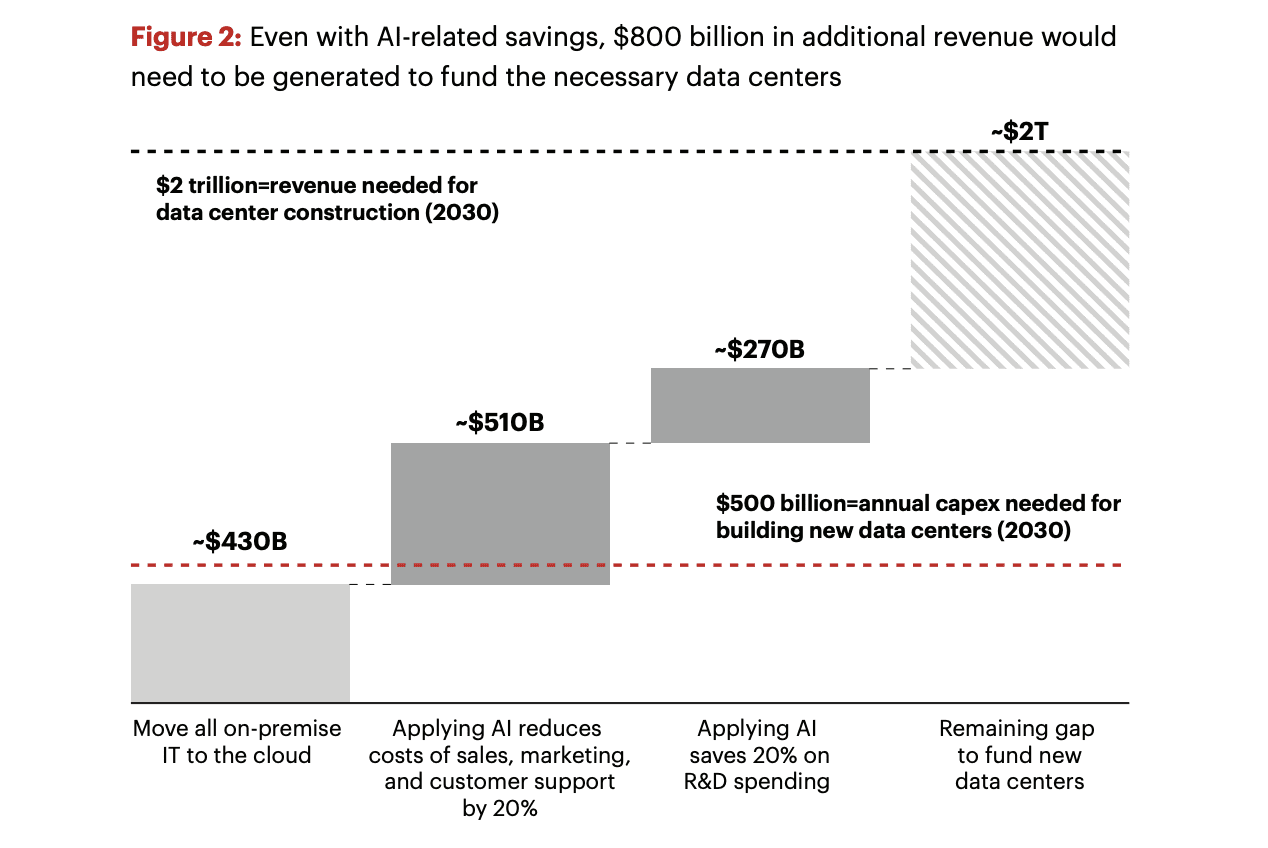

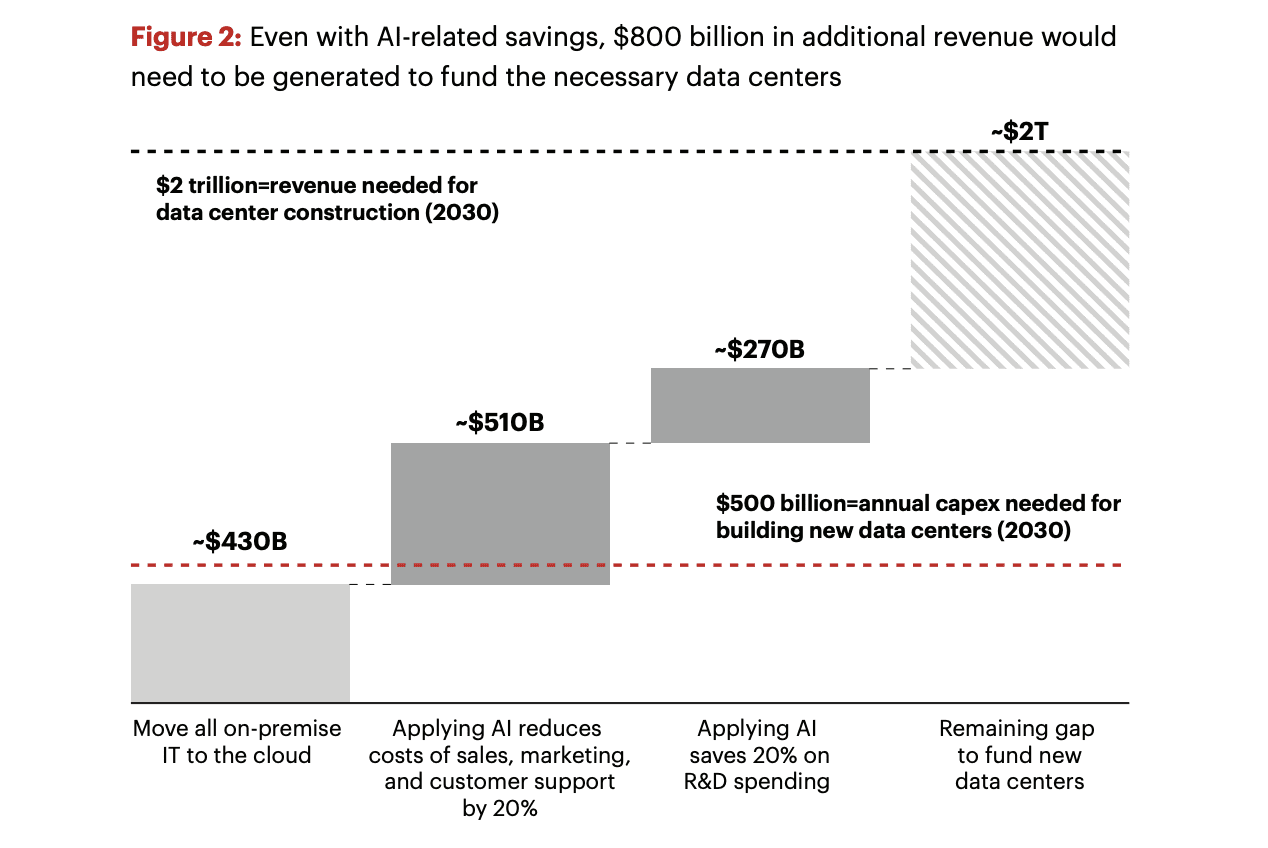

By 2030, the artificial intelligence industry could face a funding gap of nearly $800 billion as the cost of building new data centers outpaces revenue growth, warns Bain & Company.

The artificial intelligence sector is rolling out ambitious investment plans for data centers and hardware. But the key question is whether companies can raise the funds needed to turn them into profitable businesses.

In its new annual report, Bain & Company estimated that by 2030, the industry will require about $2 trillion in cumulative annual revenue just to finance the necessary computing. According to analysts' estimates, revenues could fall short of this target by around $800 billion, creating a significant funding gap.

Potential growth in AI market costs. Source: Bain report

Such a deficit poses risks to current valuations and business models. Services like ChatGPT and Gemini are driving user demand for AI, along with surging requirements for computing power and electricity. But the economic benefits for companies are lagging behind the infrastructure's appetite.

Bain notes that if the current scaling dynamic continues, financial pressure on the sector will intensify. According to Bloomberg Intelligence, the largest tech players (Microsoft, Amazon, and Meta) will be spending over $500 billion annually on AI by the start of the next decade. At the same time, many providers of AI services are still far from sustainable profitability. For example, OpenAI continues to operate at a loss and expects to achieve a positive cash flow only by 2029.

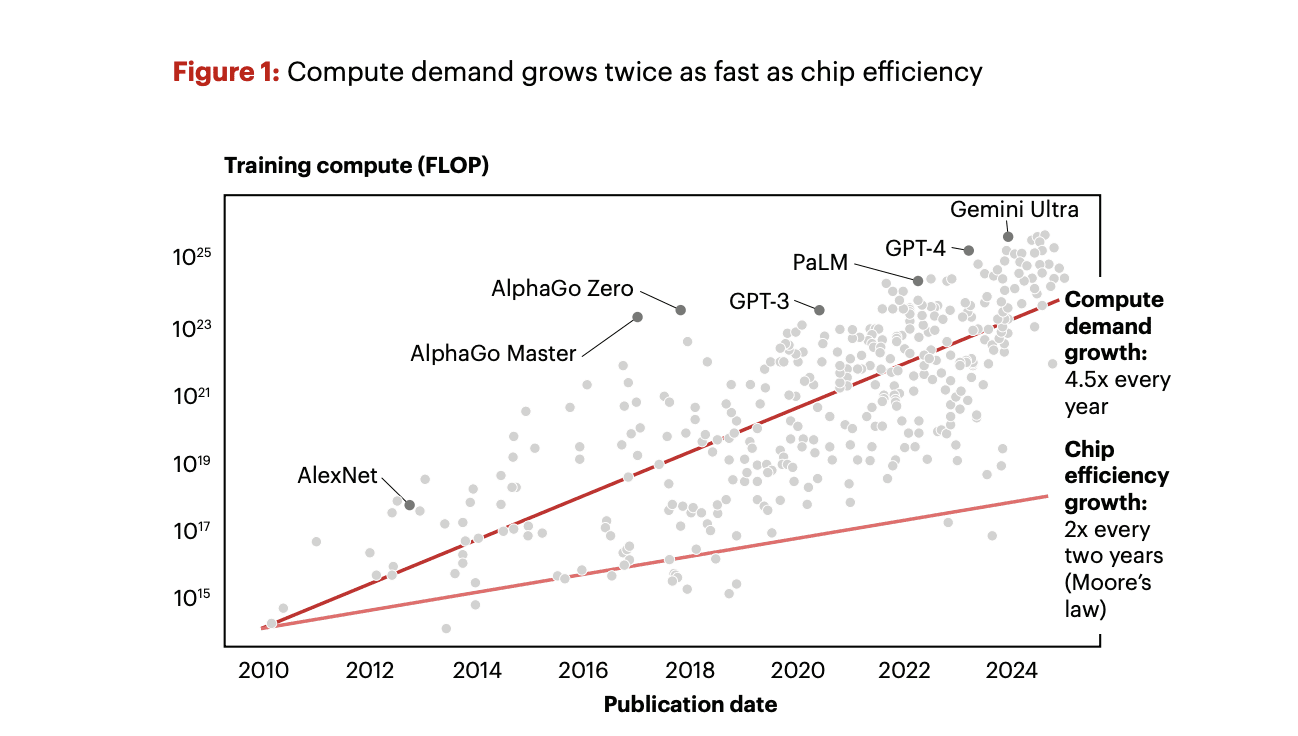

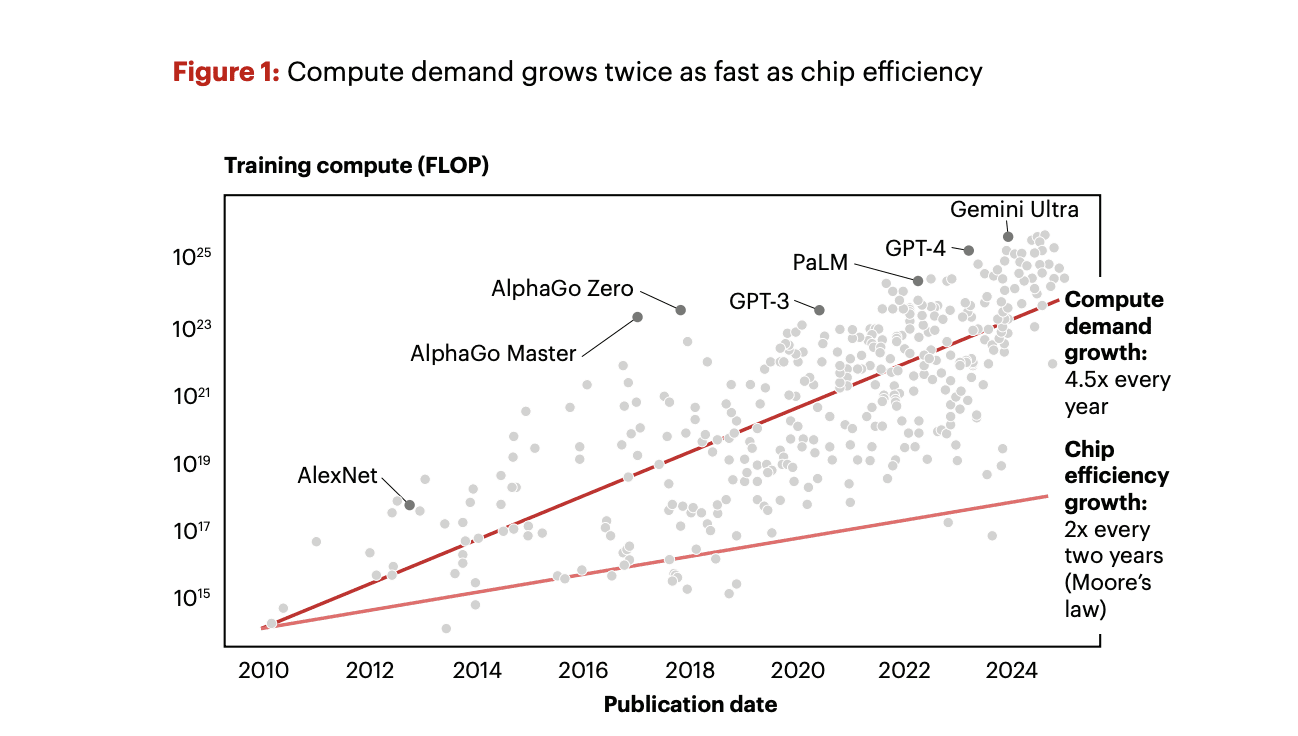

The supply side faces limits as well. Bain projects that additional global demand for computing by 2030 could reach approximately 200 GW, with the US accounting for about half. Advances in chip design, new architectures, and more efficient algorithms may ease the strain, but so far demand for computing power is growing faster than efficiency gains.

AI chip efficiency is growing more slowly than demand for power. Source: Bain report

However, large companies are actively investing in the product side. One of the priorities is autonomous AI agents that handle multi-step tasks with minimal prompts. Bain forecasts that within the next 3–5 years, up to 10% of corporate technology spending could go toward developing autonomous AI agents capable of managing complex, multi-step tasks with minimal human input.

The report also mentions related areas. Quantum technologies cloud generate up to $250 billion in new value in sectors including finance, pharma, logistics and materials science. But mass adoption will likely be gradual: first narrow use cases, then expansion. A similar trend is evident with humanoid robots: while pilot projects are multiplying, large-scale adoption is constrained by limited funding.

AI requires vast amounts of capital and energy, with no guarantee of returns. Without stronger monetization, cheaper computing, or significant breakthroughs in efficiency, investment plans risk outpacing actual revenues. For investors and executives, the most valuable resource now is not inflated valuations, but clear-eyed discipline in prioritizing products and managing capacity.