Asian markets tumble in the biggest sell-off in seven months

Asian equity markets posted their largest decline in seven months as investors rushed to take profits after a prolonged rally driven by enthusiasm for artificial intelligence.

Technology stocks led the downturn: Japan’s Nikkei 225 fell nearly 7%, while South Korea’s KOSPI dropped more than 6% before recovering part of the losses. Europe followed the same pattern – tech was the weakest sector in the STOXX 600, and Germany’s DAX slipped 0.7%.

The sell-off followed remarks from the heads of Morgan Stanley and Goldman Sachs, who questioned the sustainability of record-high valuations in AI-linked companies. Their comments triggered a rotation out of risk assets and a broad market correction.

“When a market rallies for seven straight months and gains more than 50% from its spring lows, at some point profits have to be taken. That time is now,” said Matt Simpson, analyst at StoneX.

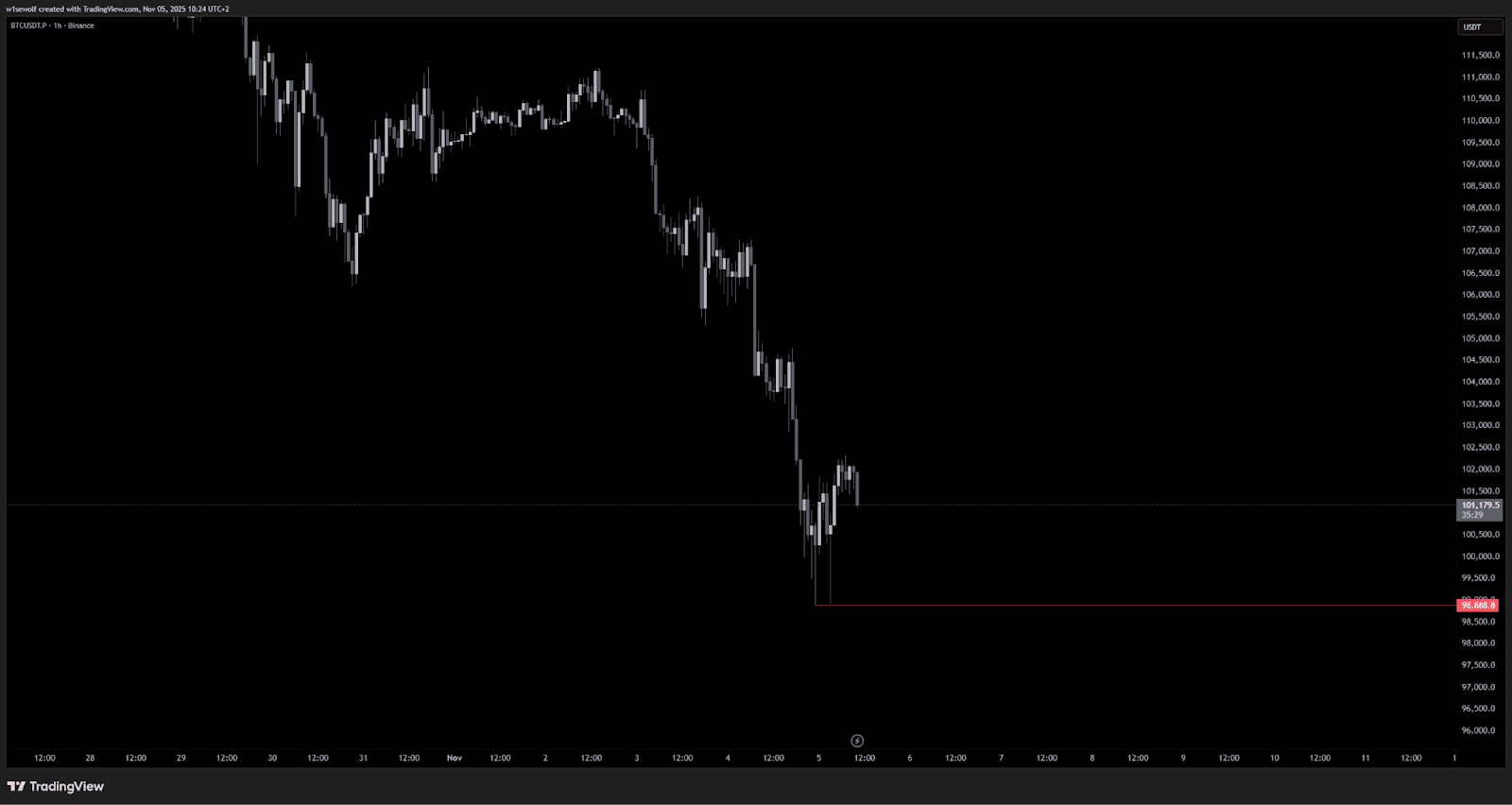

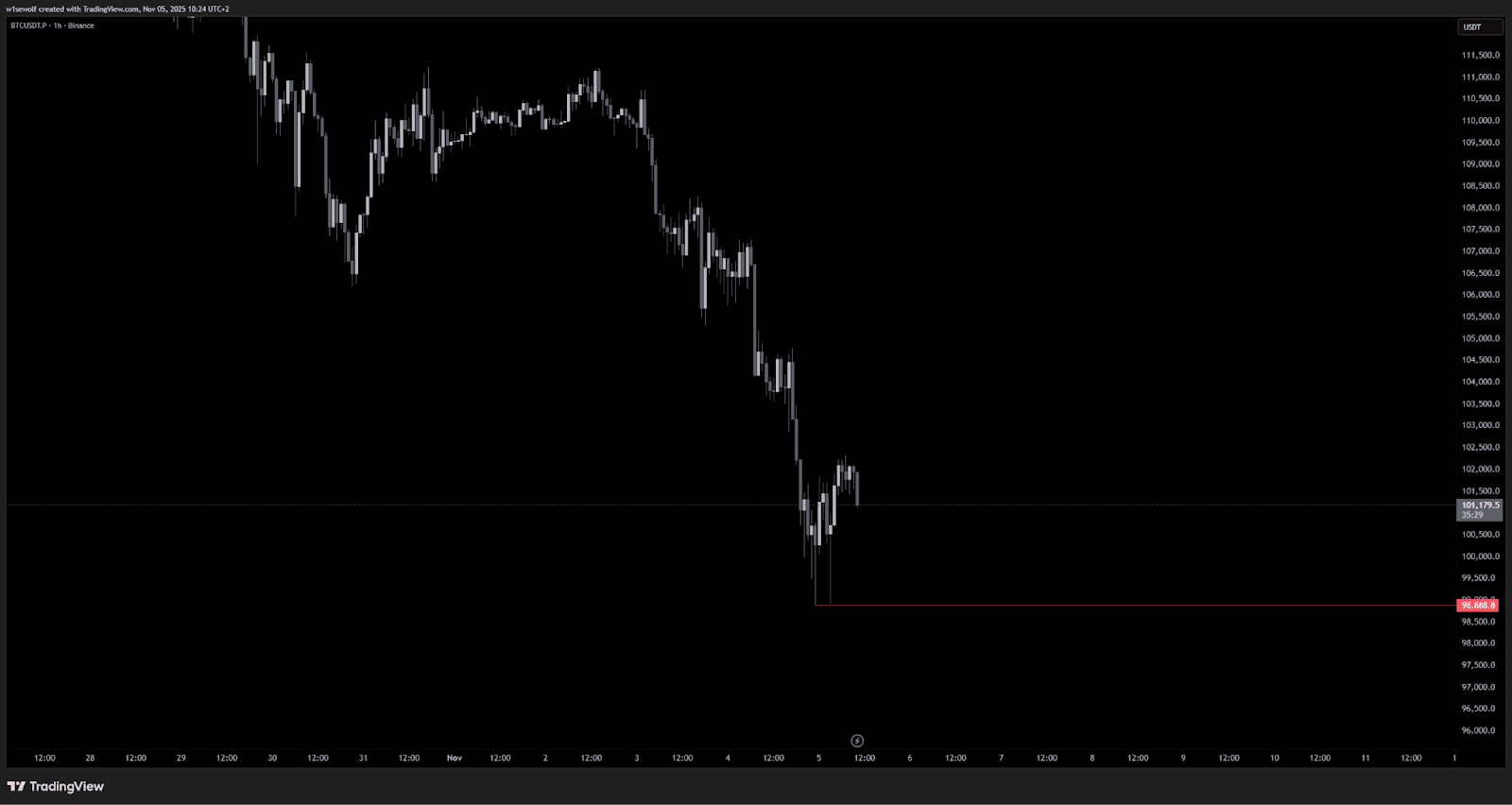

Beyond profit-taking, pressure mounted from the prolonged U.S. government shutdown and concern that bond yields could rise once it ends. These factors pushed investors toward safer assets such as gold and Treasuries, both up about 1%, while Bitcoin briefly fell below $100,000.

Bitcoin price drops below $100,000. Source: tradingview.com

Market fundamentals remain broadly supportive – interest rates are falling and the economy is stable – but valuations have become stretched, leaving markets exposed.

Much of the decline reflects positioning: funds and retail investors had built heavy exposure to AI and semiconductor stocks such as SoftBank, SK Hynix, and ASML.

Despite the scale of the drop, analysts view the move as a correction rather than the start of a crisis. Asian assets remain cheaper than their U.S. counterparts, which could help limit further downside even if Wall Street weakness continues.

Recommended