Can altcoins sustain their summer rally? Binance Research report

August saw a major capital rotation from Bitcoin into altcoins. Chainlink (+35.9%) and Ethereum (+18.6%) led the charge while BTC fell 8%. A new Binance Research report analyzes why August was the month of the altcoin.

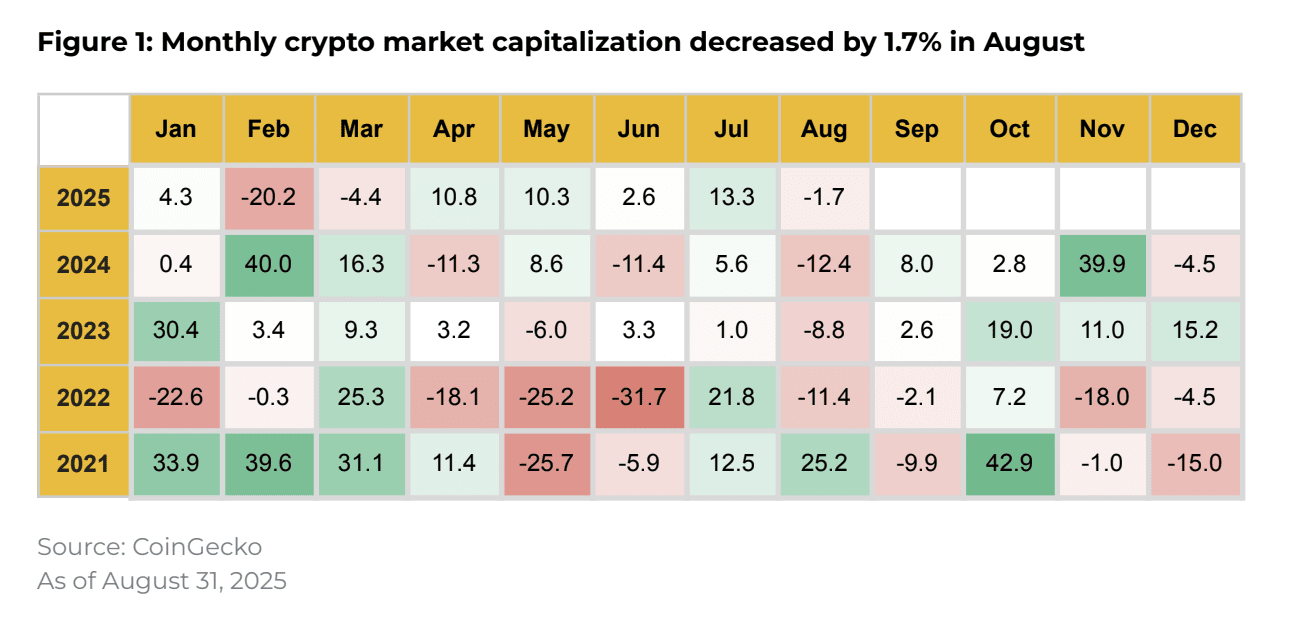

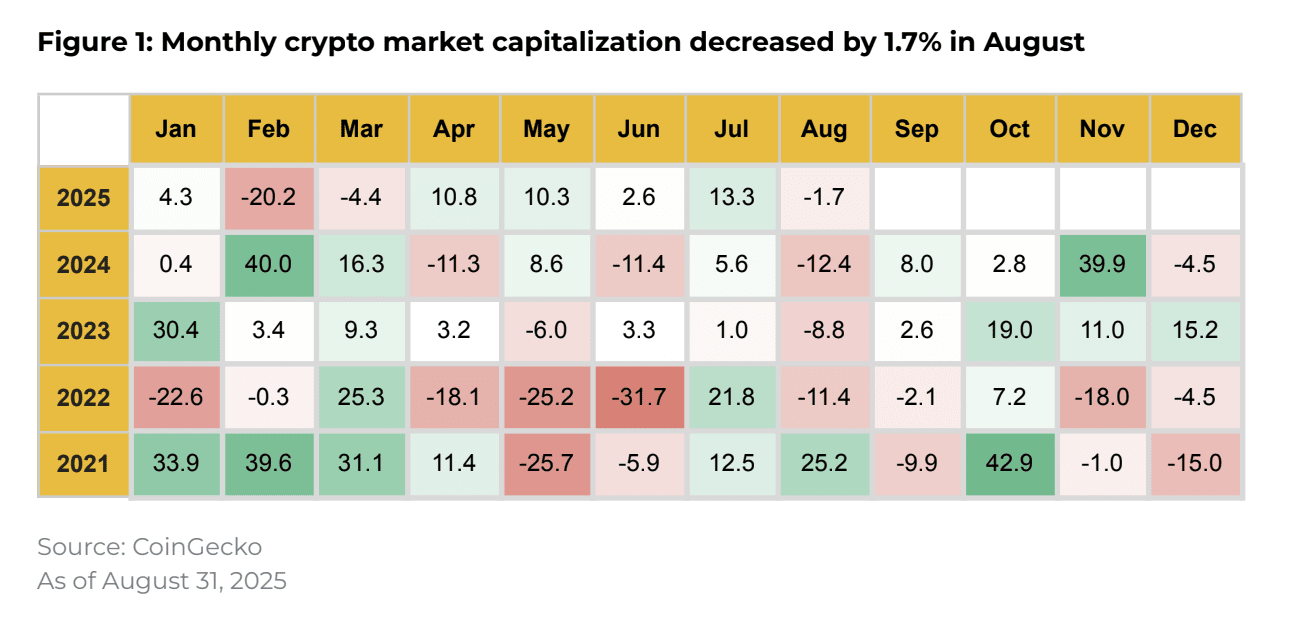

How much should the crypto market have lost in August when Bitcoin, its undisputed leader, dropped a full 8%? The answer might surprise you: total market cap declined by just 1.7%.

Mixed:

Losers:

Investors locked in Bitcoin profits and pivoted toward alternative opportunities ahead of anticipated Fed rate cuts. Bitcoin's dominance tumbled to 57.3% – the lowest since spring 2025 – while Ethereum captured 14.2% market share.

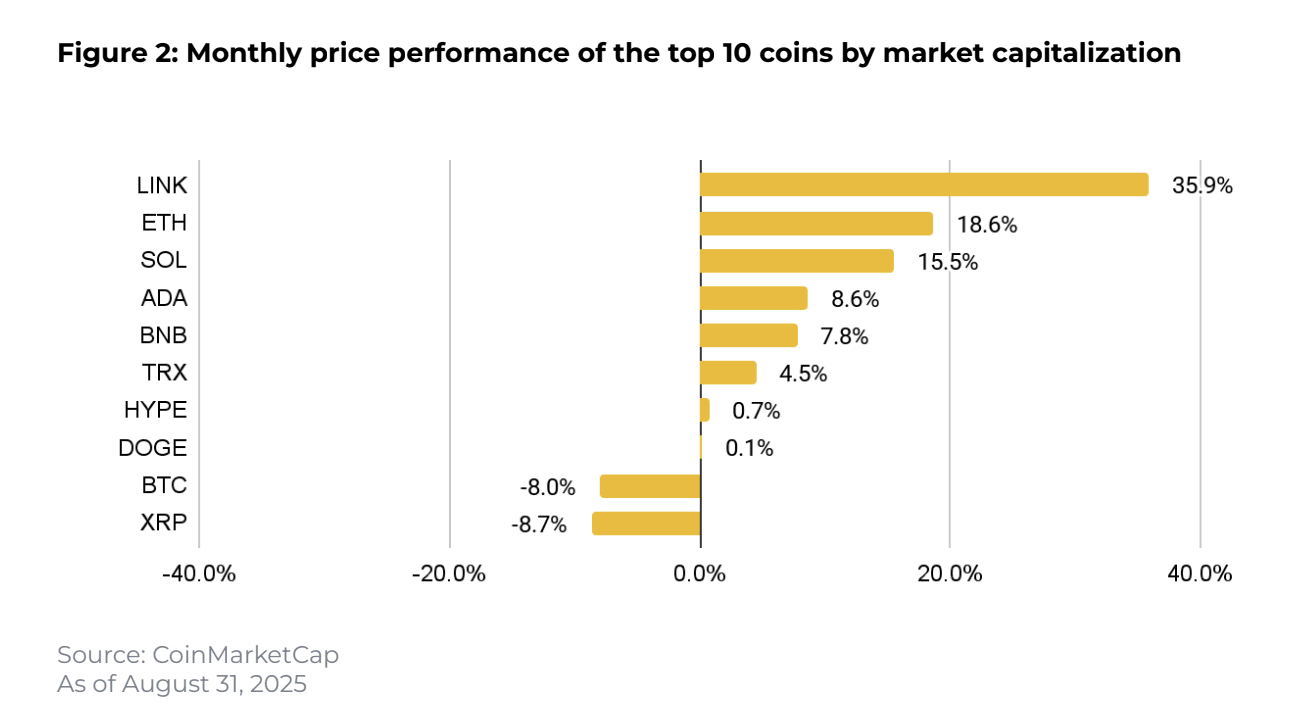

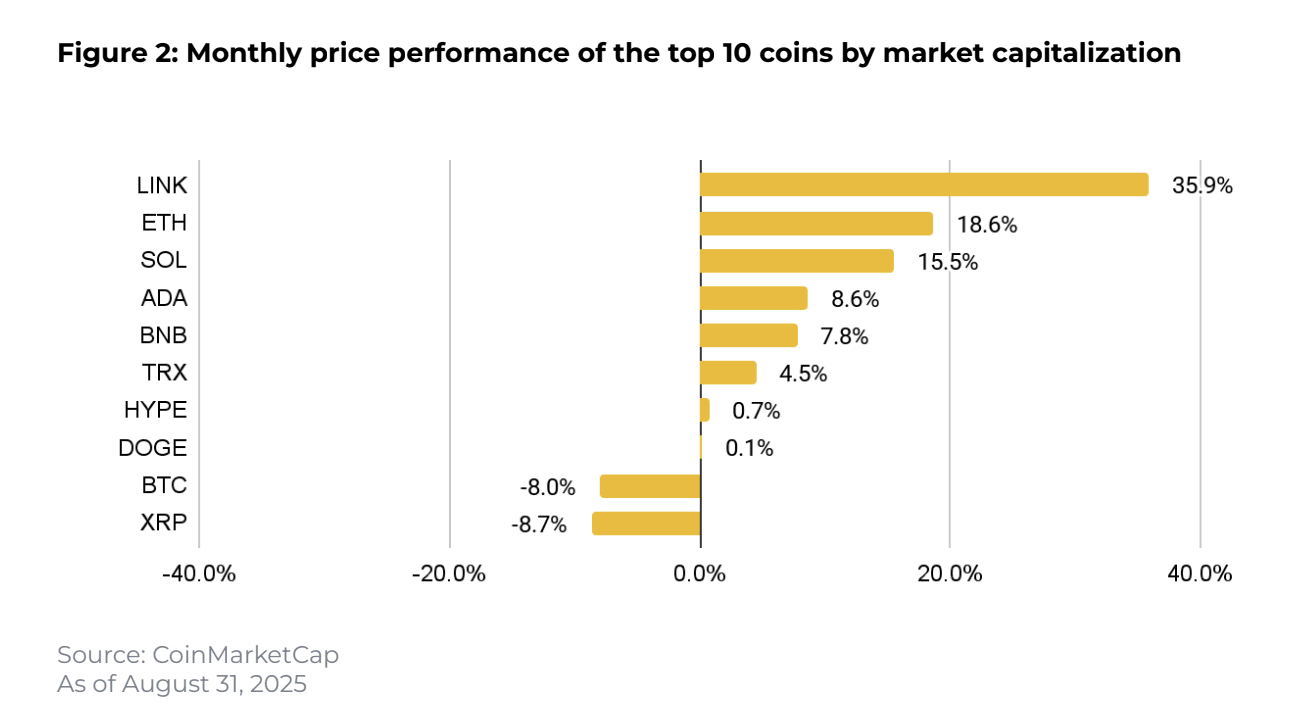

Chainlink dominates on Government integrations

Chainlink crushed the competition with a 35.9% monthly gain after securing a landmark government contract. The U.S. will publish GDP data on-chain using LINK oracles – marking the first time crypto infrastructure has powered official federal reporting.

Japan's SBI Group partnership added fuel to the fire, fast-tracking Cross-Chain Interoperability Protocol (CCIP) adoption for tokenizing real-world assets across the Asia-Pacific region.

Ethereum captures corporate America

Ethereum's 18.6% surge reflects a seismic shift in corporate treasury strategy. Public companies now hold a record 4.44 million ETH – 3.67% of total supply. Bitmine alone acquired over $9 billion worth of ETH in six weeks, signaling institutional FOMO.

Record ETF inflows and sustained retail demand reinforced Ethereum's emerging role as Bitcoin's institutional alternative for long-term allocations.

Solana rides technical momentum

Solana jumped 15.5% as the Alpenglow upgrade delivered on performance promises. Reduced transaction finality times and enhanced reliability are attracting corporate treasuries and DeFi protocols demanding enterprise-grade infrastructure.

The technical improvements position Solana as a serious contender for institutional adoption, particularly for high-frequency DeFi applications.

Top 10 tokens: winners and losers

The altcoin rally wasn't universal among large-caps:

Winners:

- ADA (+8.6%) shrugged off SEC's ETF delay until October

- BNB (+7.8%) benefited from corporate treasury interest

- TRX (+4.5%) surged after approving 60% fee reductions

- HYPE (+0.7%) hit new highs before retreating

- DOGE (+0.1%) stagnated amid whale selling concerns

- XRP (-8.7%) plummeted on insider trading allegations

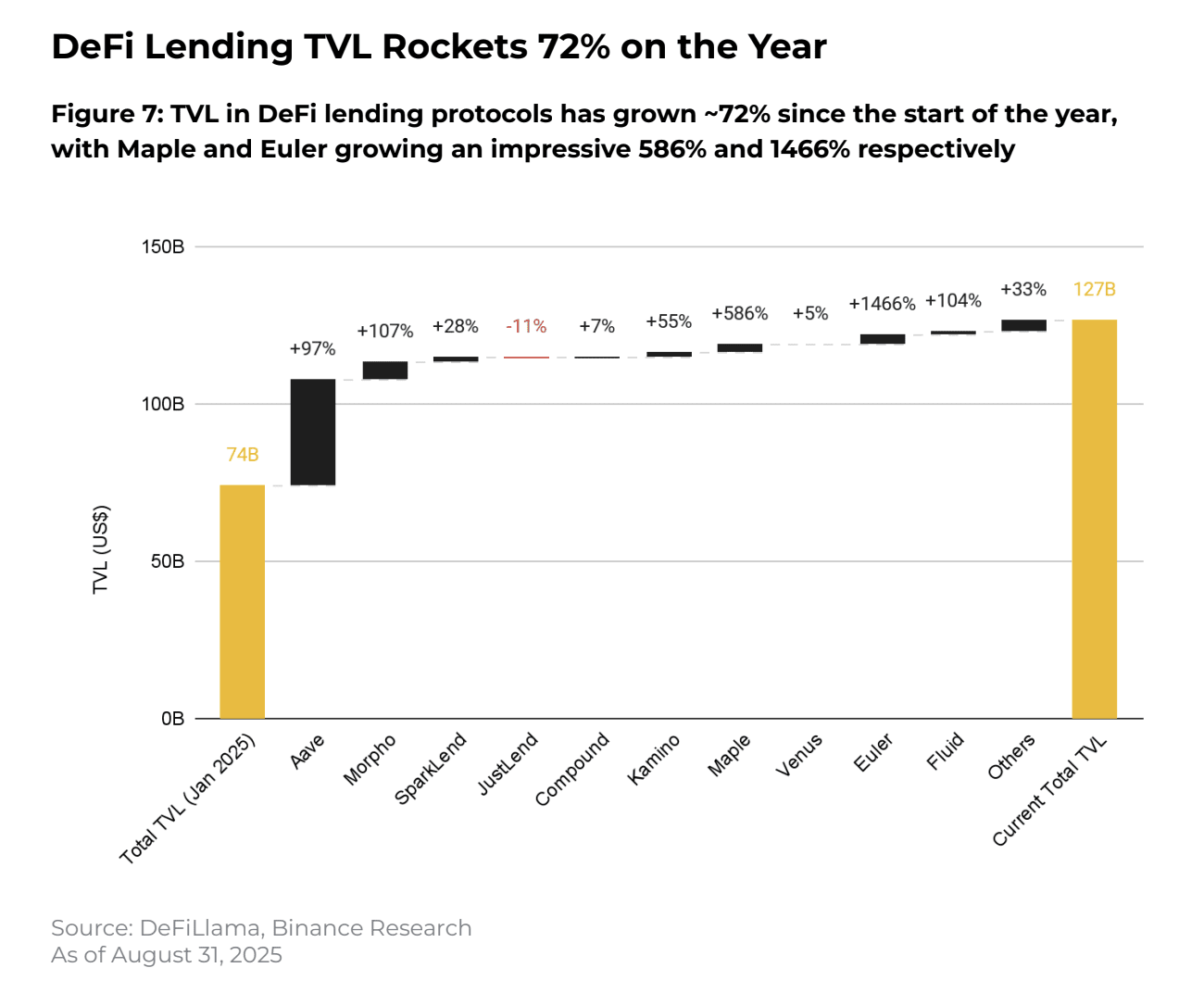

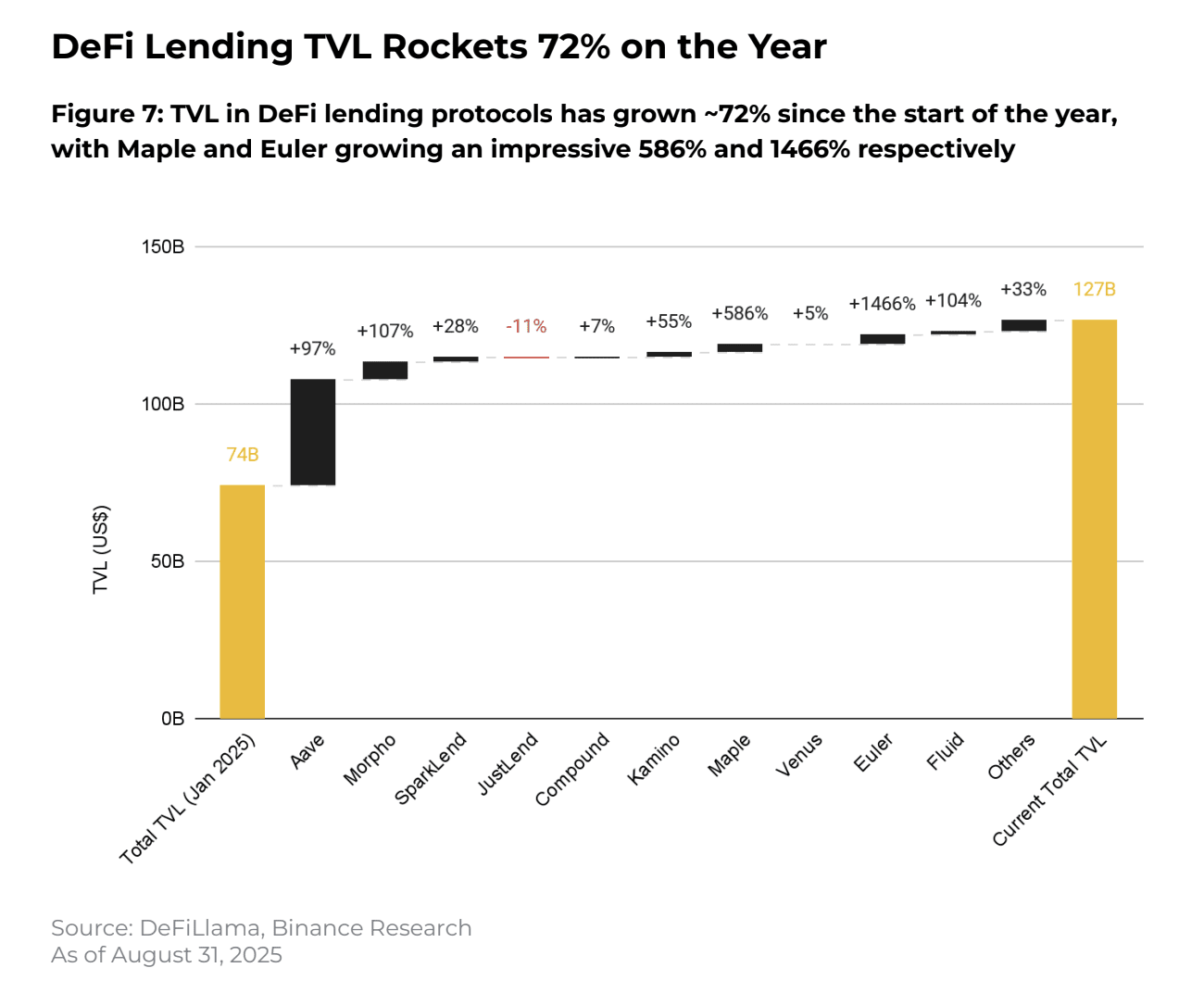

DeFi TVL explodes 72% year-over-year

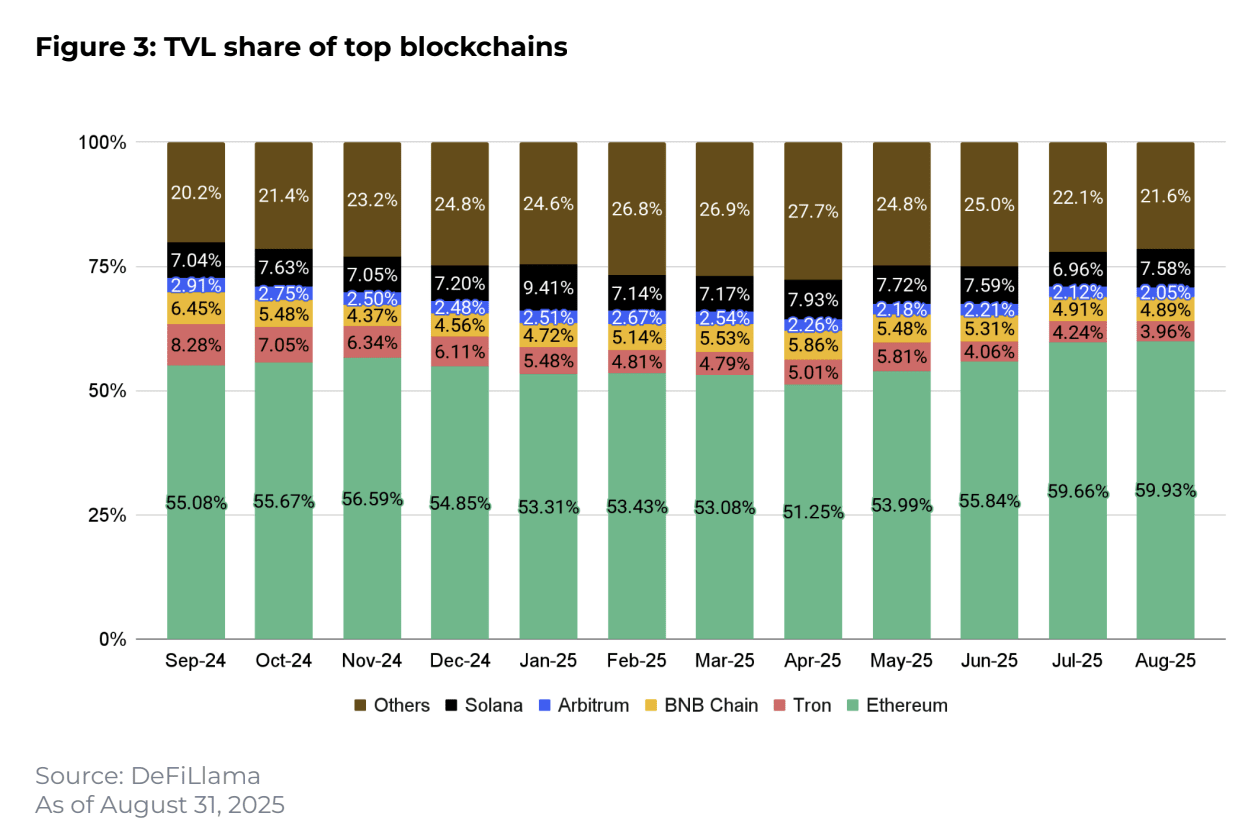

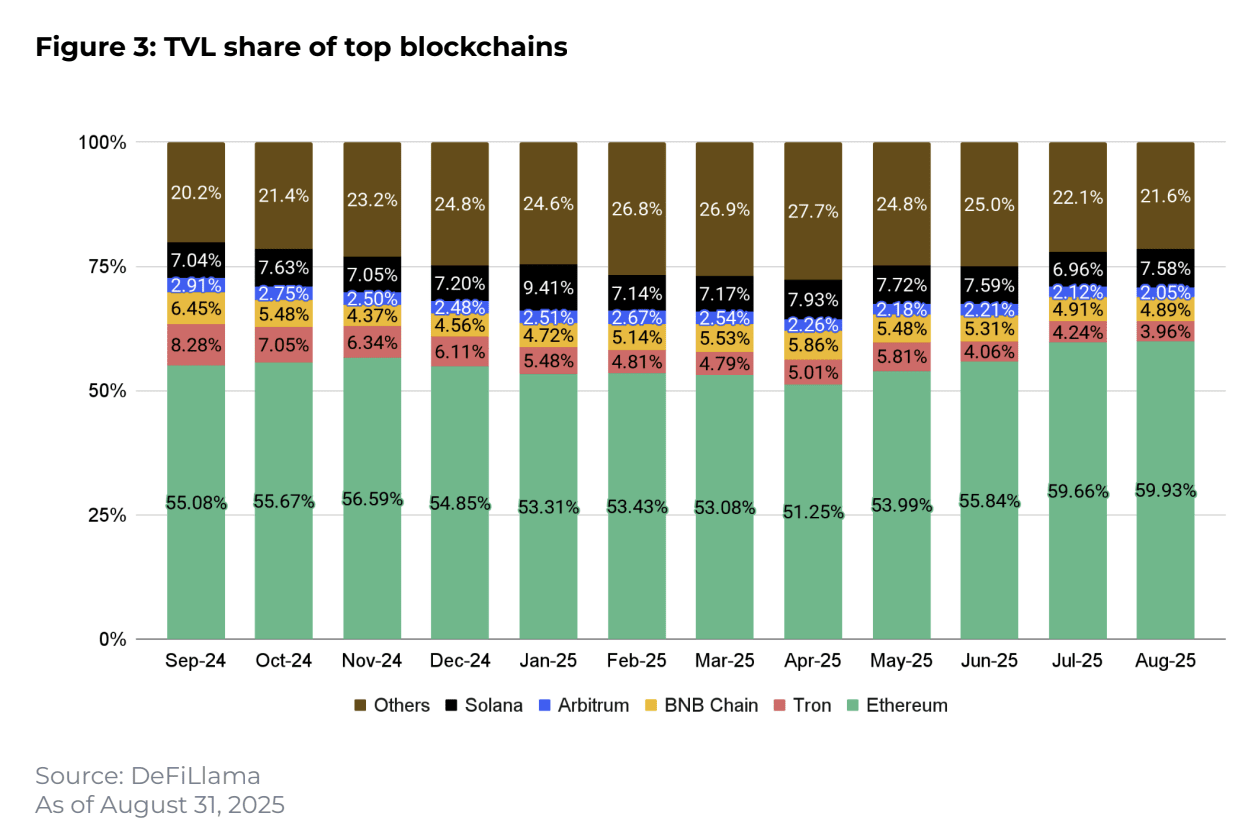

DeFi protocols added $12 billion in August alone, pushing total value locked (TVL) to $127 billion – a staggering 72% annual increase. Ethereum commands nearly 60% of the market share, with Solana the only top-5 blockchain gaining ground.

Maple and Euler stole the show with explosive 586% and 1,466% growth respectively, each crossing $3 billion TVL. These lending protocols are capitalizing on institutional demand for yield-generating DeFi products.

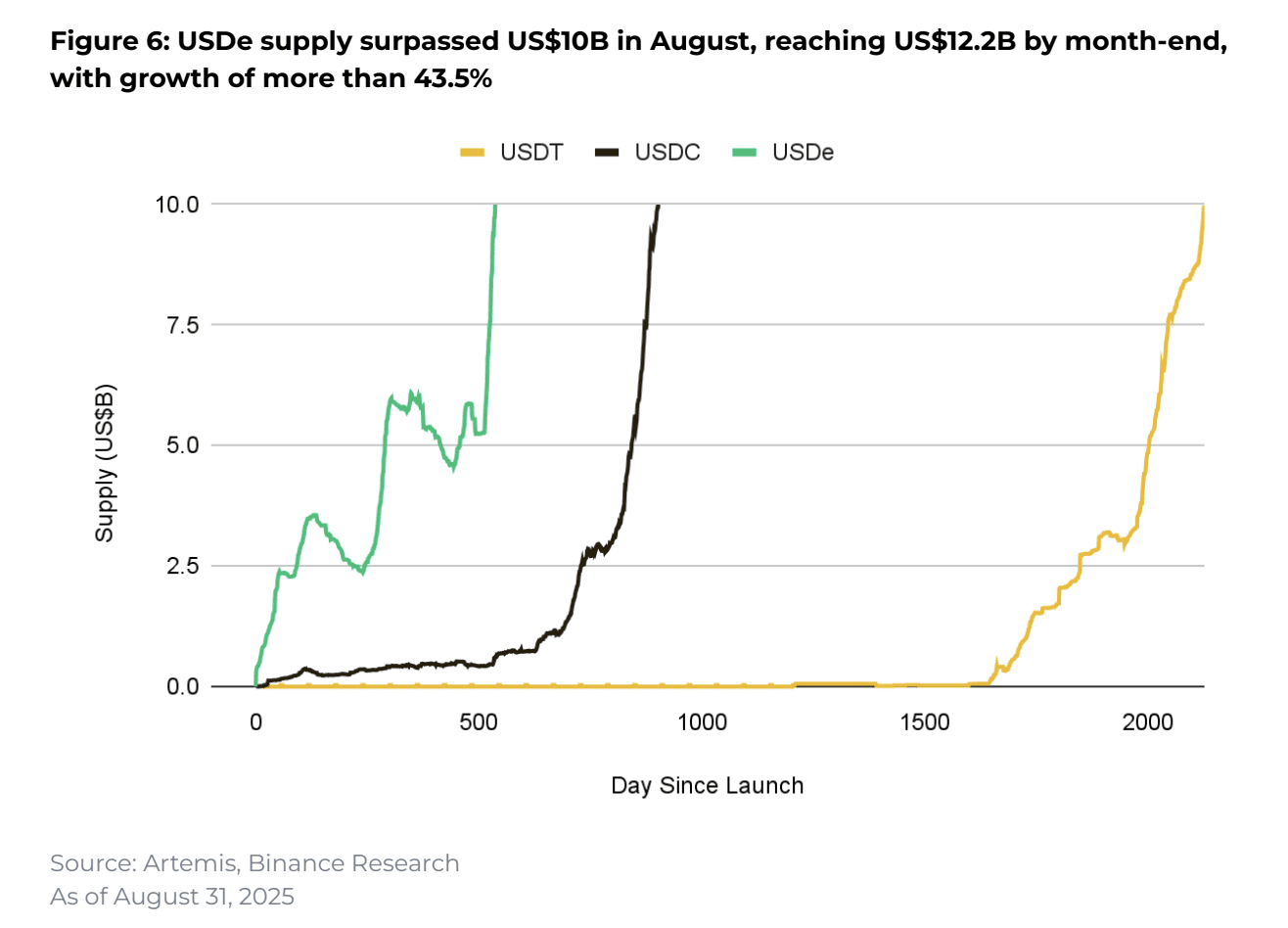

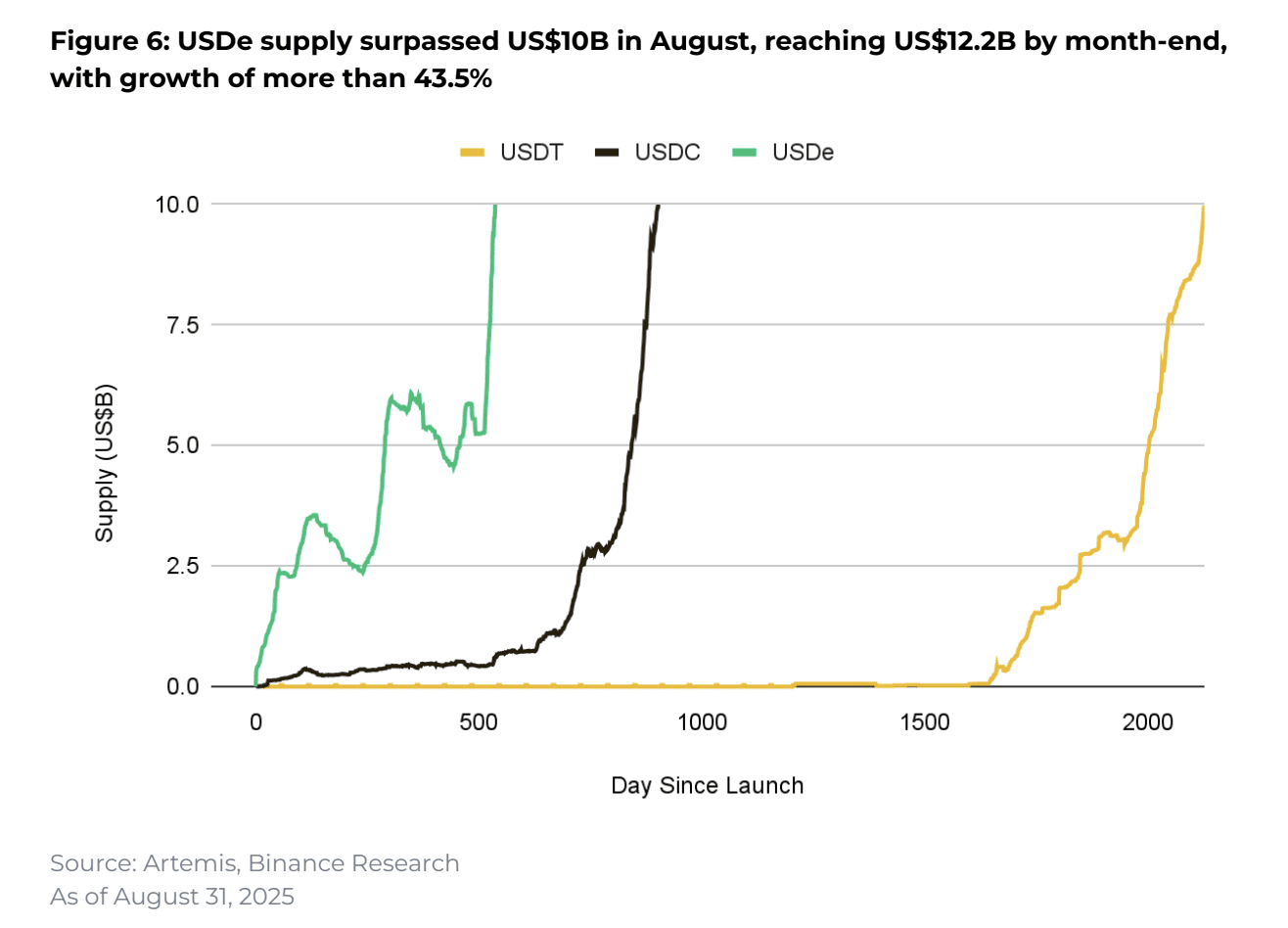

USDe shatters speed records

Ethena's USDe stablecoin obliterated adoption records, growing 43.5% to $12.2 billion supply in August alone. The yield-bearing stablecoin reached $10 billion faster than any asset in crypto history – just 536 days compared to USDC's 903 days and USDT's 2,000+ days.

USDe now commands over 4% of the $280 billion stablecoin market, with yield generation proving the killer feature that differentiates it from purely transactional competitors.

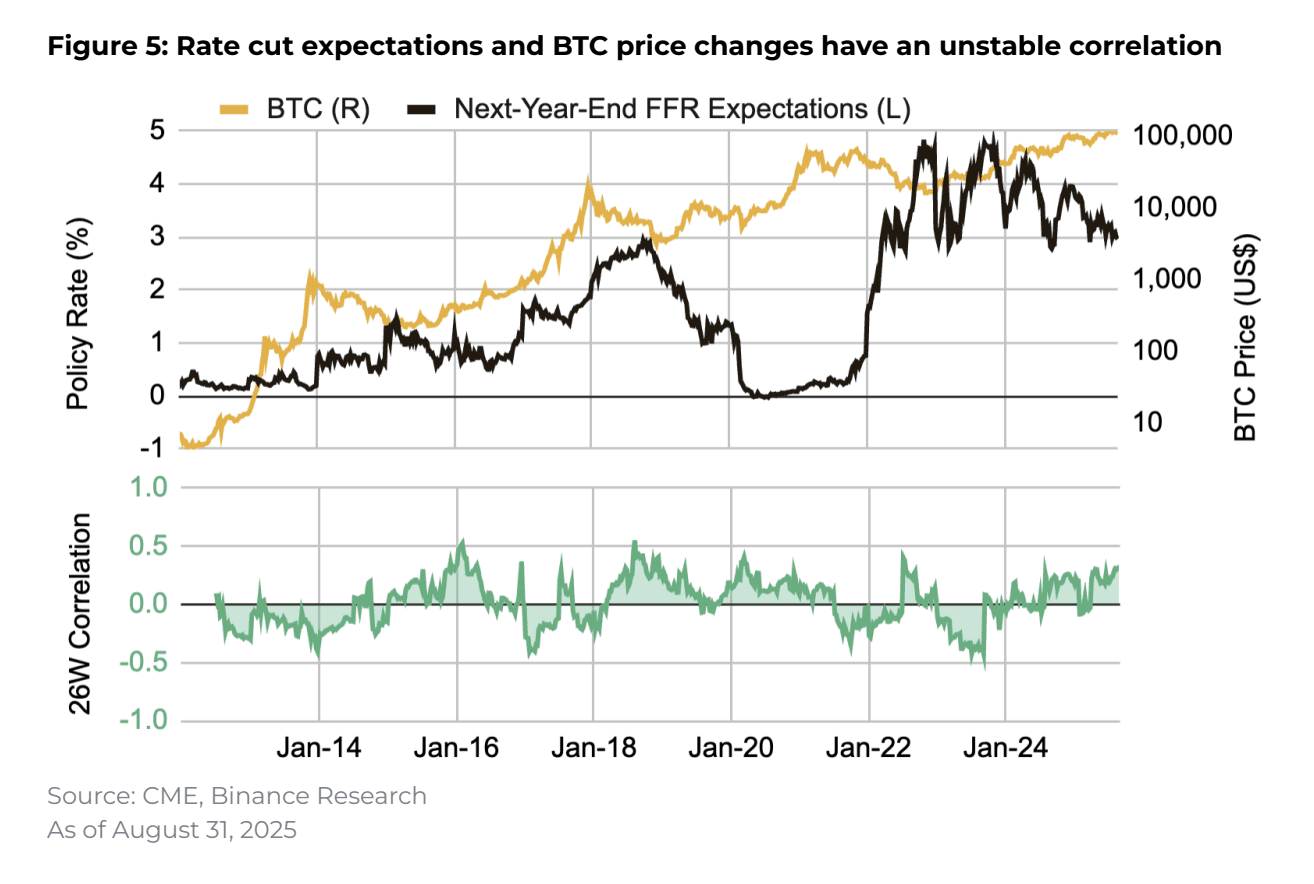

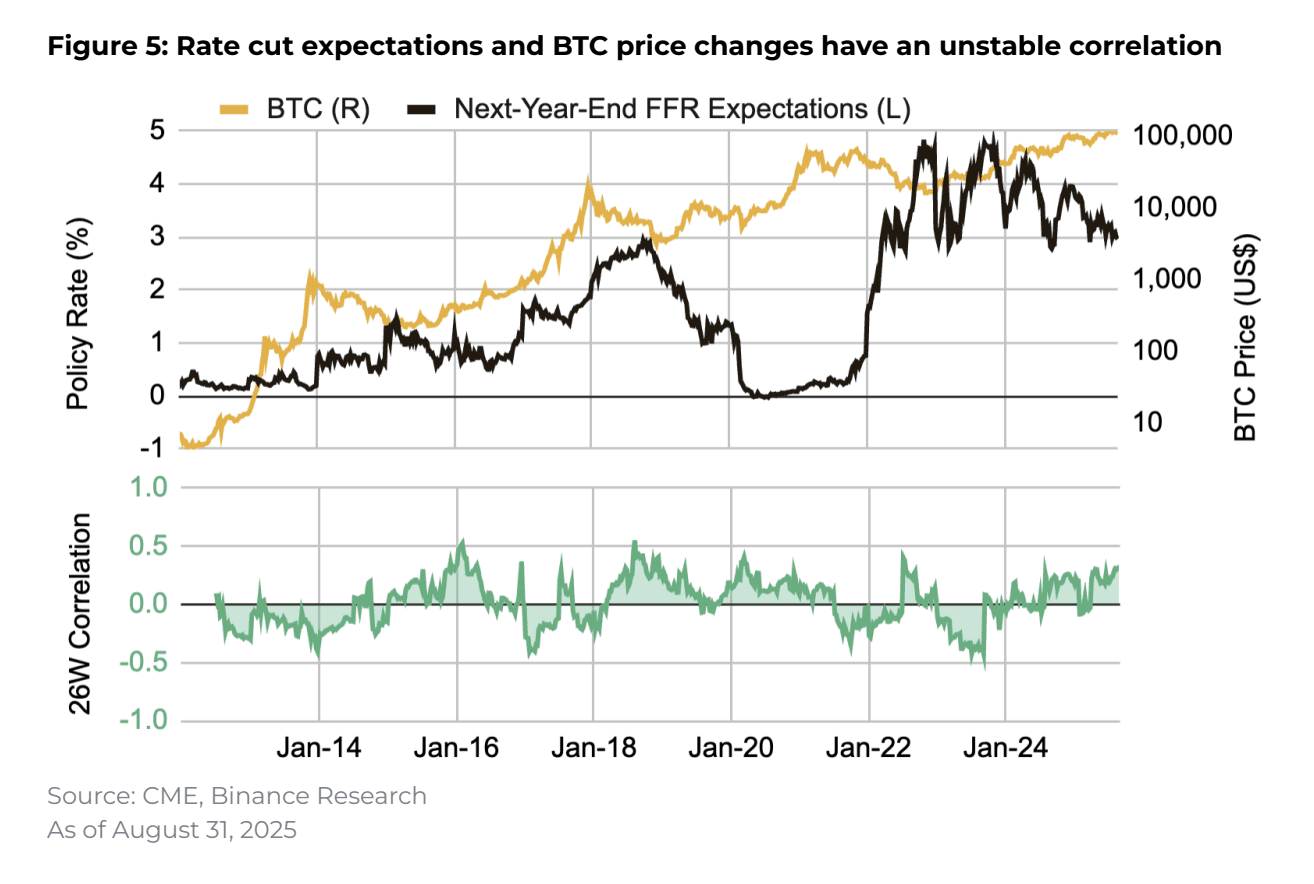

Fed rate cuts: the Bitcoin correlation myth

Common wisdom says rate cuts boost Bitcoin. When Powell signaled dovish policy at Jackson Hole, Bitcoin popped 4% from $112,400 to $117,300. But the data tells a different story.

Binance Research's 26-week rolling correlation analysis between rate expectations and Bitcoin prices revealed essentially zero predictive power – a coefficient of determination near zero with extreme volatility.

The relationship has evolved beyond simple monetary policy mechanics. Institutional adoption, regulatory developments, and structural market changes now drive Bitcoin's price action. Markets have already priced in two expected rate cuts through 2025, making the "cuts equal gains" narrative dangerously oversimplified.

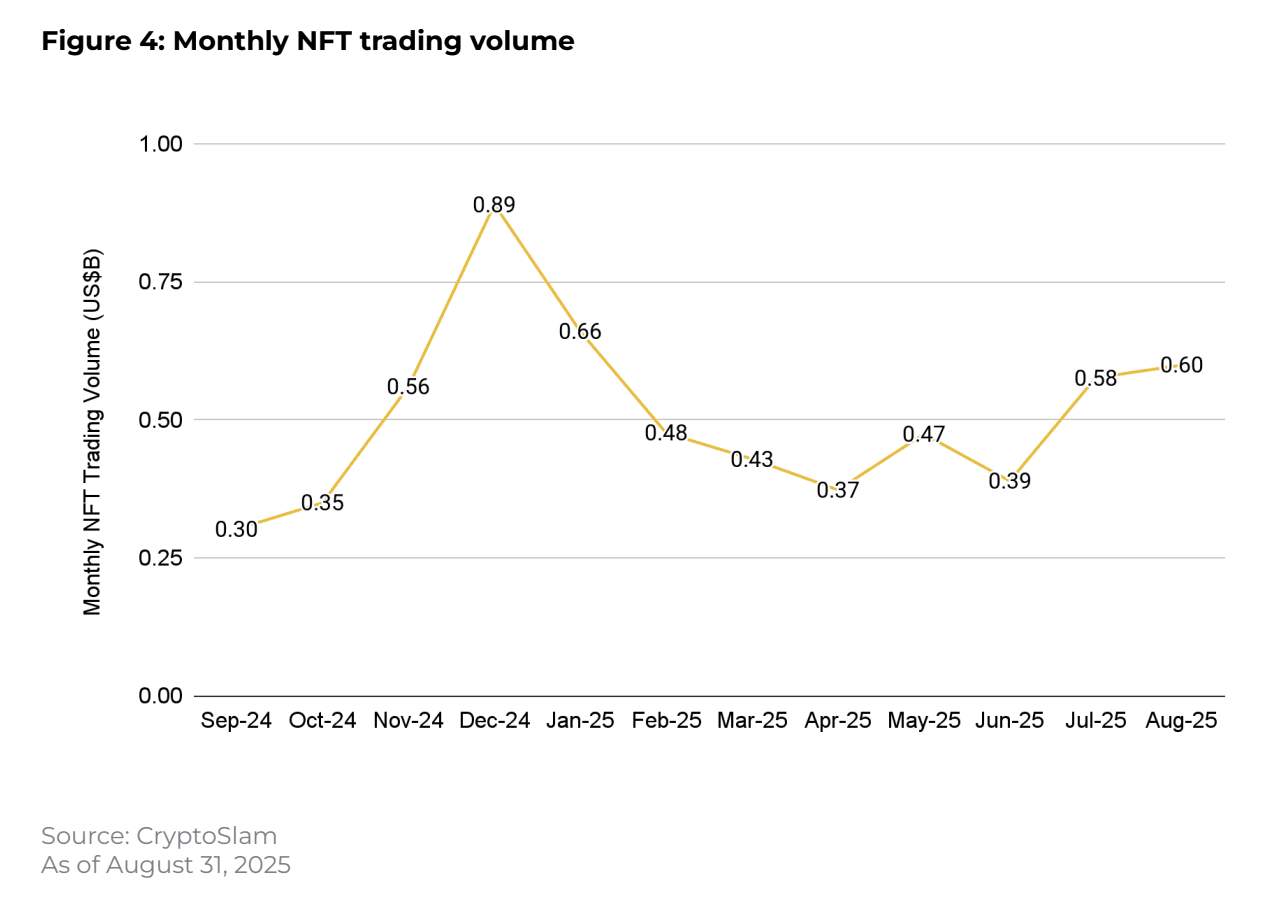

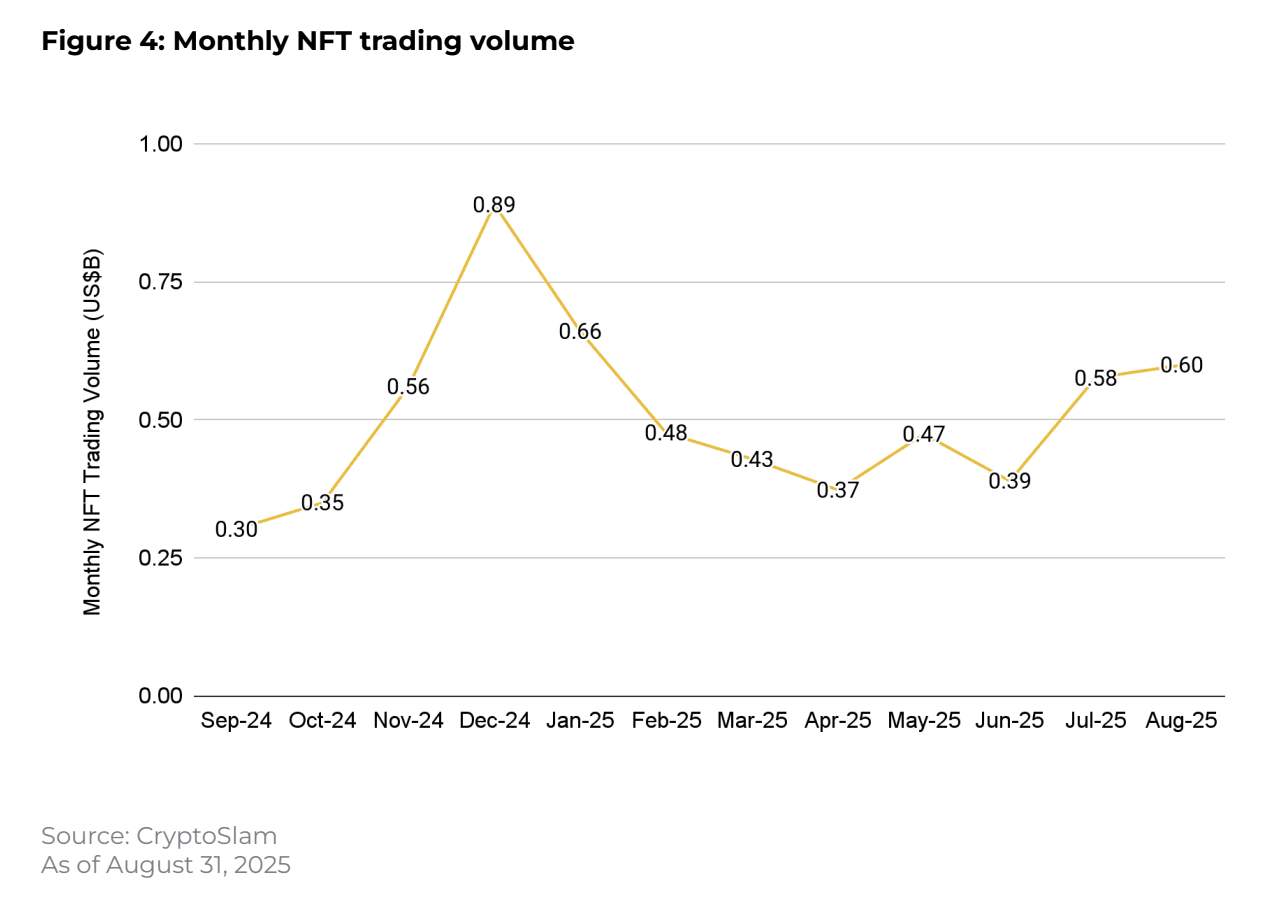

NFTs struggle despite august gains

NFT trading volume inched up 4% in August, following July's stronger performance. However, sustainability remains questionable as underlying metrics weakened.

Ethereum NFTs maintained leadership but saw 19.6% volume decline. Polygon crashed 51%. Among top collections, Polygon's Courtyard led while Ethereum classics like CryptoPunks and Bored Apes ranked high by volume.

Market saturation, buyer fatigue, and utility questions plague the sector. Without compelling new use cases, NFTs face an uphill battle against macroeconomic headwinds.

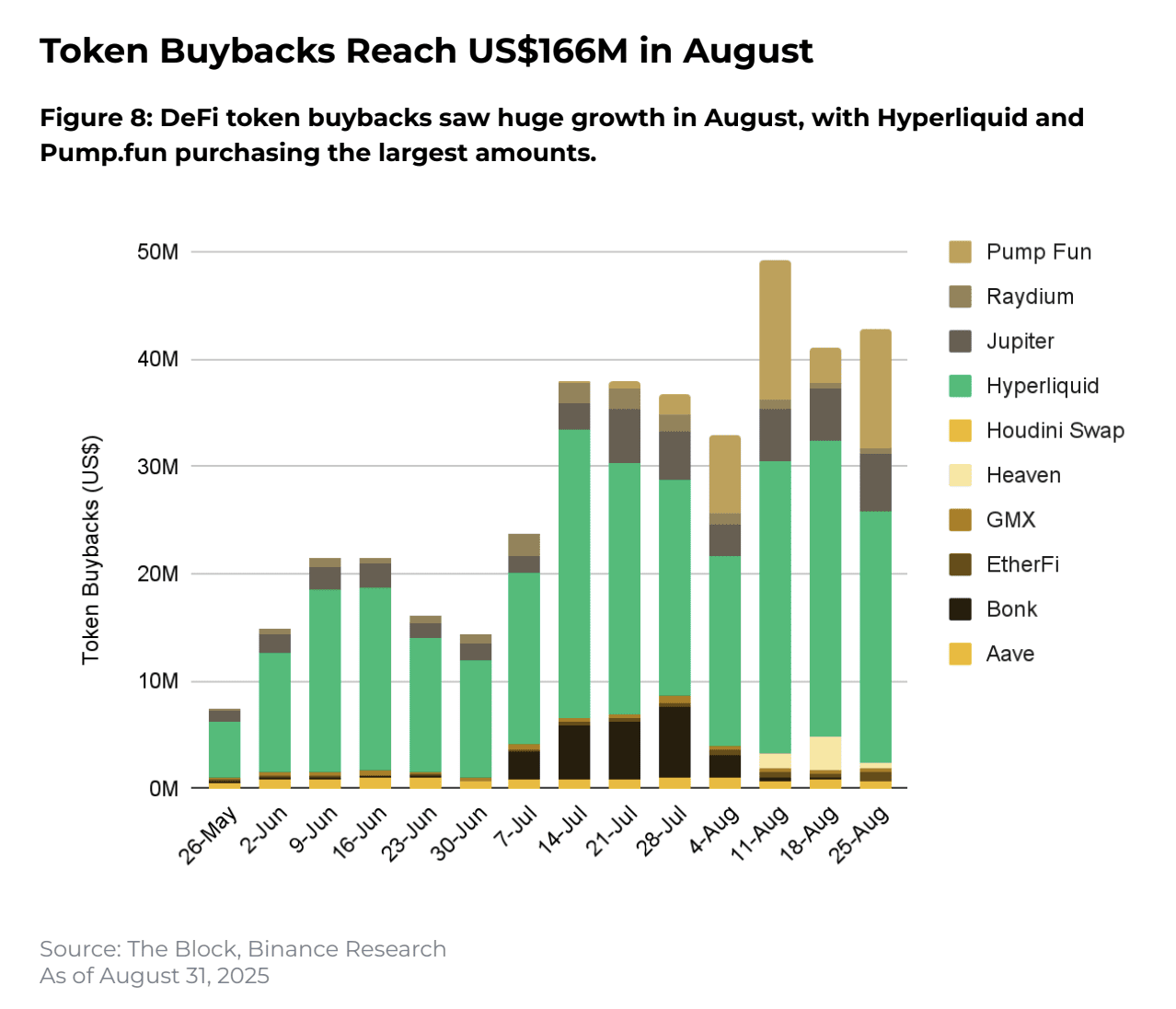

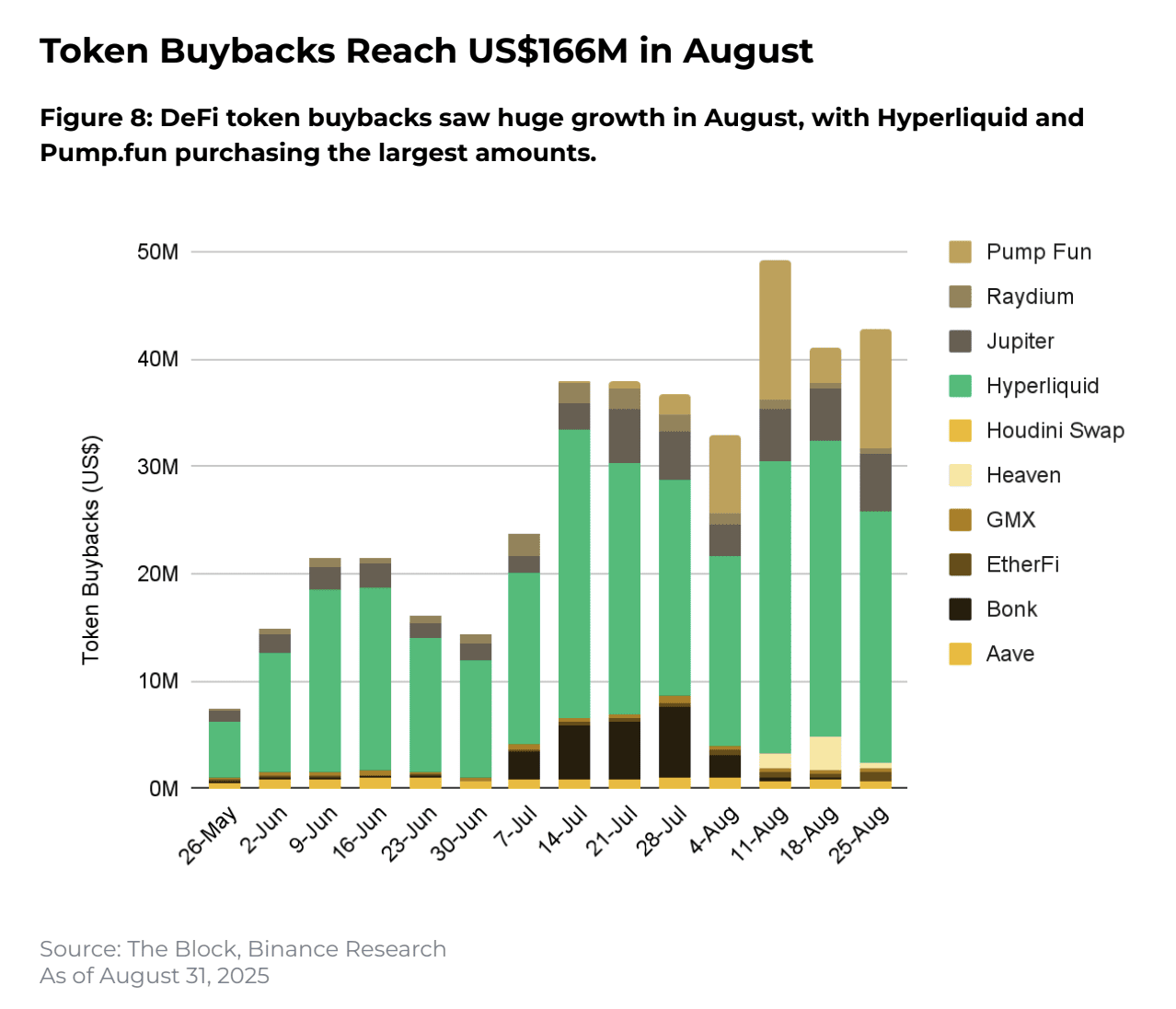

Token buybacks hit $166M record

DeFi platforms deployed $166 million in token buybacks during August, led by Hyperliquid and Pump.fun capitalizing on record revenues. Pump.fun alone spent $58 million, shrinking circulating supply by 4%.

Buybacks signal management confidence but raise sustainability questions. Investors should scrutinize revenue consistency before betting on continued support.

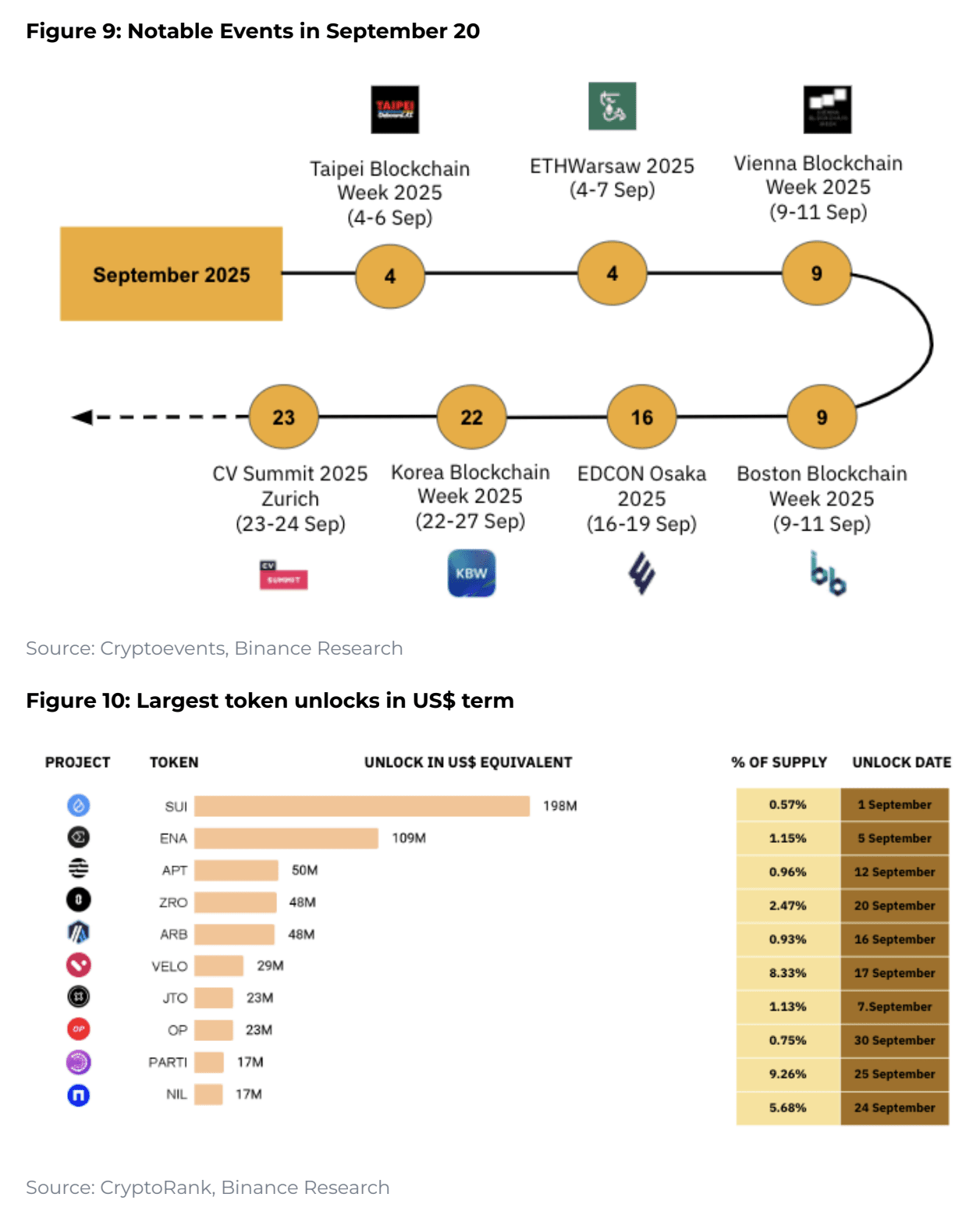

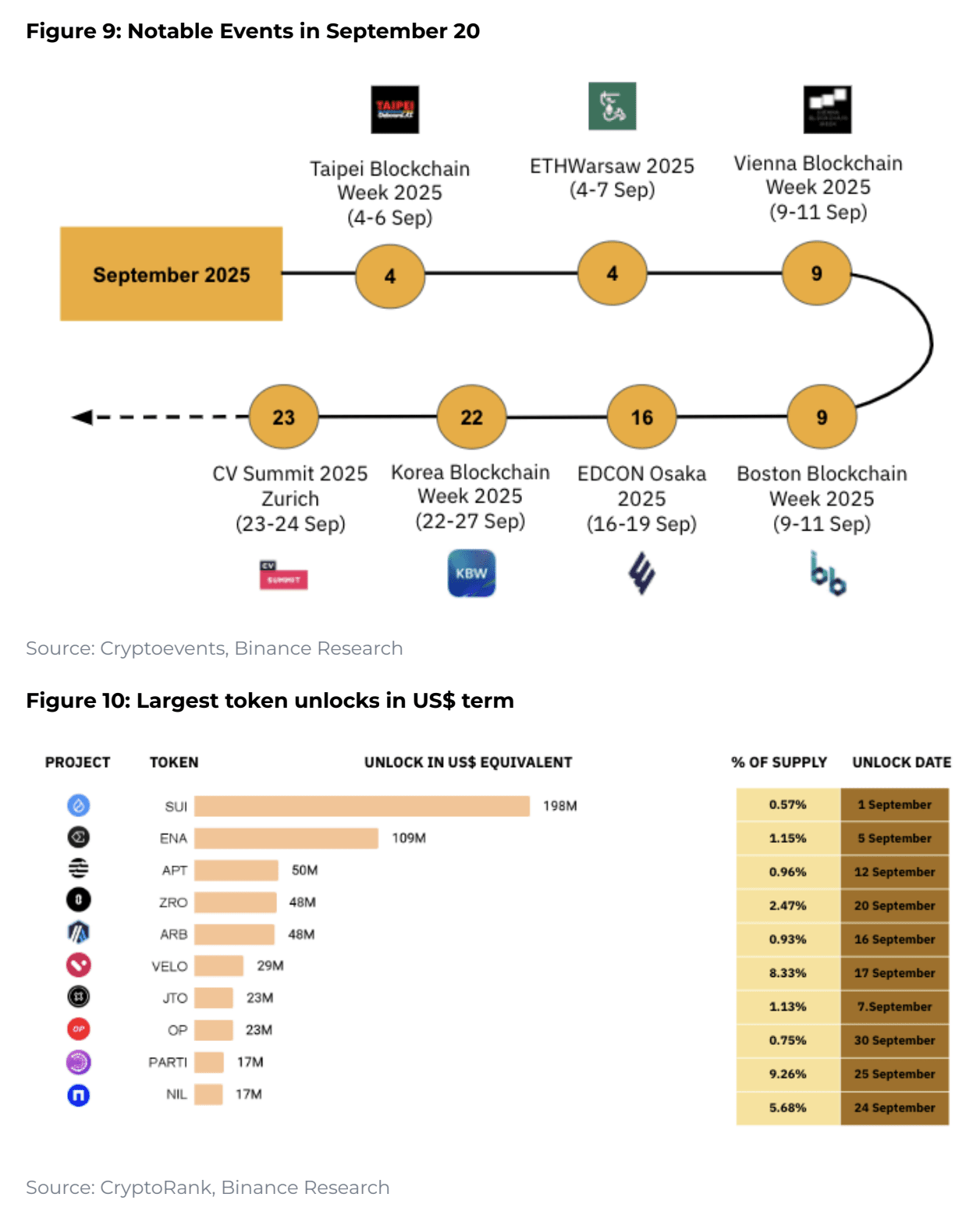

September: historical weakness ahead

Despite the positive momentum for altcoins, September is historically a weak month for cryptocurrencies. Investors traditionally take profits during this period, which can put downward pressure on prices.

Furthermore, several projects face huge token unlocks in September, which could create additional selling pressure.

The verdict

August's capital rotation from Bitcoin into altcoins reflects healthy market maturation rather than speculative excess. Tokens with genuine utility – Chainlink's oracle network, Ethereum's institutional infrastructure, USDe's yield generation – captured the lion's share of gains.

September's seasonal weakness and token unlocks present near-term risks. However, accelerating DeFi adoption, corporate treasury allocation, and technological advancement create robust fundamentals for quality altcoins.

The real question isn't whether altcoins can hold August gains, but which projects will separate themselves from the pack as institutional adoption accelerates.

Recommended