Fitell stock sinks after $10M Solana bet

Australia’s Nasdaq‑listed fitness equipment maker Fitell said it bought more than 46,000 Solana (SOL) tokens for about $10 million but the market pushed back.

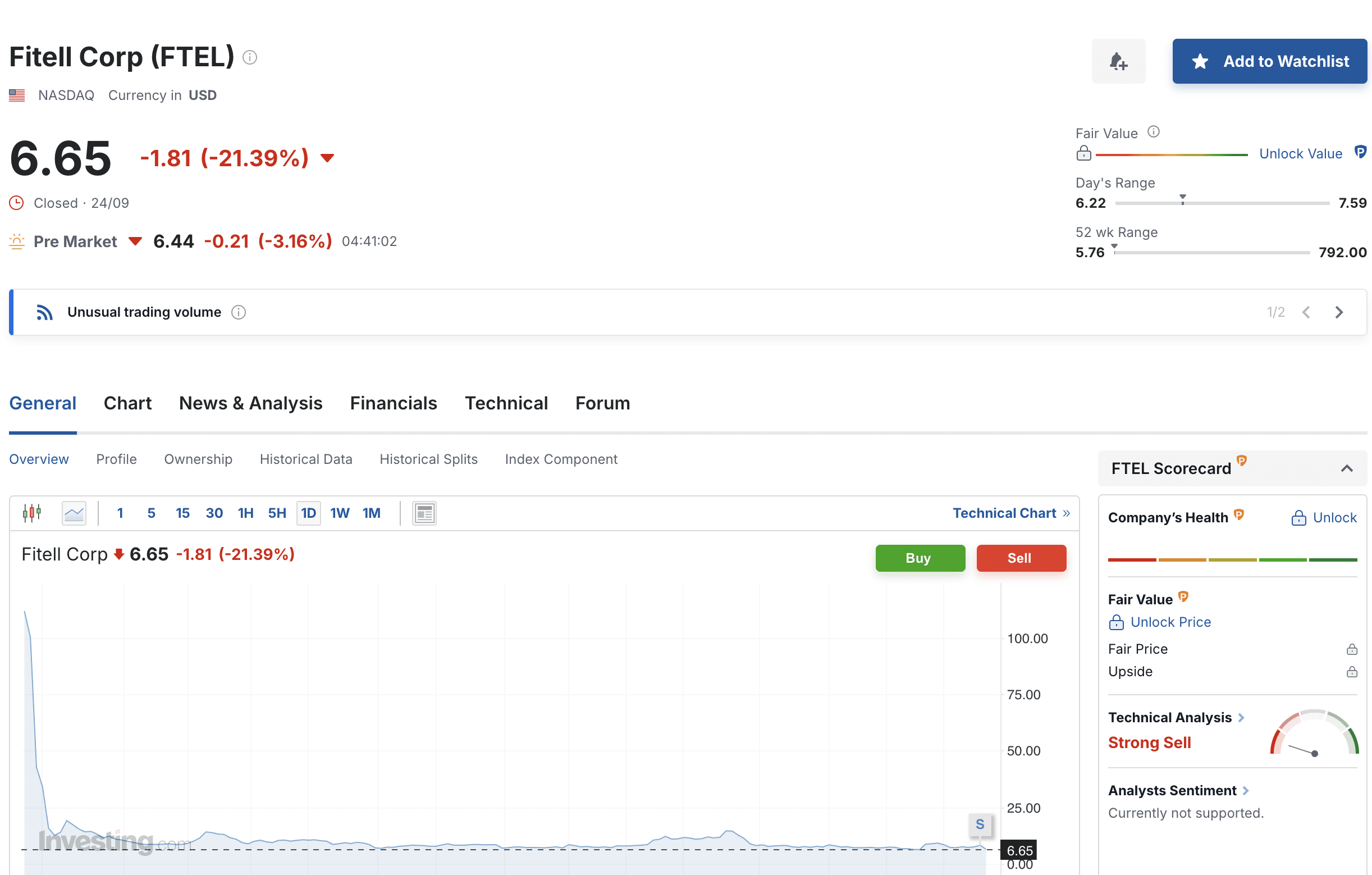

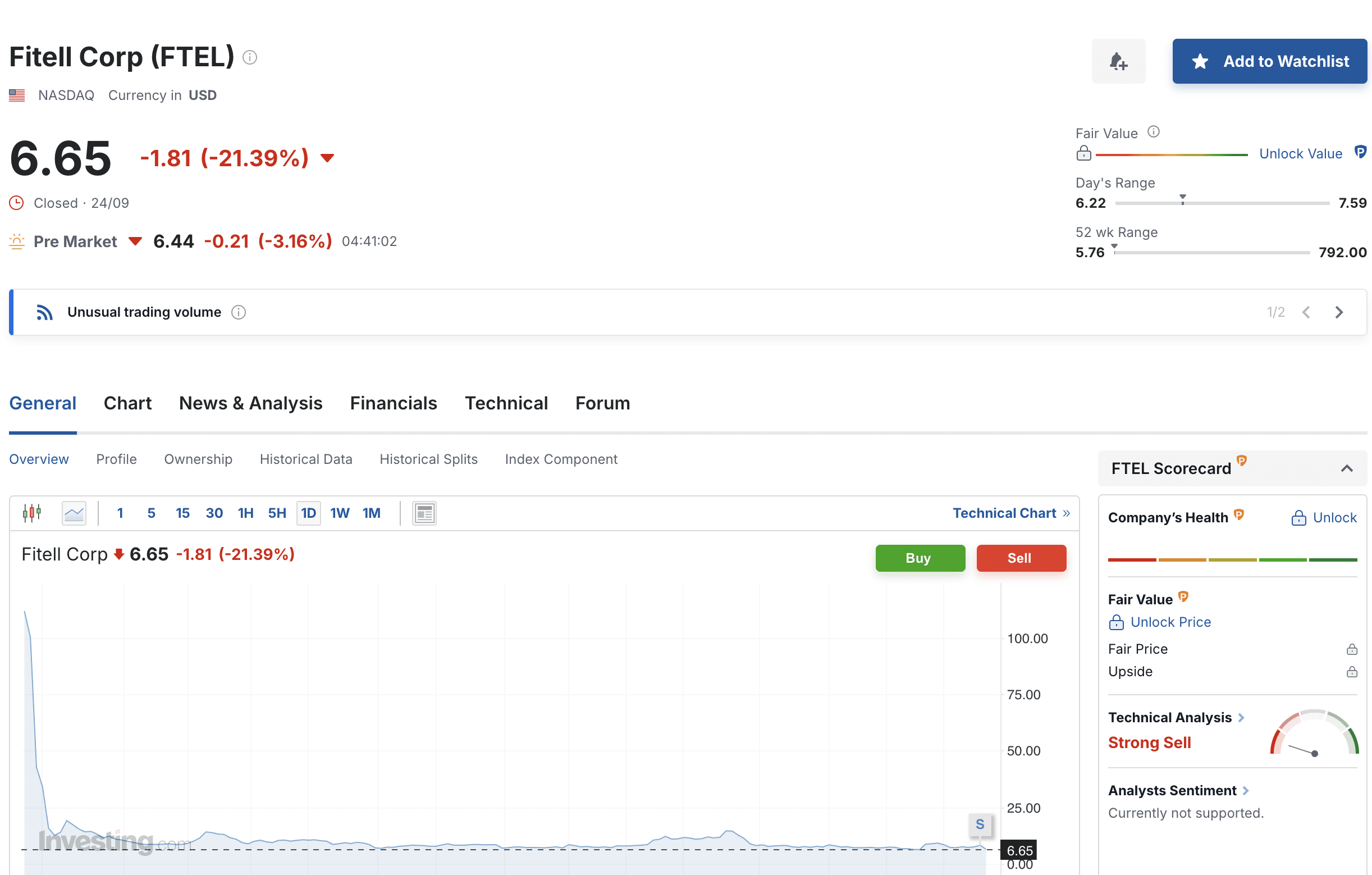

During Wednesday’s session, FTEL dropped more than 21% and finished around $6.65 per share. After‑hours trading, the stock hovered near $6.66.

The move followed the company’s disclosure of a new treasury strategy. The company plans to raise up to $100 million through convertible notes to fund digital asset purchases, with SOL as the primary holding. Up to 70% of net proceeds from each deal will go into crypto, while the remaining funds will cover operating needs, on‑chain initiatives, and working capital.

FTEL price dynamics. Source: Investing.com

Management says the focus on staking and digital liquidity is designed to generate long-term shareholder value. To support the effort, Fitell brought in advisers David Swaine and Kylen Sullivan, who will build a yield-focused staking model and seek returns in the DeFi market while managing risk.

That caution framing comes as crypto volatility has repeatedly unsettled public companies experimenting with digital assets.

Fitell isn’t the only name under pressure after crypto buys. Earlier this week, shares of several firms that announced plans to add digital assets to their treasuries also slipped. Meanwhile, industry trackers estimate corporate entities now hold more than 17 million SOL (roughly 3% of the coin’s circulating supply).

Fitell’s core business remains fitness equipment and accessories. The company’s stock has been trending lower since the start of the year, and the shift into crypto comes as an apparent attempt to revive growth. Investors so far have responded skeptically.

Recommended