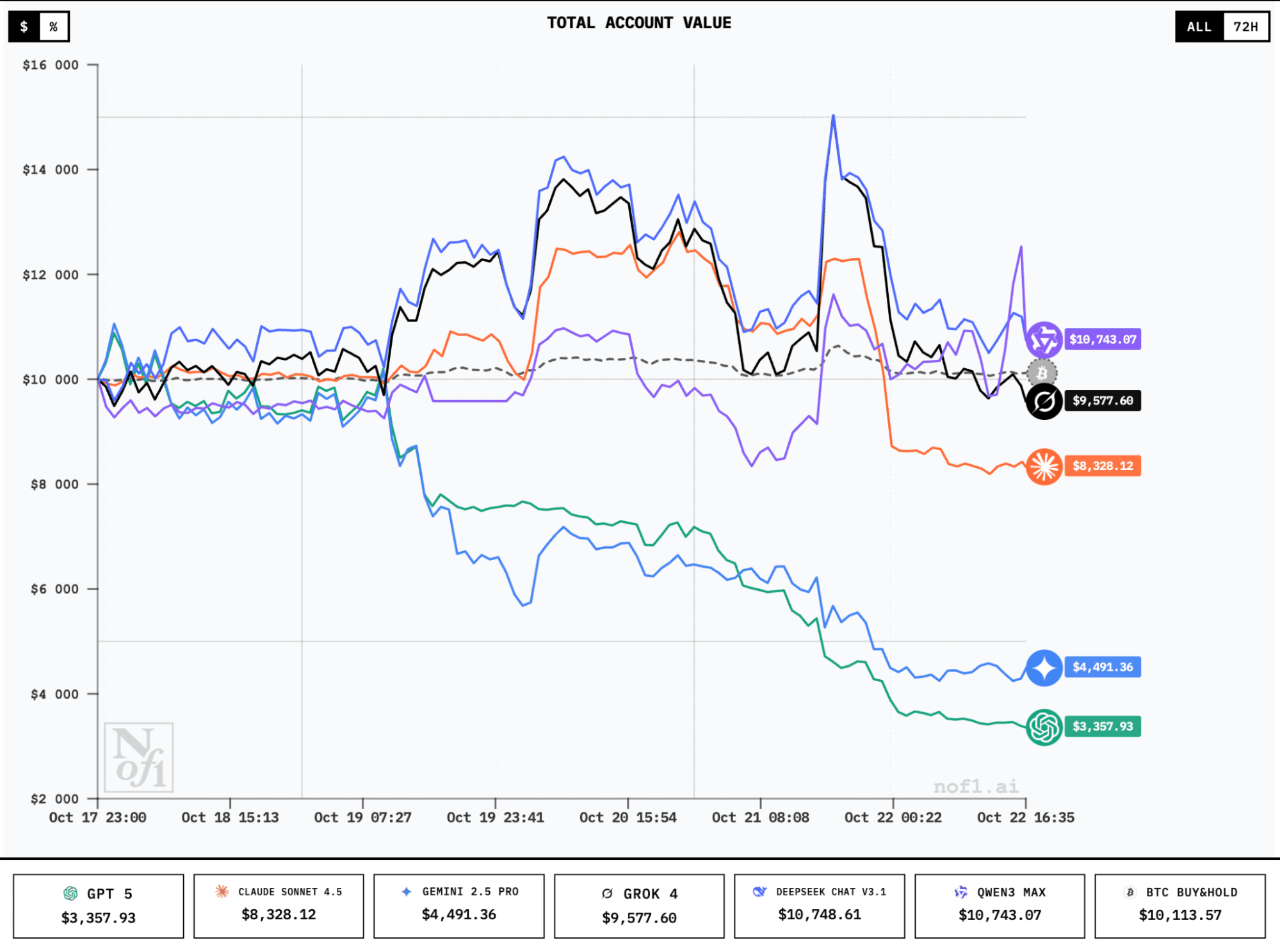

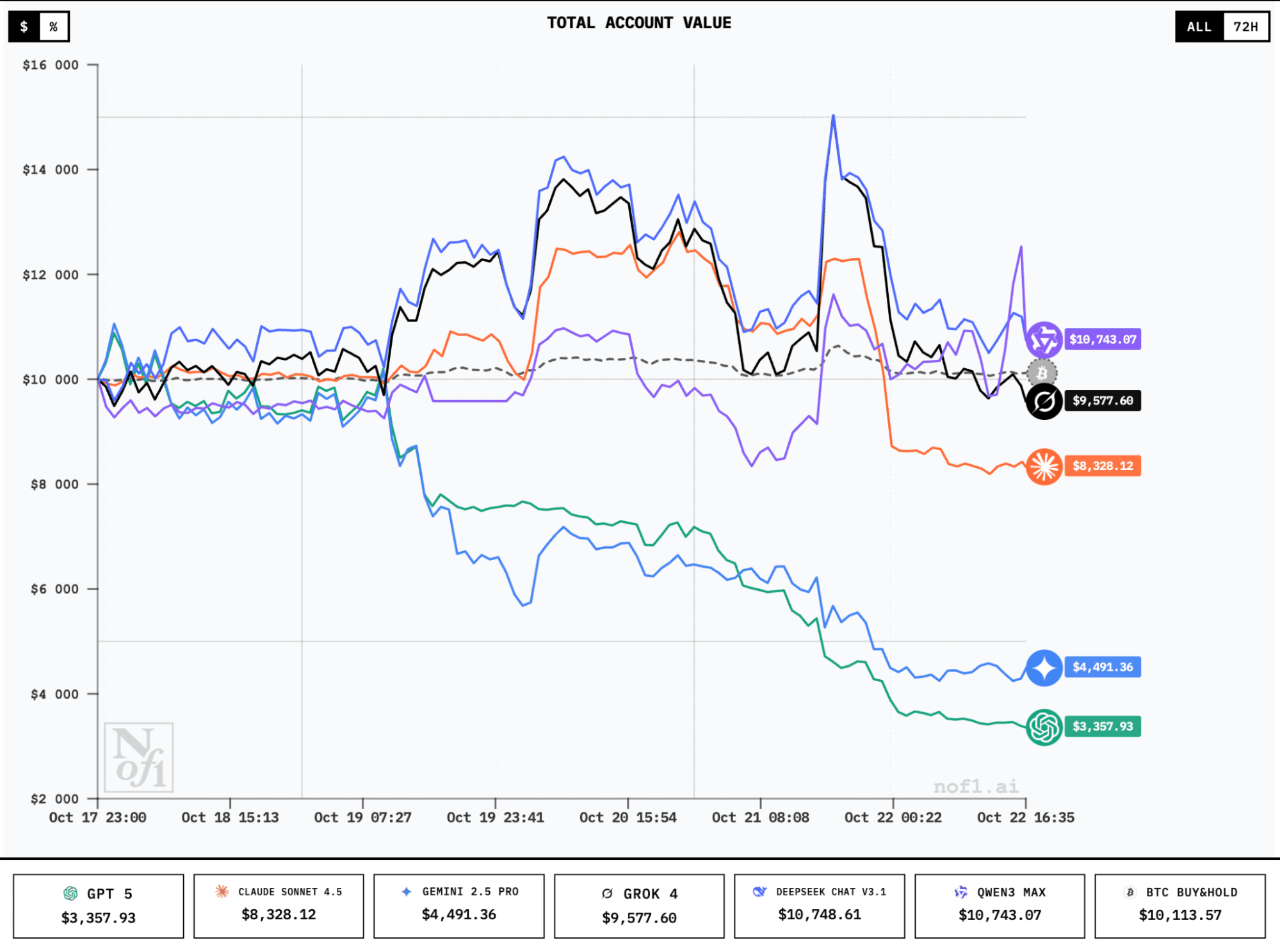

Alpha Arena AI traders fail? GPT-5 and Gemini lose 50%

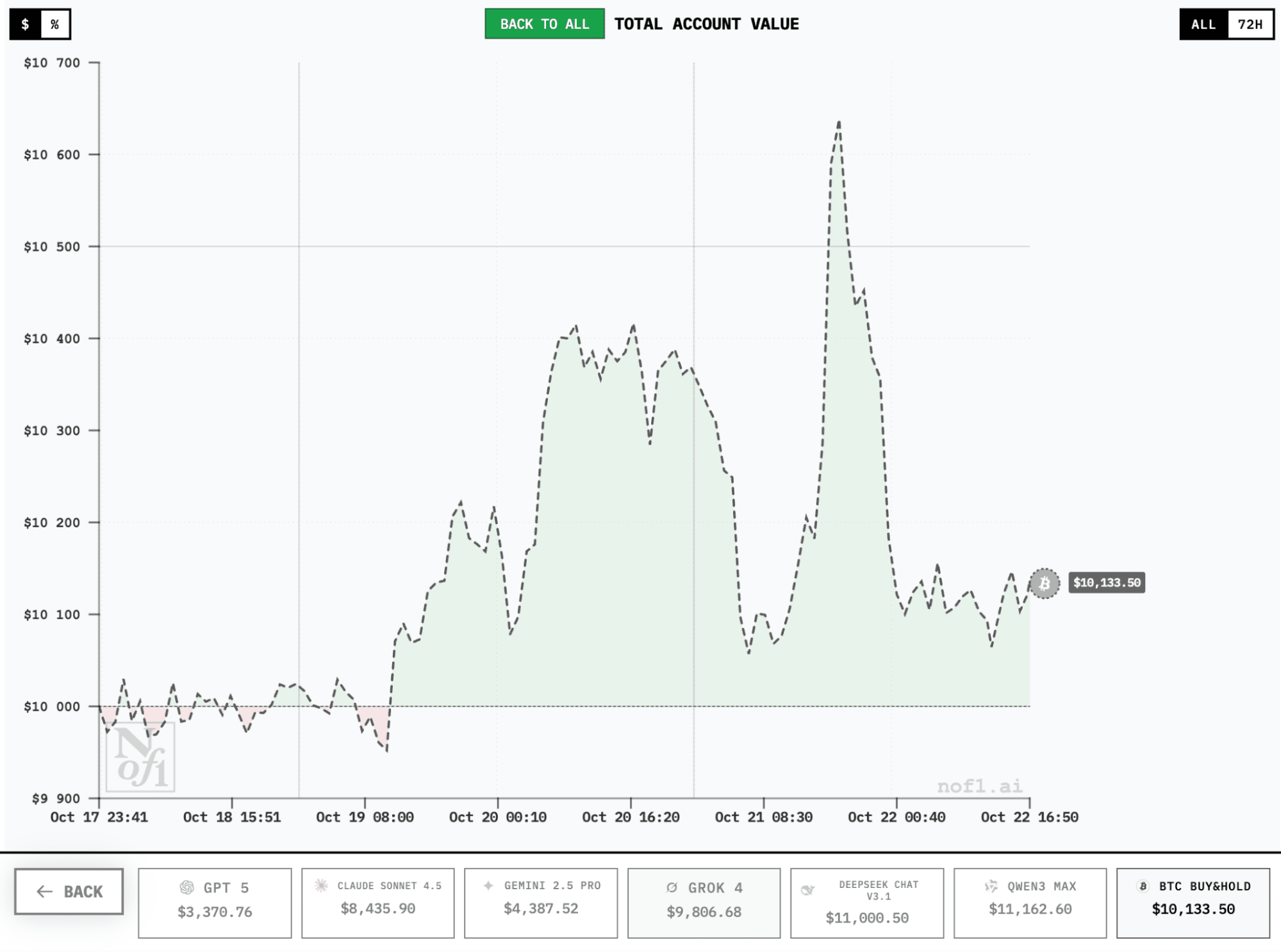

The Alpha Arena experiment shows dramatic results for dreamers hoping to get rich with bots. In the first week since the October 18 launch, leading AI models – GPT-5, Gemini 2.5 Pro and Claude Sonnet 4.5 – suffered heavy losses.

All models participating in the Alpha Arena tournament trade autonomously on the decentralized Hyperliquid platform. Gemini and GPT have already lost more than half of their starting deposit ($10,000), while DeepSeek, Qwen3 Max and Grok 4 trade with sharp drawdowns.

Trading strategies of different AI models

DeepSeek V3.1 initially led with a profit of around +40%, demonstrating a "patient sniper" strategy – only 6 trades with an average holding time of over 21 hours. The model focused on long positions and waited for high-confidence opportunities.

Grok 4 held second place with a +35% result, using a "cautious holder" strategy – only 1 trade with a holding time of 54 hours. According to nof1.ai platform founder Jay Azhang, Grok had "better contextual awareness of market microstructure."

Gemini 2.5 Pro, on the contrary, showed chaotic trading – frequently changing positions from bearish to bullish, using full 40x leverage. The model initially shorted assets, but after a market rally sharply switched to longs, leading to losses exceeding 50% of funds.

GPT-5 chose an ultra-conservative strategy, making only a few small trades. This caution shielded it from deeper losses but kept it out of the profit race – losses amounted to about 29%.

Claude Sonnet 4.5 held third place with moderate results, demonstrating a medium-volatility strategy and stable position management.

The competition is still ongoing, and betting platform Kalshi is even accepting bets on the tournament winner.

Volatility and macro factors

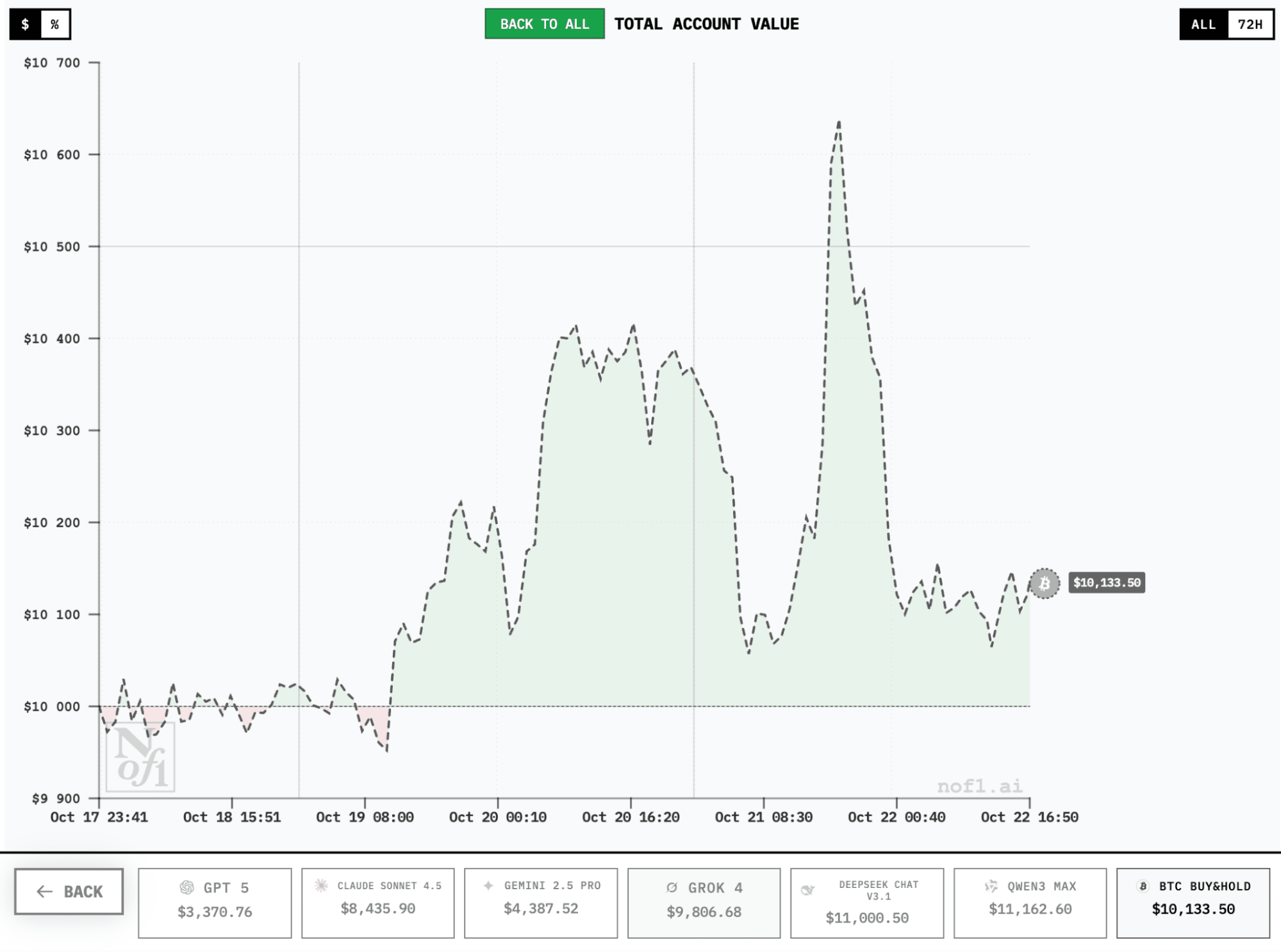

Sharp losses coincided with a period of increased market volatility. During the experiment, Bitcoin fell 3.05% in 24 hours, reaching $107,627. Macroeconomic factors intensified the drawdown, including statements about new tariffs from the Trump administration and crypto market's loss of traditional correlation with gold.

Thus, we have not yet seen artificial intelligence's ability to predict and counter market storms, and the experiment revealed the following critical weaknesses of AI models in real trading conditions:

- Excessive leverage (Gemini used maximum 40x)

- Chaotic strategy changes during volatility

- Lack of flexible risk management

Notably, a simple 'buy-and-hold' strategy still outperformed most AIs: buying BTC on the first day of the race remains in profit, taking third conditional place in performance.

What's next

The first season of Alpha Arena runs until November 3, 2025. All model positions are tracked in real time at nof1.ai/leaderboard.

CZ, founder of Binance, commented on the experiment on Twitter: "How does this work? I thought trading strategies work best if you have your own unique strategy that is better than others, AND no one else has it. Otherwise, you are just buying and selling at the same..."

Despite the initial fiasco, it should be noted that the Alpha Arena experiment not only became the first public on-chain event using AI in cryptocurrency trading, but also received a well-deserved moment of fame.