Argentina under Milei: fiscal wins, social strain, crypto reform

President Javier Milei rode to power in 2023 on a pledge to reboot Argentina’s economy after decades of stagnation and triple‑digit inflation. Two years on, the paradox of his program is clear: striking fiscal wins paired with a steep social bill.

An economy stretched between market freedom and job losses

The most visible success has been disinflation. Annual inflation fell from nearly 300% in April 2024 to about 36.6% by the autumn of that year. For a chronically fragile financial system, it was a sign that discipline was finally starting to work after years of failed price anchors. Yet the peso remained unstable, and the government is now frantically seeking loans to keep the currency within a tolerable band.

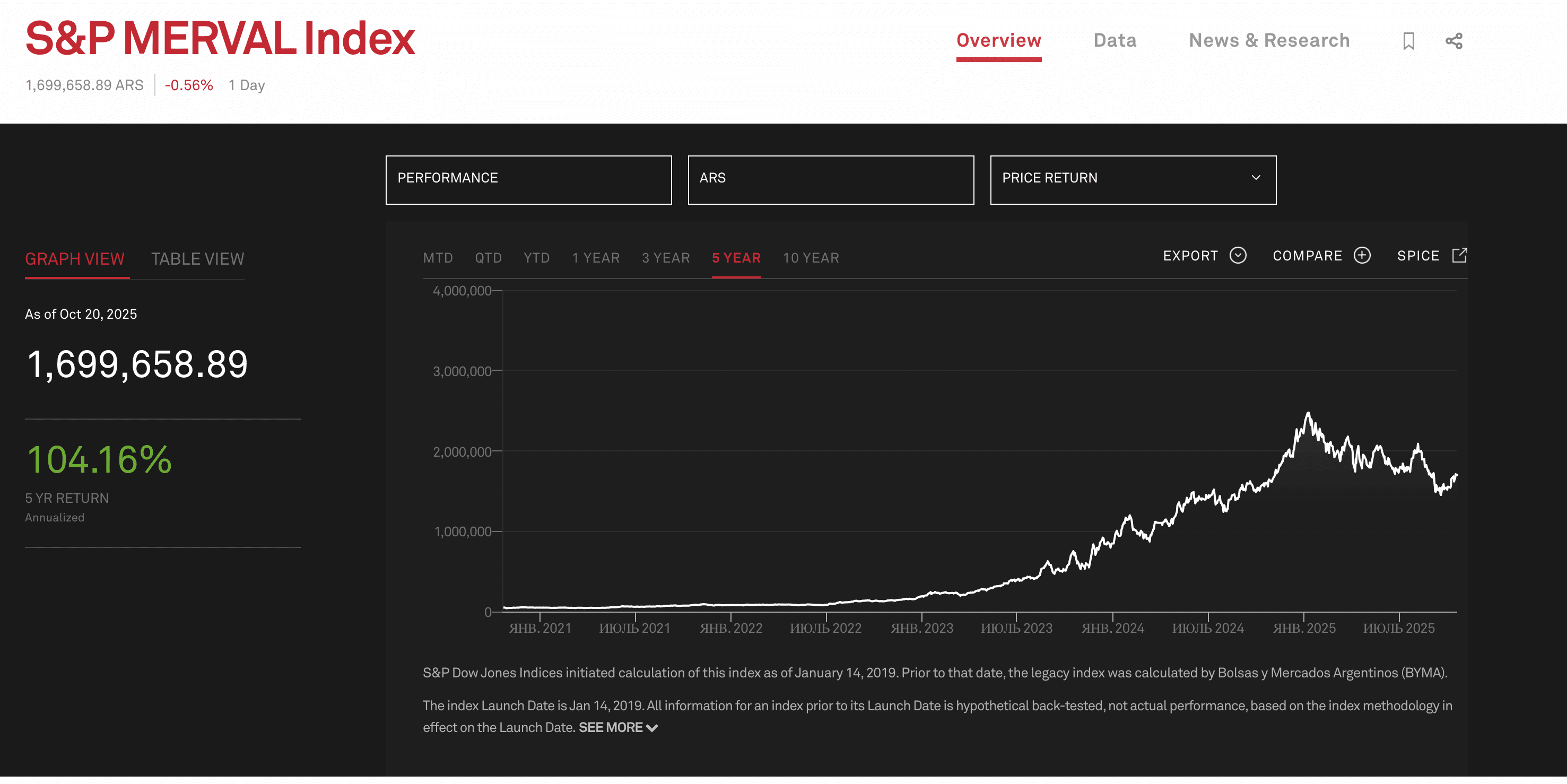

At first, Milei’s fast‑track privatizations translated into a market surge: the Merval index (Argentina’s main equity benchmark on BYMA) jumped more than 170% in 2024 (113% in US dollars), briefly turning Buenos Aires into the world’s top‑performing market.

S&P Merval over five years. Source: spglobal.com

Initial reforms boosted investor confidence and inflows. In April 2025, the government removed most capital controls for individuals: the much‑debated cepo cambiario (limits on retail access to US dollars) was lifted, restoring broad access to official FX markets.

But libertarian purity quickly met parliamentary arithmetic. Milei’s party controls only a small share of Congress (the balance could shift after the Oct. 26 legislative vote), forcing compromises with the very political forces he lambasted on the trail. The social cost has been heavy: by February 2025, unemployment and deindustrialization rose, output shrank (GDP fell by roughly 3.5%), and monthly poverty rates topped 50% at times. Pensioners, teachers and doctors filled Buenos Aires streets in near‑daily protests.

Some signature promises also stalled. The central bank (BCRA) was not abolished; instead, its short-term debt costs were transferred to the Treasury. Market euphoria cooled. Amid stagnation and corruption scandals, by September 2025 Argentina’s stock market had turned from one of the best- to one of the worst-performing globally, reflecting doubts about the government’s ability to steer a durable recovery.

Argentina’s crypto market: regulated freedom

Milei positioned himself as an ally of the digital economy. He often spoke enthusiastically about blockchain technology and individual financial freedom. And the crypto community did feel a tailwind. Ending capital controls in spring 2025 widened room for foreign‑currency operations and, de facto, lowered many frictions for crypto transactions.

In parallel came a tax amnesty (“Blanqueo”), allowing Argentines to regularize crypto assets at reduced rates of 5–15% (with the first $100,000 tax‑free). With a weakening peso, stablecoins cemented their role as a savings tool, while Bitcoin and altcoins purchases in 2024 rose 126% and 158.5% respectively – a sign BTC is increasingly seen as a long‑term asset.

Reality proved more complex than the slogans. Argentina introduced mandatory registration for virtual‑asset service providers, in line with FATF standards on AML/CFT. In June 2025, the government unveiled its first framework for tokenizing real‑world assets (RWA) on distributed-ledger technology – another sign that while the state speaks of “freeing the market,” it is also defining the rules of that freedom.

Then came a reputational shock. In February 2025, the promotion around Milei-linked memecoin LIBRA ended in a crash, with estimated investor losses of around $250 million. The anti‑corruption agency cleared the president, saying he had participated in the project as an economist, but legal proceedings brought by affected investors are still ongoing in Argentina, the US and Spain, clouding trust in his initiatives.

In the end, Argentina’s crypto revolution became a compromise between liberalization and pragmatic oversight. Freer capital flows and the tax amnesty brought fresh oxygen to the market, but they also ushered in registration rules, tokenization frameworks, and reputational scars. Milei’s campaign‑trail dream of maximally free money has morphed into managed freedom with user benefits and caveats dictated by Argentina’s broader economic reality.

Recommended