Asian markets notch fresh highs as oil eases on Gaza news

Asian equity benchmarks ended Thursday higher, setting fresh local peaks as investors continued to add exposure to AI‑linked names. Gold is holding near multi‑year highs above $4,000/oz, while the US dollar extends its recent dominance.

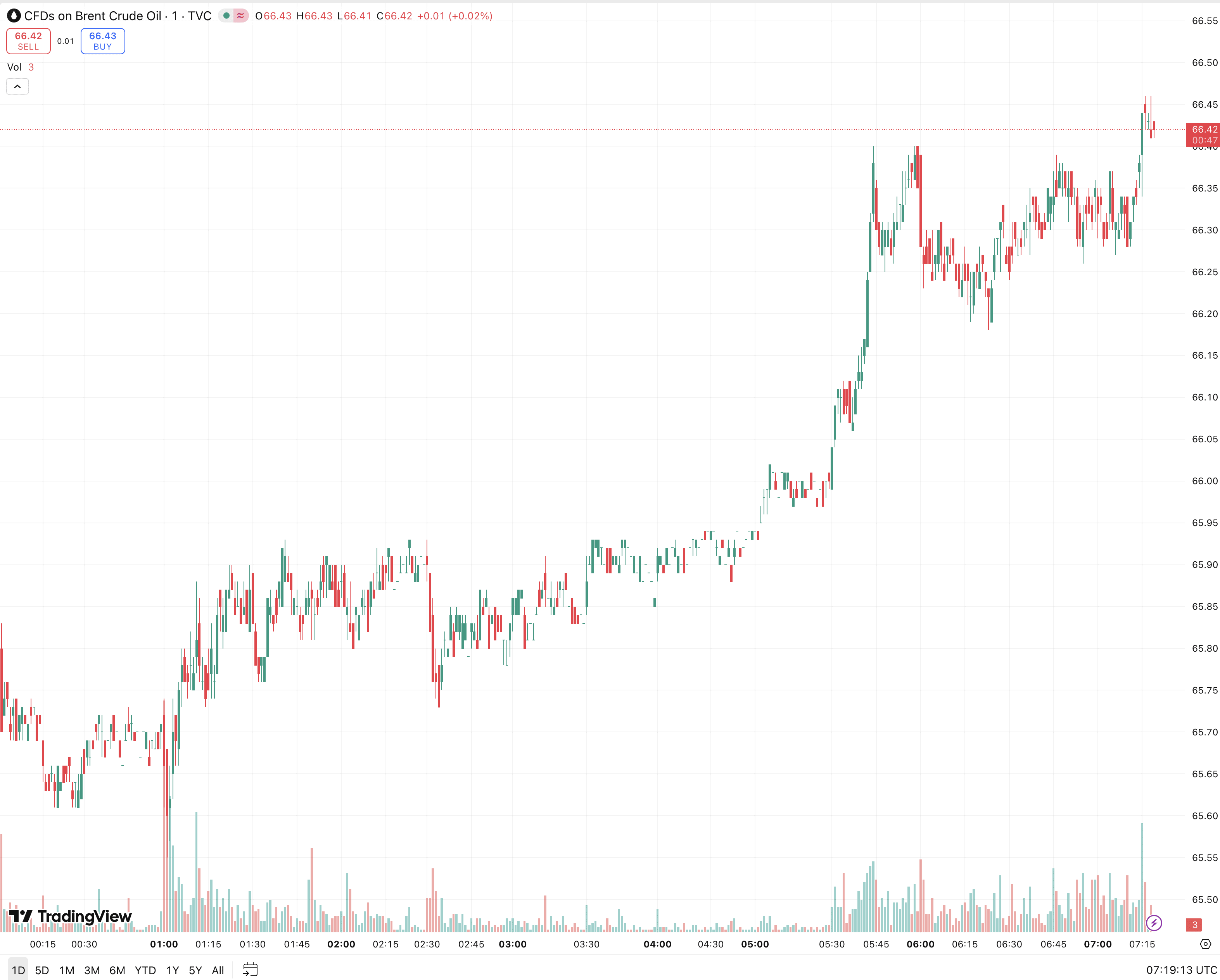

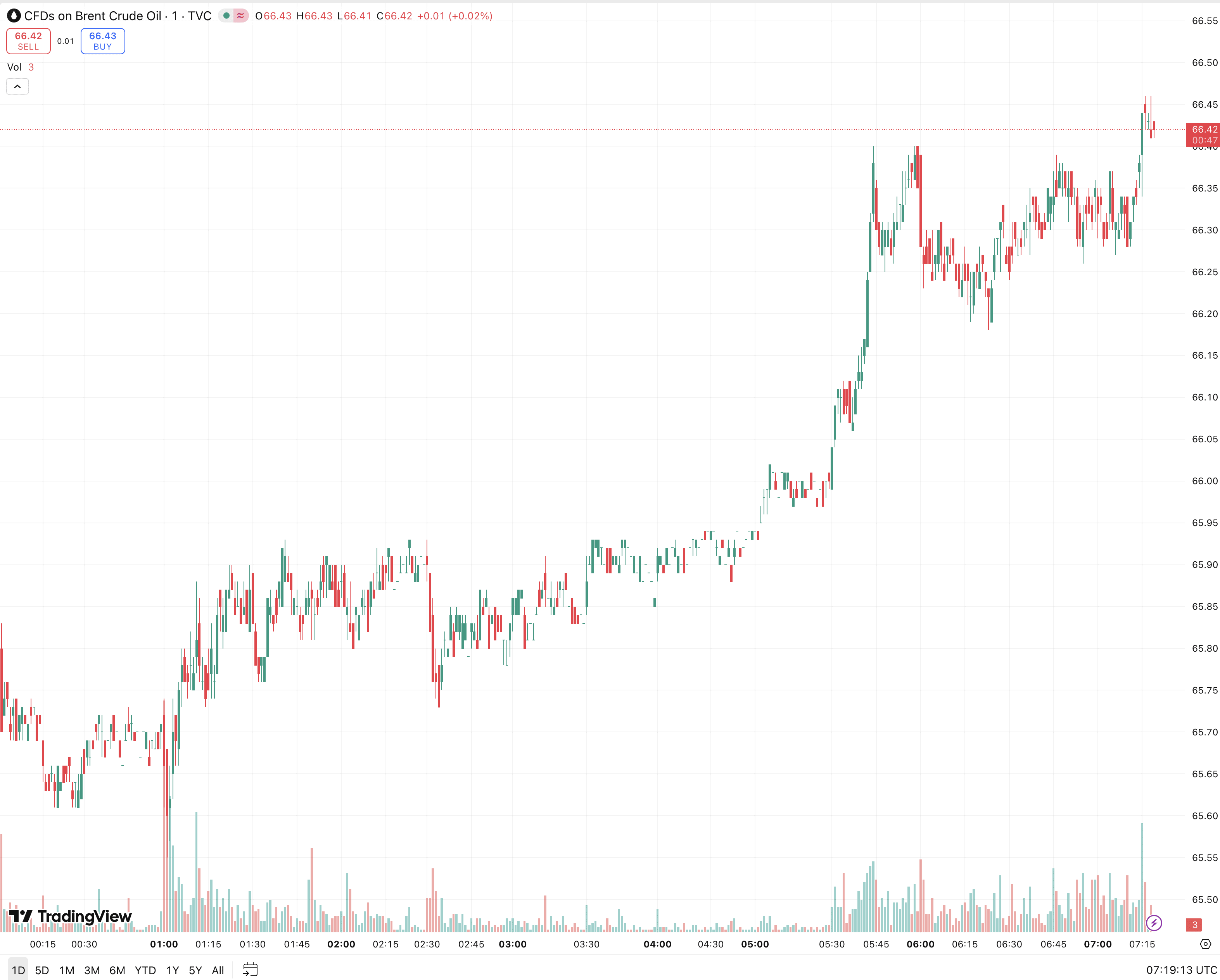

In commodities, crude retreated after headlines about an initial ceasefire phase between Israel and Hamas. At one point Brent dipped to roughly $65.6/bbl, with WTI near $62.1.

Brent price trend. Source: TradingView

Japan’s Nikkei gained about 1.5%, edging back towards record territory. Fresh data showed net foreign purchases of Japanese equities of roughly ¥2.5tn in the week to 4 October, underpinning demand for large‑cap tech and industrials. Taiwan’s benchmark rose about 1.2% to a record, while a broad Asia ex‑Japan gauge added roughly 0.3%.

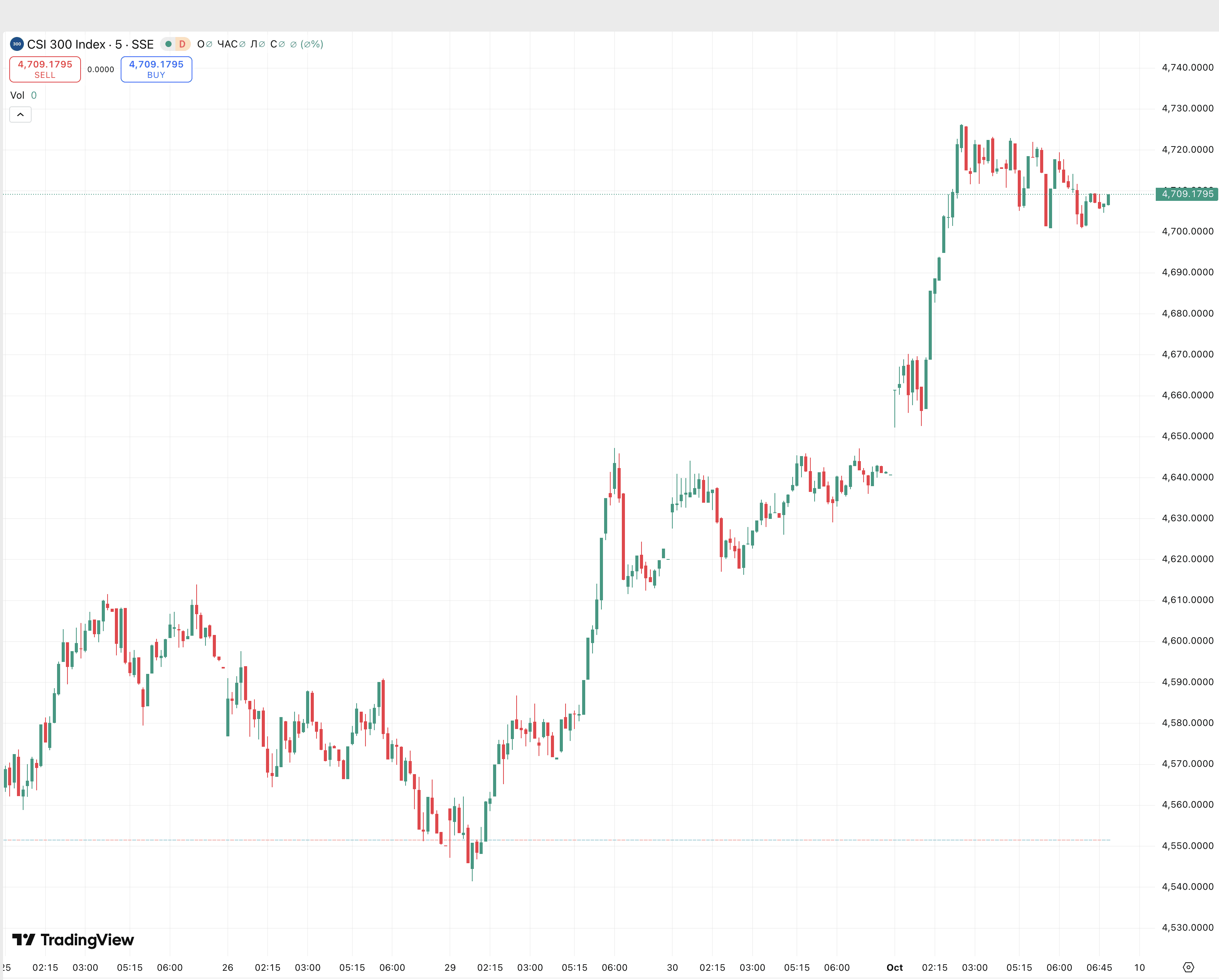

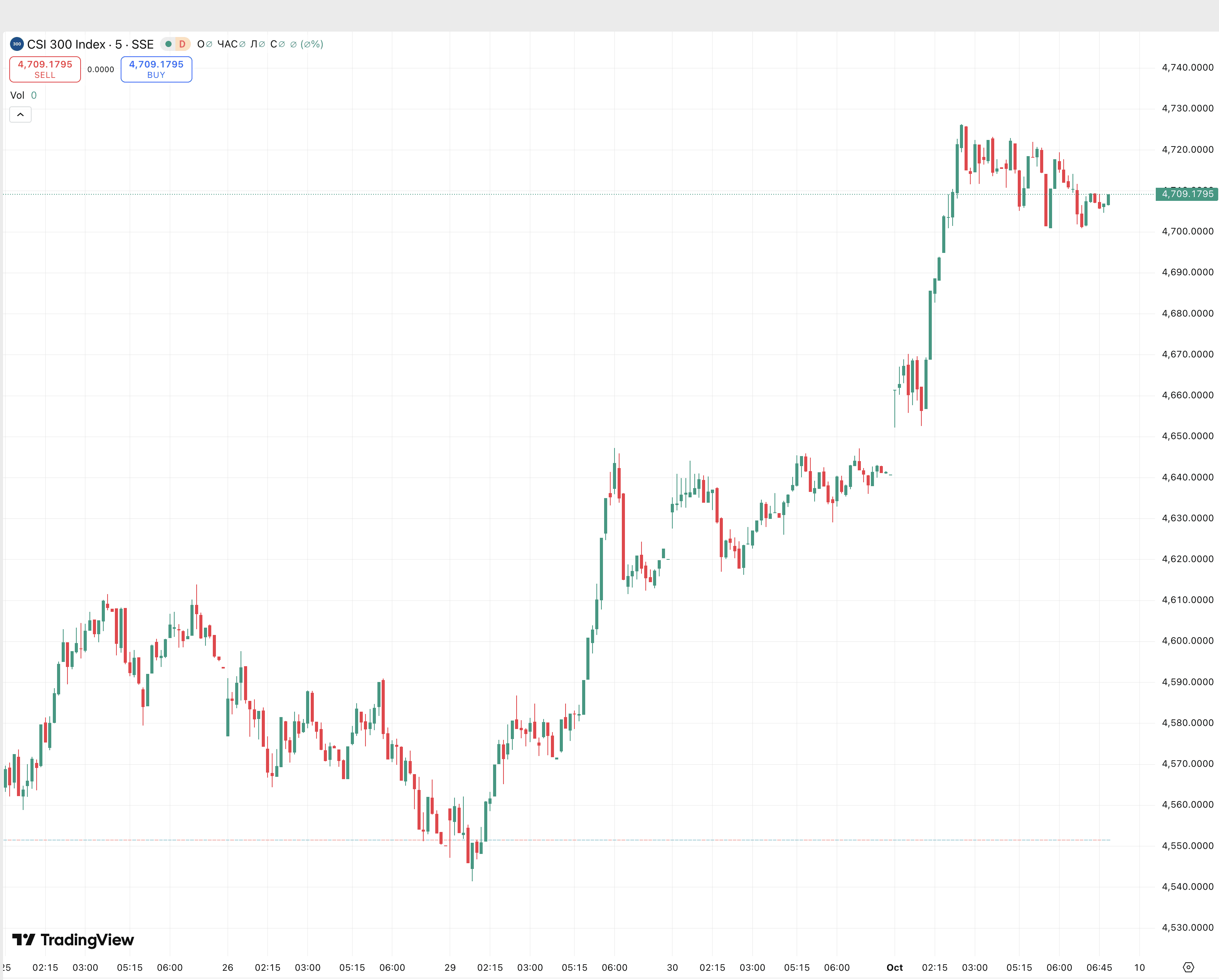

China’s blue chips advanced around 0.4% after the week‑long holiday: authorities reported holiday spending of about CNY 809bn and roughly 888m trips. Beijing also announced fresh curbs on exports of rare‑earth products and equipment – a factor markets are watching ahead of upcoming US–China talks.

Chinese blue chips advance. Source: TradingView

In the US, the tech rally rolls on: AI enthusiasm helped the S&P 500 and Nasdaq set new highs. According to investment banks, the sector’s earnings growth outlook for the coming reporting season has been lifted to around 21% from ~16% in June, with expectations revised up for a broad swathe of names, led by Nvidia and Apple.

The US 10‑year Treasury yield is hovering near 4.11%. Minutes from the latest Fed meeting did little to shift expectations: futures still imply a high probability of a November rate cut and about 44 bps of easing by year‑end.

On FX, the dollar trades near ¥152.5, while the euro is steady around $1.164 after soft German industrial data.

In Europe, futures are mixed: EURO STOXX 50 edges lower, while the FTSE 100 and DAX are slightly in the red. Investors are watching France’s political calendar, with President Emmanuel Macron set to name a new prime minister and present the draft budget.