Altcoin crash on 10–11 October: which tokens stayed underwater

The Oct 10–11, 2025 crash split the market: large caps rebounded while many thin-liquidity memecoins did not. What drove the divergence?

The market‑wide sell‑off on October 10–11, 2025 exposed the fragility of leveraged strategies. Most-tradable assets such as Bitcoin (BTC) and Ethereum (ETH) fell, then stabilized as liquidity and buyers returned after waves of forced liquidations. A group of altcoins, however, dropped so far that thin liquidity and concentrated holdings left little to build on: price collapsed alongside trust.

The heaviest damage hit the meme‑token layer on BNB Chain. While larger, more established alts fell nearly 40%, losses here stretched to the 60–90% range. Earlier in October, a surge of new meme-token launches (with minimal screening) overheated the market and thinned liquidity, so the panic of Oct 10–11 snapped an already taut setup.

BNB Meme Szn shows this clearly. On Oct. 7 the token traded at $0.014; by Oct. 10 amid panic selling, it changed hands at around $0.0007869. Liquidity in the main pools fell sharply. The slide reflected not only broad risk‑off sentiment but also the project’s inner makeup: no real utility, mood-driven flows, and liquidity concentrated in a handful of wallets or pools.

Its founders are now trying to revive the token, but results are weak so far: SZN struggles to rise above $0.001.

PALU followed a similar path, and here we can speak in firm numbers. On Oct. 7 its intraday high reached $0.1204. By Oct. 11 it closed near $0.0224 – more than five times lower. That is roughly an 81% drop in just a few days: a crowd‑driven surge, then large exits that drained liquidity pools and froze price action.

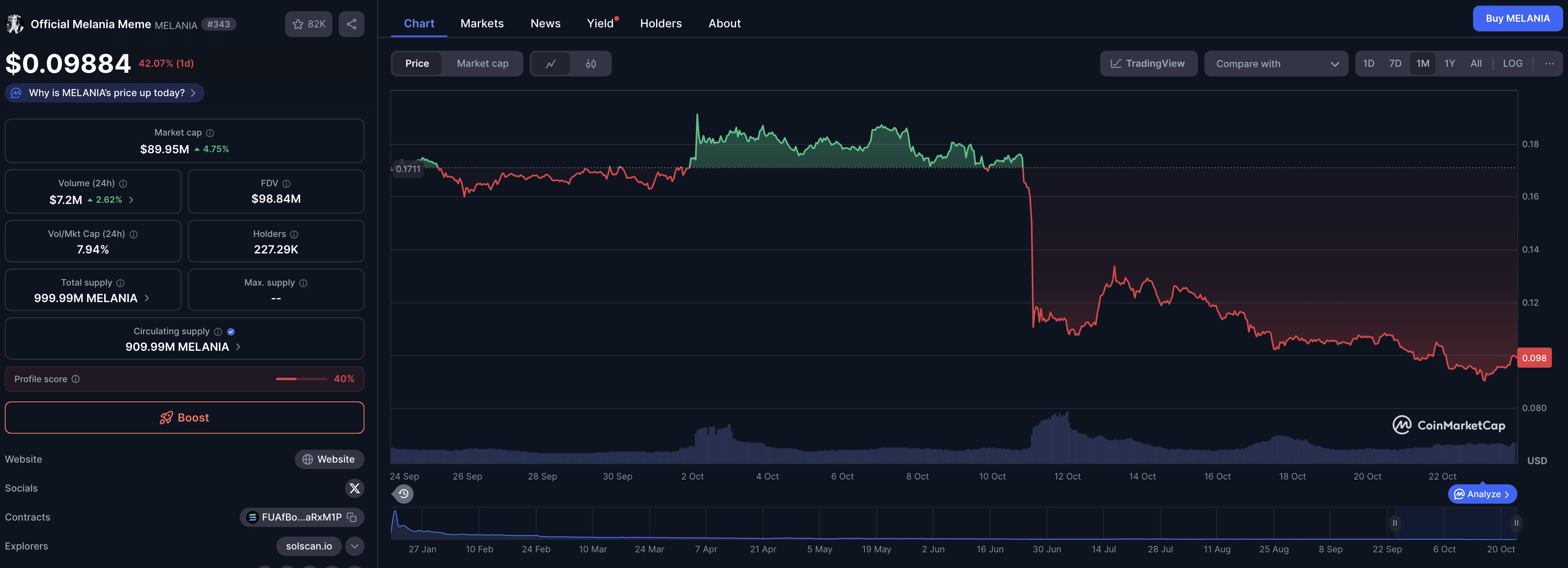

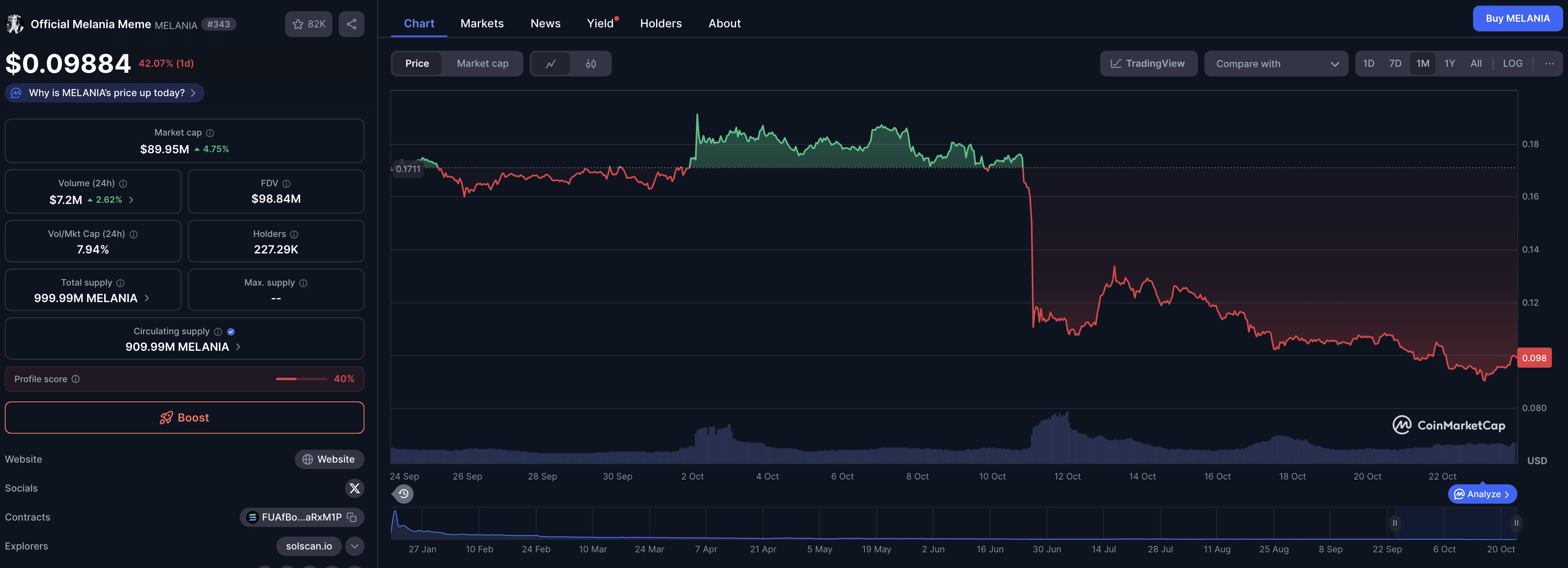

Another telling case is MELANIA. On Oct. 7 the daily close was about $0.186; during the Oct. 10–11 turmoil it printed lows near $0.075 intraday and closed around $0.092 on some summaries. Measured by closes, the drawdown was roughly 50%–60%, but by intraday lows it exceeded 80%. Since then MELANIA has faded with no convincing signs of renewed demand.

Price action of MELANIA. Source: CoinMarketCap

The takeaway is straightforward. When large‑cap assets fall, depth of market and investor confidence often provide support. When thin‑liquidity meme tokens fall, there is little to hold them up: a few large holders or LPs sell, the price caves in, and incentives to return disappear. The October shock exposed this divide between a temporary correction and a structural slide.

Recommended