Avalanche plans $1B treasury initiative to purchase AVAX tokens

The Avalanche Foundation is negotiating with investors to set up two digital asset treasury firms in the US. The $1B deals would allow bulk purchases of AVAX at reduced prices.

The Avalanche Foundation, the organization behind the Avalanche blockchain, is in advanced talks with investors to establish two US-based digital asset treasury companies with deals totaling up to $1B, the Financial Times reported.

According to sources, one deal involves a private placement of up to $500M through a Nasdaq-listed company backed by Hivemind Capital. Advising on the deal is SkyBridge Capital founder and former White House communications director Anthony Scaramucci. The transaction is expected to close by the end of September.

The second deal is a SPAC sponsored by Dragonfly Capital, also targeting around $500M, with finalization anticipated in October.

Funds from both companies will be used to purchase millions of AVAX tokens from the foundation at a discount. Currently, about 420M AVAX are in circulation out of a total supply cap of 720M tokens.

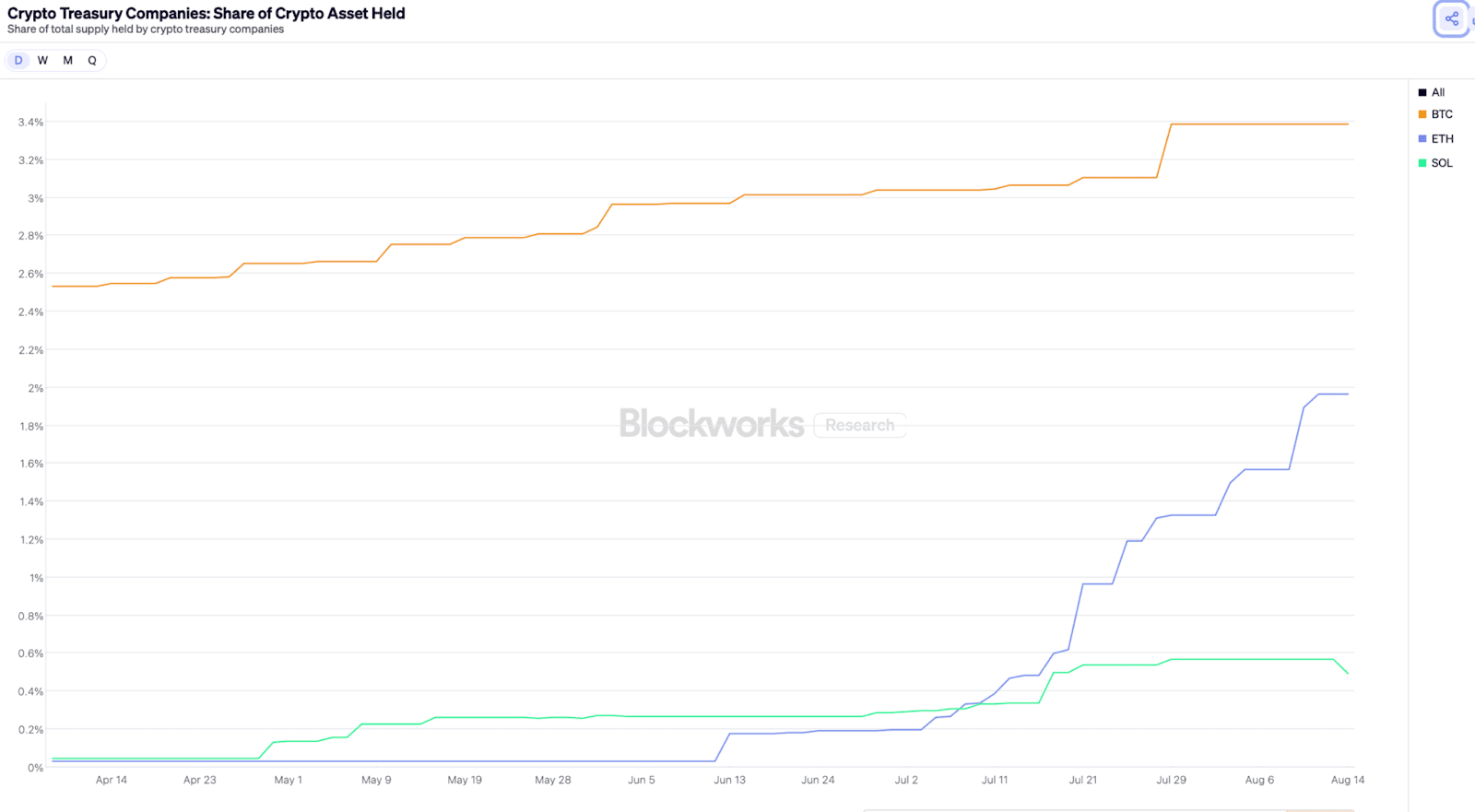

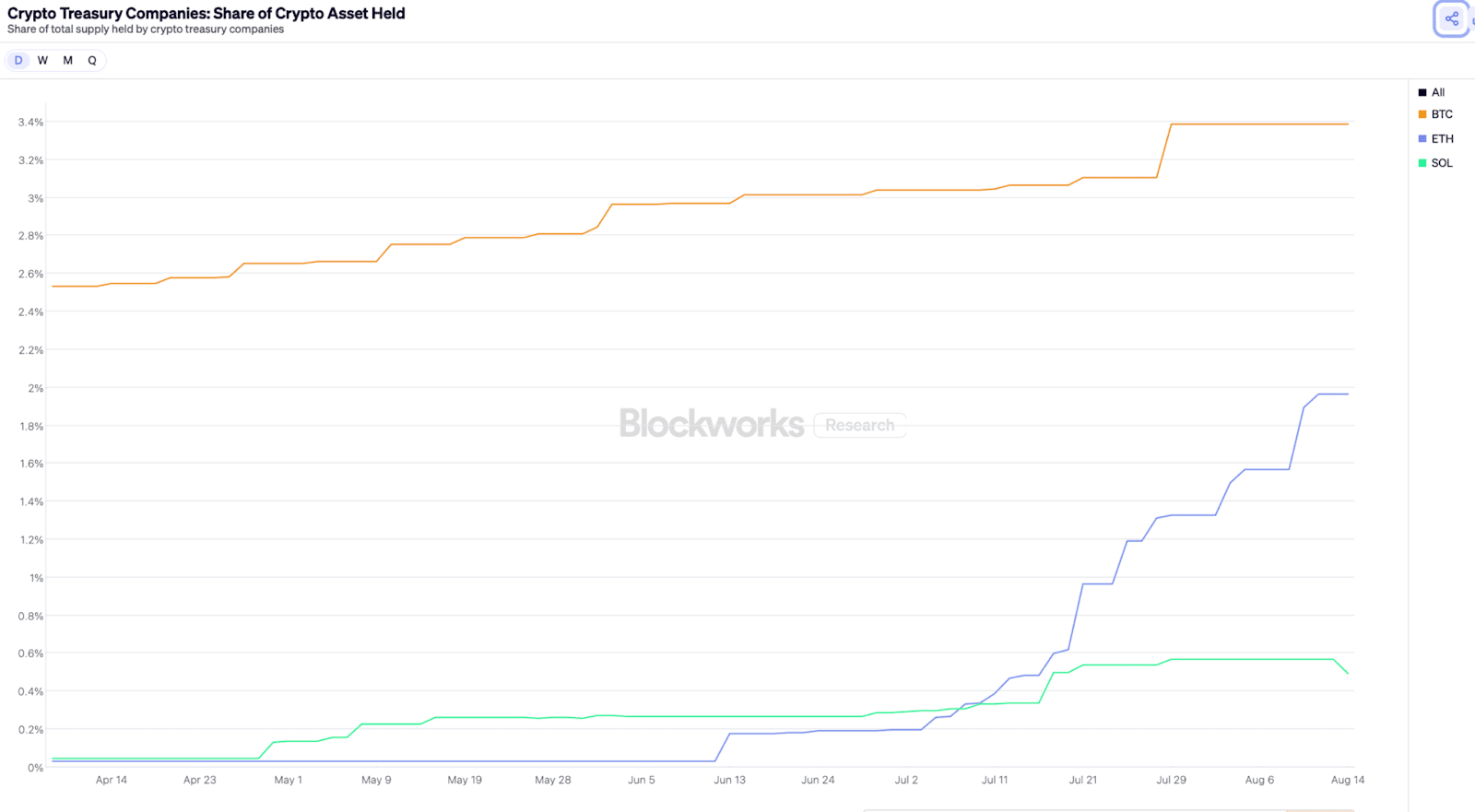

The Avalanche Foundation’s initiative aligns with the growing trend of digital asset treasuries (DATs) – companies that accumulate crypto assets following the model popularized by Strategy (MSTR) with Bitcoin. In 2025, such entities have already raised more than $16B to acquire BTC, ETH and other tokens for long-term holding.

The foundation has not commented on the details of the negotiations, but the market views the initiative as an effort to strengthen Avalanche’s position among blockchains actively tested by major players such as BlackRock and Apollo for fund tokenization.

According to sources, one deal involves a private placement of up to $500M through a Nasdaq-listed company backed by Hivemind Capital. Advising on the deal is SkyBridge Capital founder and former White House communications director Anthony Scaramucci. The transaction is expected to close by the end of September.

The second deal is a SPAC sponsored by Dragonfly Capital, also targeting around $500M, with finalization anticipated in October.

Funds from both companies will be used to purchase millions of AVAX tokens from the foundation at a discount. Currently, about 420M AVAX are in circulation out of a total supply cap of 720M tokens.

The Avalanche Foundation’s initiative aligns with the growing trend of digital asset treasuries (DATs) – companies that accumulate crypto assets following the model popularized by Strategy (MSTR) with Bitcoin. In 2025, such entities have already raised more than $16B to acquire BTC, ETH and other tokens for long-term holding.

Crypto treasury companies: share of assets held in cryptocurrencies. Source: blockworks.co

Following the news, AVAX surged more than 10% in 24 hours to reach $29.11. Still, Avalanche’s token has lagged behind Ethereum and Solana, which have seen stronger institutional buying.

The foundation has not commented on the details of the negotiations, but the market views the initiative as an effort to strengthen Avalanche’s position among blockchains actively tested by major players such as BlackRock and Apollo for fund tokenization.